Escrow Agreement Form

Description

How to fill out Escrow Agreement - Long Form?

Bureaucracy requires exactness and correctness.

If you do not handle completing documentation like Escrow Agreement Form on a daily basis, it can lead to some misunderstanding.

Choosing the right specimen from the outset will ensure that your document submission will proceed smoothly and avoid any troubles of resending a document or repeating the same task from the start.

Acquiring the correct and current specimens for your documentation is a matter of moments with an account at US Legal Forms. Eliminate the bureaucracy issues and simplify your paperwork.

- Locate the template using the search field.

- Confirm the Escrow Agreement Form you’ve discovered is valid for your state or county.

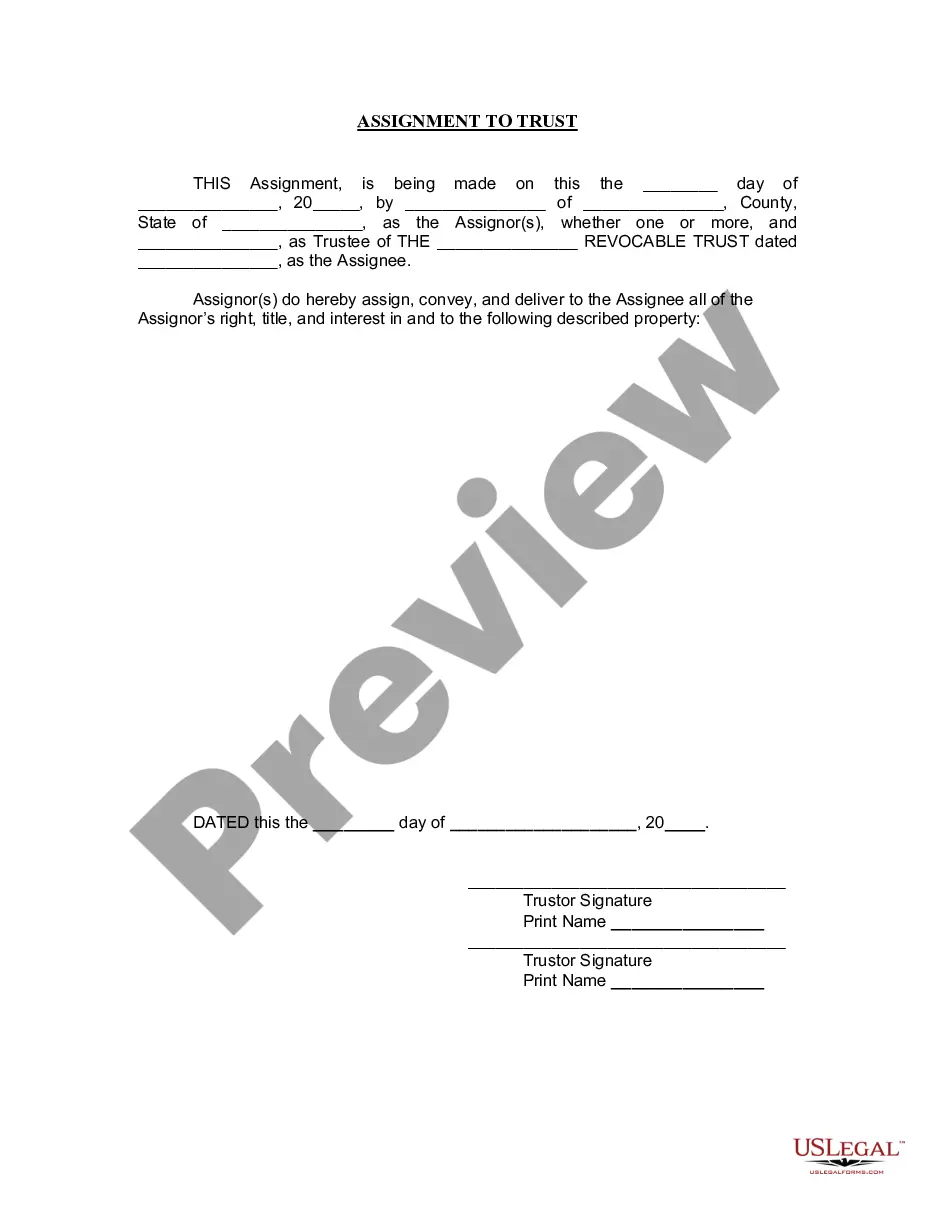

- View the preview or examine the description that contains the information on the application of the specimen.

- If the result meets your criteria, click the Buy Now button.

- Select the suitable choice among the recommended pricing options.

- Sign in to your account or create a new one.

- Complete the transaction using a credit card or PayPal payment method.

- Download the document in your preferred format.

Form popularity

FAQ

A thorough escrow agreement will list out the information that should be included in JWI or any instructions, such as the amount to be released, the party to whom the funds should be delivered, payment instructions and tax characterizations, or alternatively attach an instructions template to the escrow agreement.

In a real estate escrow agreement, the buyer and seller agree to have a neutral third party an escrow agent hold the buyer's funds while the contractual conditions and obligations of each party are fulfilled. Escrow accounts provide protection to all parties involved in the transaction.

Escrow instructions define the events that must take place prior to an escrow closing. The escrow instructions are your written instructions to the escrow holder acknowledging the terms and conditions of the sale. An itemized statement is included with your instructions, reflecting all agreed upon debits and credits.

A demand letter provides an escrow or title company with the amount needed to pay off your current mortgage. It is the actual request for a payoff statement. The payoff statement is a binding balance the existing lender must honor when the loan is paid off at close of escrow.

Most escrow agreements are put into place when one party wants to make sure the other party meets certain conditions or obligations before it moves forward with a deal. For instance, a seller may set up an escrow agreement to ensure a potential homebuyer can secure financing before the sale goes through.