Financial Strategic Planning

Description

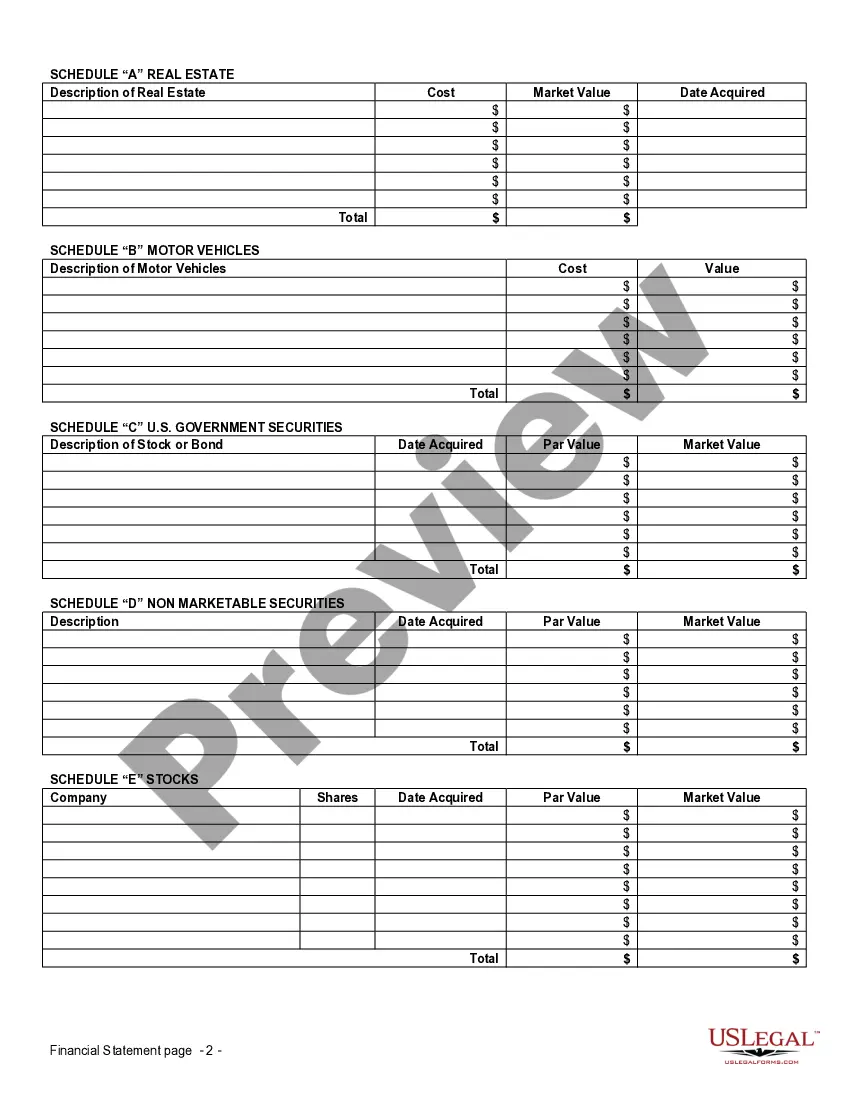

