Title Transfer Form For Texas

Description

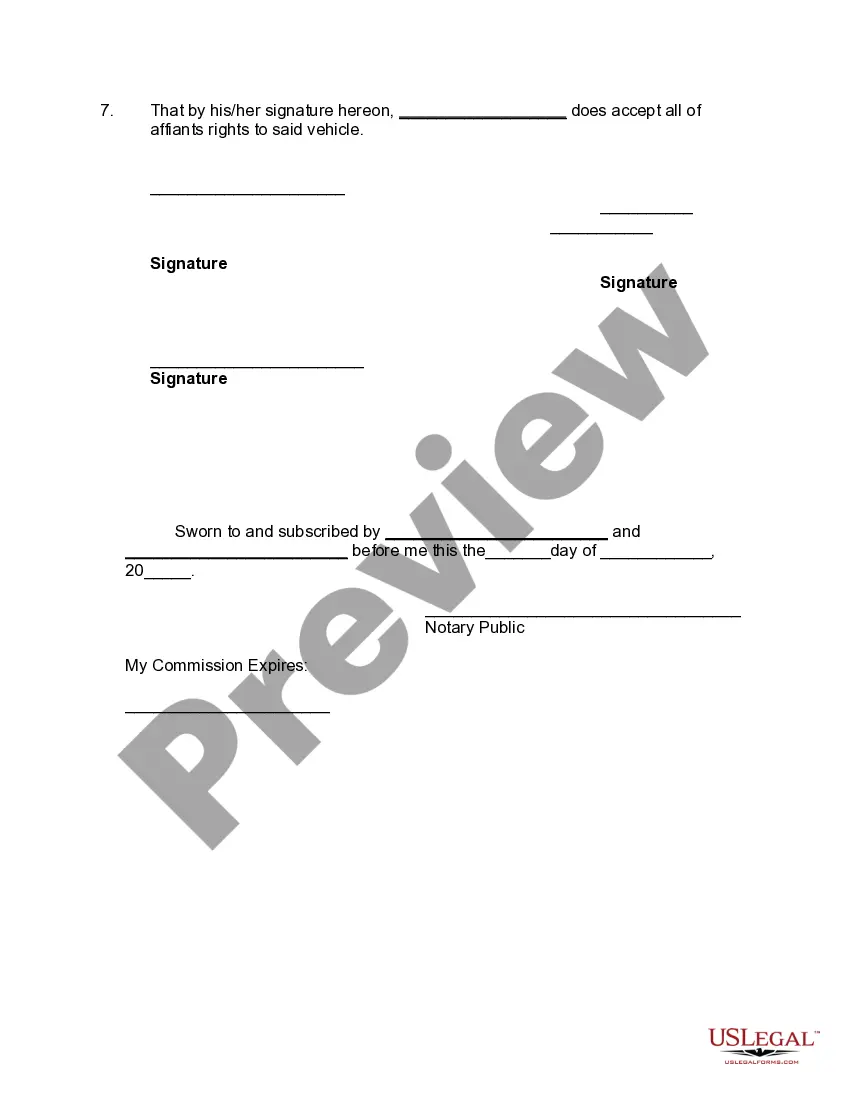

How to fill out Affidavit By Heirs Regarding Agreement As To Who Shall Inherit Motor Vehicle - To Obtain Transfer Of Title?

Legal management can be daunting, even for experienced professionals.

When you're looking for a Title Transfer Form For Texas and don’t have the time to search for the right and current version, the process can be overwhelming.

US Legal Forms accommodates any requirements you may have, ranging from personal to corporate documents, all in a single location.

Leverage advanced tools to fill out and manage your Title Transfer Form For Texas.

Below are the steps to follow after obtaining the form you need: Verify that it is the correct form by previewing it and reviewing its details. Ensure that the template is sanctioned in your state or county. Select Buy Now when you are prepared. Choose a subscription option. Locate the format you desire, and Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Streamline your daily document management into a seamless and user-friendly experience today.

- Access a wealth of articles, guides, and resources related to your circumstances and needs.

- Save time and effort searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Review feature to locate Title Transfer Form For Texas and download it.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to review the documents you have previously saved and manage your folders as you see fit.

- If this is your first experience with US Legal Forms, create an account to gain unlimited access to all the benefits of the library.

- A comprehensive online form repository could be a transformative solution for anyone who wishes to navigate these matters proficiently.

- US Legal Forms stands as a leader in online legal documents, offering over 85,000 state-specific legal forms available to you at any moment.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

Please contact the Texas Department of Motor Vehicles at 1-888-368-4689 or 512-465-3000 for details. This form must be completed and submitted to a county tax assessor-collector's office accompanied by any required application fee, supporting documents, registration fee, if applicable, and any motor vehicle tax due.

Fees one can expect to pay when buying a car in Texas are as follows: Sales Tax: 6.25% of the total vehicle purchase price. Title Transfer Fee: $28 to $33 (varies by county) Tag / License Fee: $51.75 base fee, $10 local fee.

To transfer a Texas titled vehicle, bring in or mail the following to our offices: Texas title, signed and dated by the seller(s) and buyer(s). ... VTR-130U (Application for Texas title), signed and dated by the seller(s) and buyer(s). ... Proof of insurance in the buyer's name. Acceptable form of ID. Proof of inspection. Fees.

If there is more than one seller named on the title and their names are separated by ?and? or ?and/or? then both sellers need to sign the title before it is transferred to the buyer. If nothing separates the owner names, both must sign. The same applies to multiple buyers.

Transferring a title from one co-owner or co-maker to another is not a taxable transfer. Co-owners or co-makers have purchased a motor vehicle together. Both parties own the motor vehicle and, if there is a lien involved, both are jointly and separately liable for repayment of the entire loan.