Executor Estate Form

Description

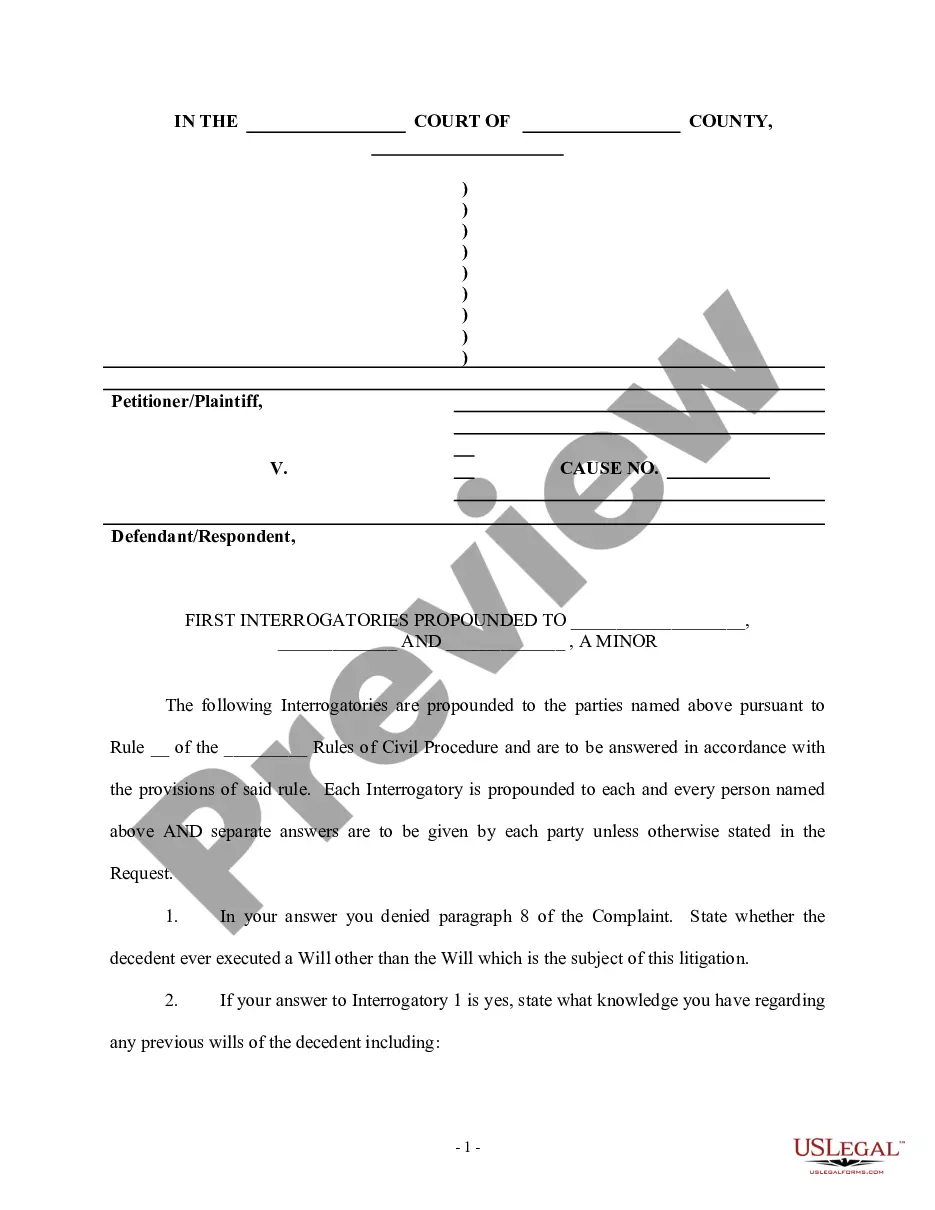

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

Properly created official documents are one of the essential guarantees for steering clear of complications and legal disputes, but achieving this without assistance from a lawyer may require some time.

Whether you need to swiftly locate an updated Executor Estate Form or any other templates for job, family, or business situations, US Legal Forms is always available to assist.

The method is even simpler for existing users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button adjacent to the selected file. Moreover, you can retrieve the Executor Estate Form at any time later, as all the documents ever acquired on the platform are accessible within the My documents section of your profile. Save time and money on preparing official documents. Try US Legal Forms immediately!