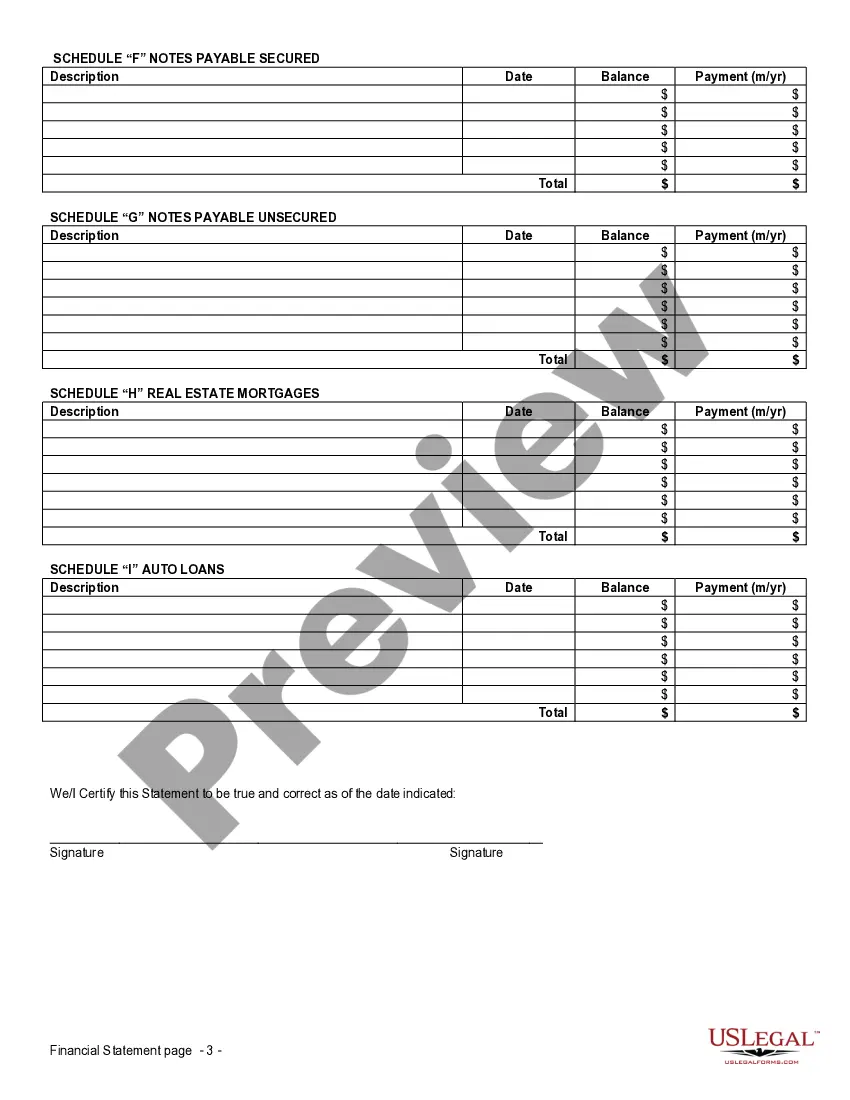

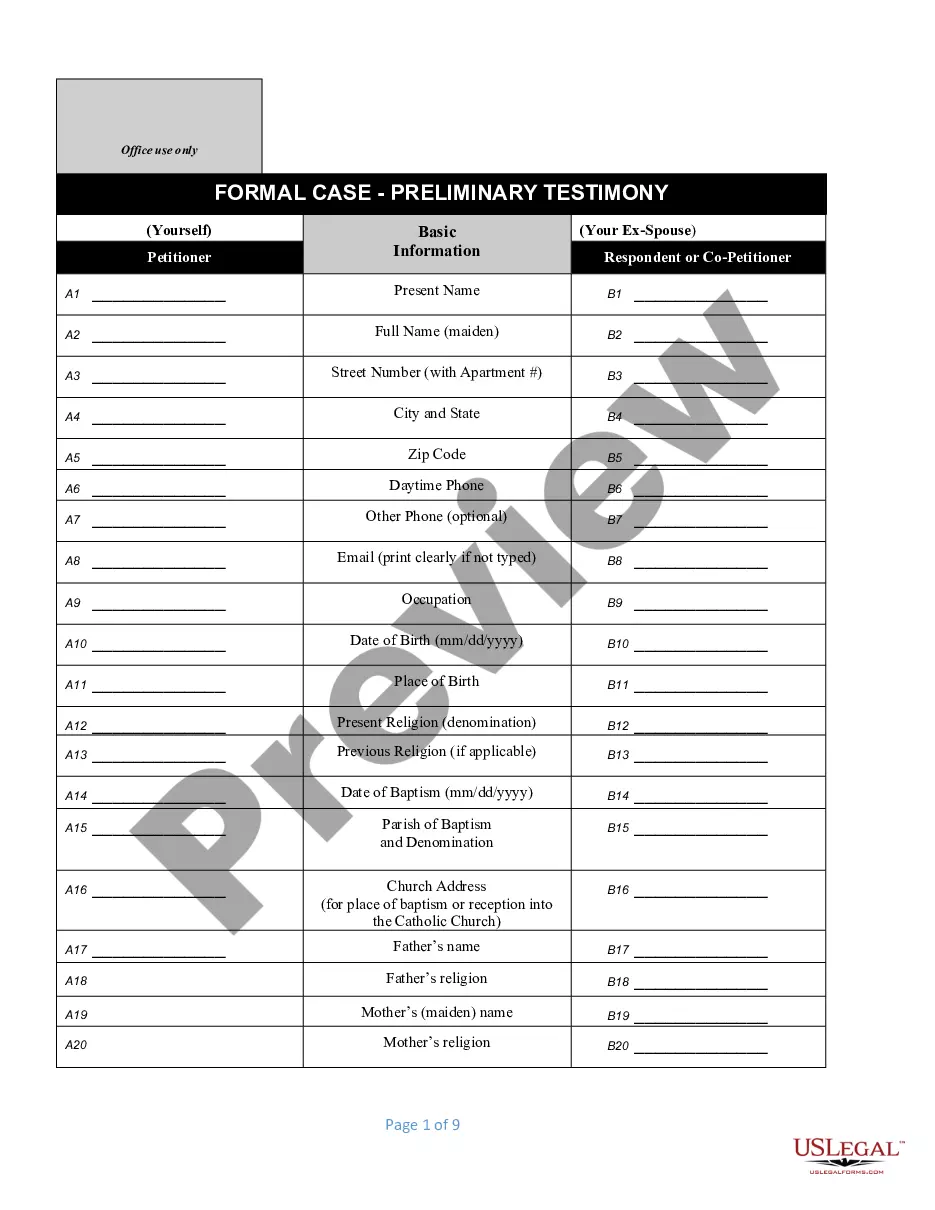

