Beach Hair Waver

Description

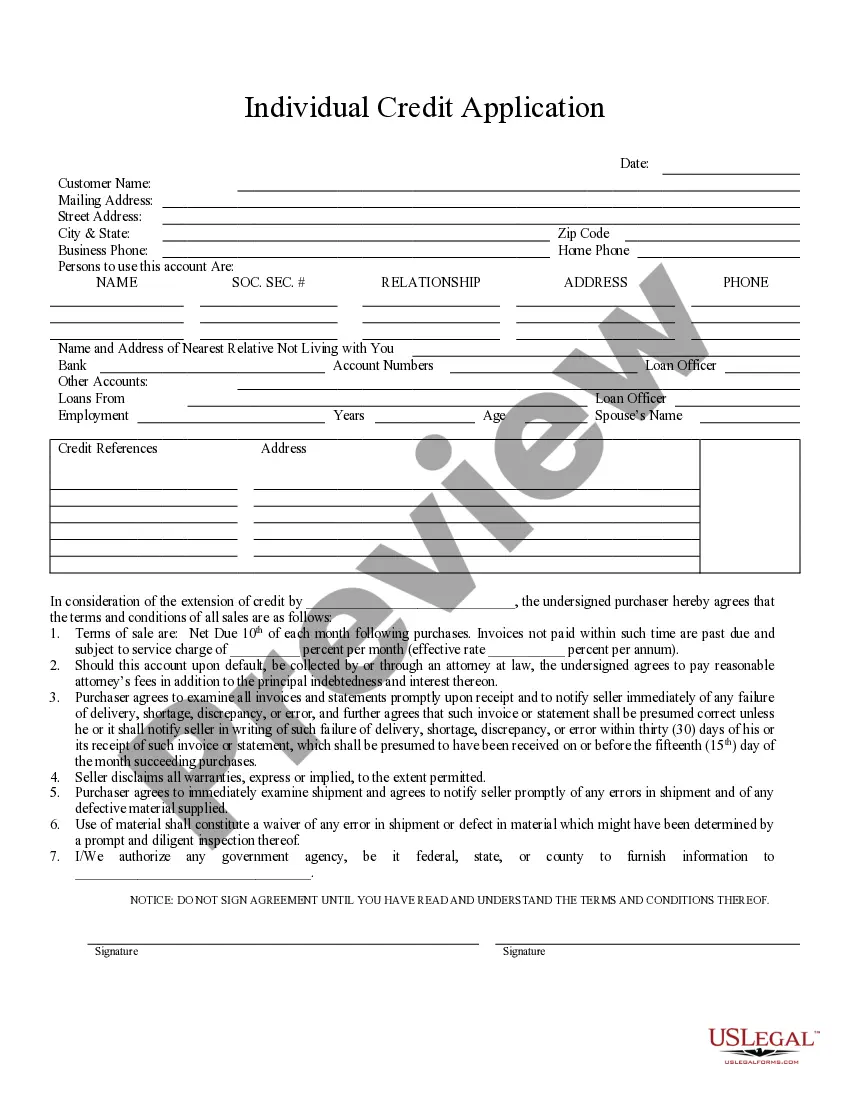

How to fill out Waiver And Release From Liability For Services At Hair Salon And Spa?

Handling legal paperwork can be exasperating, even for skilled professionals.

When you are looking for a Beach Hair Waver and don’t have the time to invest in finding the correct and current version, the process can be stressful.

With US Legal Forms, you can.

Gain access to state- or region-specific legal and corporate documents. US Legal Forms accommodates any needs you might have, from personal to business documentation, all in one platform.

If it's your first experience with US Legal Forms, create an account to enjoy unlimited access to all the platform features. Below are the steps to follow after finding the form you need.

- Employ innovative tools to fill out and manage your Beach Hair Waver.

- Access a valuable resource center filled with articles, guides, and materials pertinent to your context and requirements.

- Conserve time and energy searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Preview option to find Beach Hair Waver and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, locate the form, and retrieve it.

- Check your My documents section to view the documents you have previously obtained and to manage your folders as you deem necessary.

- Utilize a comprehensive online form repository that could be transformative for anyone needing to manage these scenarios effectively.

- US Legal Forms is a frontrunner in digital legal documents, offering more than 85,000 state-specific legal forms available at any time.

Form popularity

FAQ

If you don't have a beach hair waver, you can try using a straightening iron or curling wand. Simply twist sections of your hair around the iron while leaving the ends out for that authentic beachy finish. Alternatively, you can achieve waves by twisting your hair into buns overnight and letting them loose in the morning for a natural wave effect.

Benefits of starting an Idaho LLC: Easily file your taxes and discover potential advantages for tax treatment. Protect your personal assets from your business liability and debts. Low cost to file ($100)

While there are no specific laws that make it more suitable for LLCs than other states, Delaware is the state of choice to incorporate because of their business-friendly corporate tax laws. There's a reason why 66.8% of all Fortune 500 companies choose Delaware as their incorporation state.

You can get an LLC in Idaho in 5-7 business days if you file online (or 2-3 weeks if you file by mail).

To revive or reinstate your Idaho LLC, you'll need to submit the following to the Idaho Secretary of State: a completed Idaho Reinstatement Form. any missing annual reports. a $25 filing fee.

One of the benefits of forming an LLC in Idaho is that you avoid corporate taxes and double taxation. LLCs, including S corporations, qualify as pass-through entities, so you will pay state taxes on your personal filings. However, you might be subject to other types of state taxes, including: Sales tax.

Idaho LLC Formation Filing Fee: $100 The cost to start an Idaho LLC is $100 for online filings, and $120 for paper filings. Forming your LLC involves filing an Idaho Certificate of Organization with the Secretary of State. Filing your certificate officially creates your Idaho LLC.

We've put together a step-by-step guide to simplify the process of forming an LLC in Idaho. Step 1: Name your Idaho LLC. Choose a name for your Idaho LLC. ... Step 2: Appoint a registered agent in Idaho. ... Step 3: File an Idaho Certificate of Organization. ... Step 4: Create an operating agreement. ... Step 5: Apply for an EIN.

Apart from the filing fee, there are some federal taxes, and employment tax if the LLCs hire employees. Idaho is a desirable state to have an LLC as businesses get potential customers. Other than a few taxes, the state of Idaho does not have many annual costs.