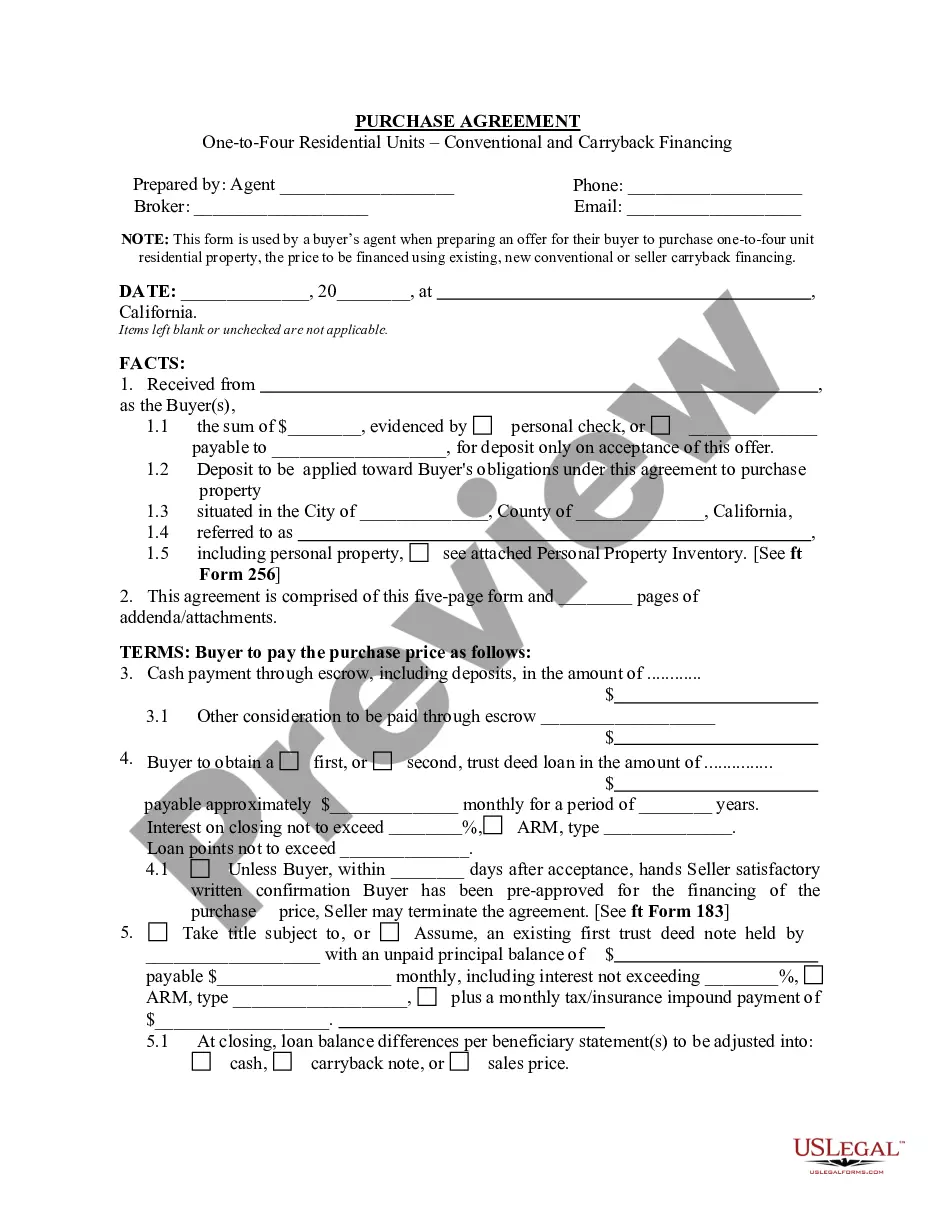

- Ensure that the form fits your circumstances and location by reviewing the description and preview.

- Search for an additional sample (if desired) using the Search bar at the top of the page.

- Hit Buy Now once you find the correct template.

- Choose the subscription option, sign into your account or create a new one.

- Select your preferred payment option to purchase the subscription (via credit card or PayPal).

- Opt for PDF or DOCX file format for your Executor Estate Form.

- Press Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Yes, executor fees are considered taxable income and must be reported to the IRS. When you receive compensation for your work as an executor, utilize the executor estate form to ensure proper reporting of these fees. It’s advisable to maintain clear records of all expenses related to your role.

The first steps include gathering the deceased’s financial information, locating the will, and filing the necessary executor estate form with the probate court. Contact beneficiaries and keep them informed about the process. Additionally, it’s crucial to secure the assets and manage immediate expenses.

To file for executor of an estate, start by submitting the signed will and the application for probate to the local probate court. Complete the executor estate form thoroughly to avoid any delays. Following submission, be prepared to address the court to confirm your role as executor.

You can prove your status as the executor by presenting the court’s letters testamentary. This document, obtained after filing your executor estate form, officially grants you the authority to manage the estate. Ensure you keep copies of this document handy for financial institutions and other relevant parties.

To file for executor of an estate, you will need the original will, the death certificate, and a completed executor estate form. Additionally, you should have identification and information about the estate’s assets and debts. This documentation is crucial for a smooth probate process.

As an executor, you must file tax returns for the estate. Use the executor estate form to report any income generated from the estate during the decedent's final year and for the estate itself. It’s essential to keep accurate records and consider consulting a tax professional for assistance.

The best person to appoint as an executor is someone who is trustworthy and organized. They should have a clear understanding of your wishes and the ability to manage responsibilities effectively. It’s also helpful if they have some familiarity with financial and legal matters.

To file as an executor, first gather the necessary documents, including the will and the death certificate. You need to submit the executor estate form to the probate court in the county where the deceased lived. After filing, attend the court hearing to confirm your appointment.

To confirm the executor of an estate, you can check the probate court records, which will list the appointed executor. This includes the relevant case number and details about the estate. If you are unsure how to navigate this process, using the executor estate form can simplify your inquiries.

You can obtain executor paperwork by contacting the probate court where the estate is being processed. They will guide you on filling out the necessary executor estate form and provide you with the specific documents you need. Having clear documents ensures a smoother process.