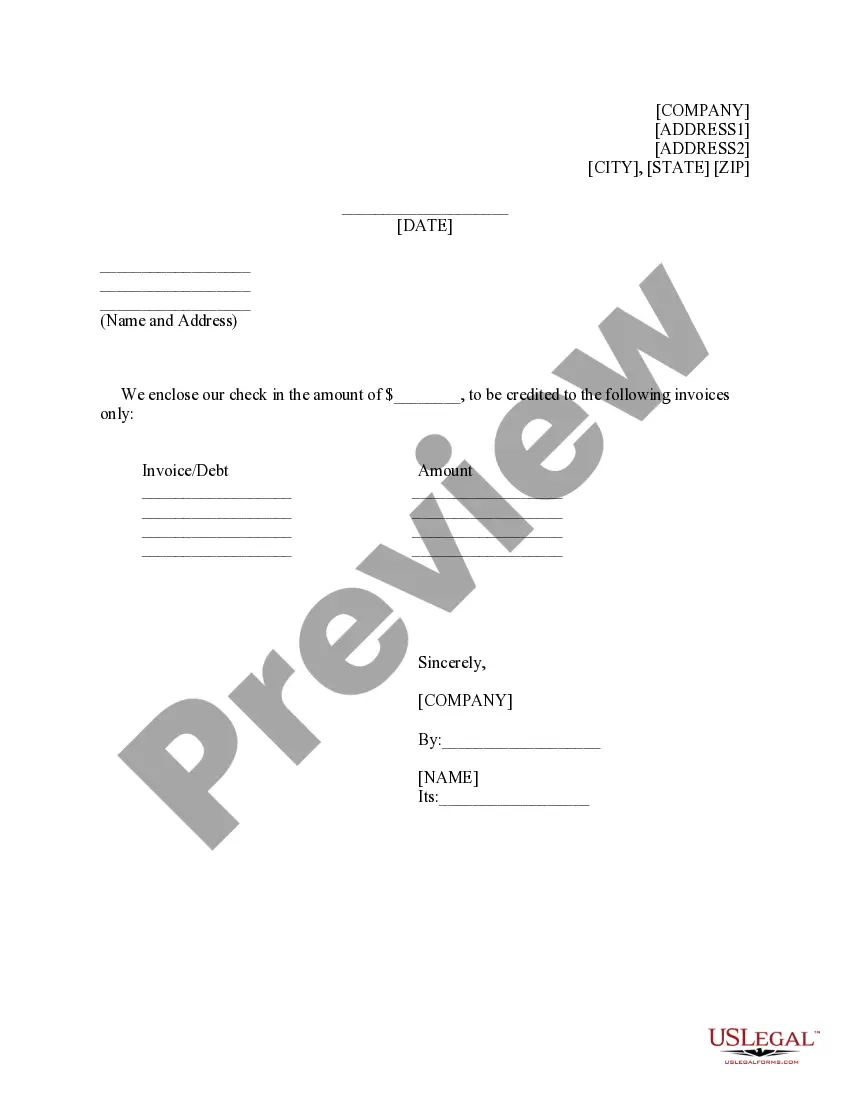

How to fill out Financial Statement Form - Husband And Wife Joint?

Management of legal documents can be daunting, even for the most experienced professionals.

If you're interested in Financial Strategic Planning but lack the time to search for the appropriate and current version, the procedures can become overwhelming.

US Legal Forms meets all your needs, whether they pertain to personal or organizational documents, all in one place.

Employ cutting-edge tools to complete and manage your Financial Strategic Planning.

Once you've downloaded the form you need, follow these steps: Verify that it is the correct form by viewing it and reading its description.

- Access a compilation of articles, tutorials, handbooks, and resources related to your circumstances and requirements.

- Save time and effort searching for the forms you need, and use US Legal Forms’ advanced search and Preview feature for Financial Strategic Planning and download it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to review the documents you've previously downloaded and to manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account to gain unlimited access to all the benefits of the library.

- Utilize a powerful online form library that can be transformative for those looking to handle these matters effectively.

- US Legal Forms is a leader in online legal documents, providing over 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you can access state or county-specific legal and business forms.

Form popularity

FAQ

To enter the field of financial planning, start by researching financial services and understanding the various roles available. Enroll in courses that emphasize financial strategic planning to gain industry knowledge and enhance your expertise. Network with professionals and attend industry conferences to build connections and learn from experienced individuals. Using platforms like US Legal Forms can help you access necessary documents and resources to formalize your career path.

Begin by assessing your current financial situation, including income, expenses, debts, and savings. Create a budget that allocates resources toward your financial goals and track your spending. Educate yourself about different aspects of financial strategic planning, such as investment strategies and retirement savings. By gradually implementing these steps, you can build a sustainable financial plan that serves your future.

To begin a career in financial planning, focus on building a solid foundation in finance and investment principles. Pursue relevant education, such as a degree in finance or business, and consider certifications like the Certified Financial Planner (CFP) designation. Gaining practical experience through internships or entry-level positions will also enhance your skills. Lastly, familiarize yourself with financial strategic planning, as it is essential for long-term success in this field.

The seven steps to financial planning are crucial for anyone aiming for financial stability. This process includes defining your goals, assessing your current financial situation, creating a plan, taking action on that plan, monitoring your progress, and revising the plan as necessary. By following these steps, you ensure that your financial strategic planning remains aligned with your long-term aspirations.

Achieving financial freedom involves a series of simple but important steps. Start by setting clear financial goals, creating a realistic budget, eliminating debt, building an emergency fund, investing wisely, establishing multiple income streams, and regularly reviewing and adjusting your financial plan. This sequence will guide you on your journey toward effective financial strategic planning and independence.

Documenting a strategic plan is essential for clarity and accountability. Start by outlining your mission statement, objectives, strategies, and action plans in a clear, organized format. It's important to ensure that the plan remains flexible to adapt to changing circumstances in your financial strategic planning, and consider using platforms like US Legal Forms for professional templates that streamline this documentation process.

The 4 P's of strategic planning are Purpose, Principles, Processes, and People. Purpose defines the core mission of your financial goals, while Principles outline the values guiding your decisions. Processes involve the methodologies used to achieve your financial objectives, and People refers to the stakeholders involved in executing your financial strategic plan. Understanding these elements enhances your financial approach.

Financial strategic planning encompasses seven critical areas. These areas are budgeting, saving, investing, insurance, retirement planning, estate planning, and tax planning. By addressing each of these areas, you lay a comprehensive foundation for a robust financial future, ensuring you meet both short-term and long-term financial goals.

In financial strategic planning, the seven steps in the planning process are vital for clarity and progress. You begin by defining your mission and vision, conducting a SWOT analysis, setting clear objectives, crafting strategies, creating an action plan, monitoring progress, and adjusting as needed. Following these steps will help ensure that your financial strategies are adaptable and effective.

The financial planning process consists of seven essential steps. These include establishing goals, gathering relevant financial information, analyzing your current financial situation, developing a financial strategy, implementing the plan, monitoring progress, and reviewing and revising the plan as necessary. This structured approach ensures comprehensive financial strategic planning for achieving long-term goals.