Fixed Fee For In Miami-Dade

Description

Form popularity

FAQ

This application must be completed and submitted online via our website or in-person to the Zoning Permits Section located at: 11805 SW 26 Street, Suite 106, Miami, FL 33175 • Phone: 786-315-2660. rer-cuinfo@miamidade • .miamidade/building.

Schedule of Fees ApplicationFee Campus Master Plan $1,135 + $8/100 sq. ft. Campus Master Plan Amendment $541 Certificate of Use $250 Certificate of Use, Renewal $25057 more rows

The Certificate of Use, often known as a CU, confirms that the business is allowed in the zoning district where it is located.

CERTIFICATE OF OCCUPANCY. Certificate of Occupancy (CO) issuance shall be assessed at $150.00 each.

Request the CC Fill out the below form for a CO/CC request. After applying, if your information is verified and correct, your certificate will be available to print within 3-5 days on iBuild (select 'manage permit, search permit', then view the "certificates" tab to print).

The most recognized test requirement for both MDC and ASTM requires an impact from a 9- pound 2x4 traveling at 50fps, followed by 9000+/- pressure cycles based on the AAMA/WDMA/CSA 101/I.S. 2/A440-08 design pressure of the unit.

Fun Fact: When a building in Miami-Dade or Broward county celebrates its 40th birthday, it must be recertified by an engineer or architect to ensure its structural and electrical safety (after the 40-year mark, buildings must also be recertified every ten years thereafter).

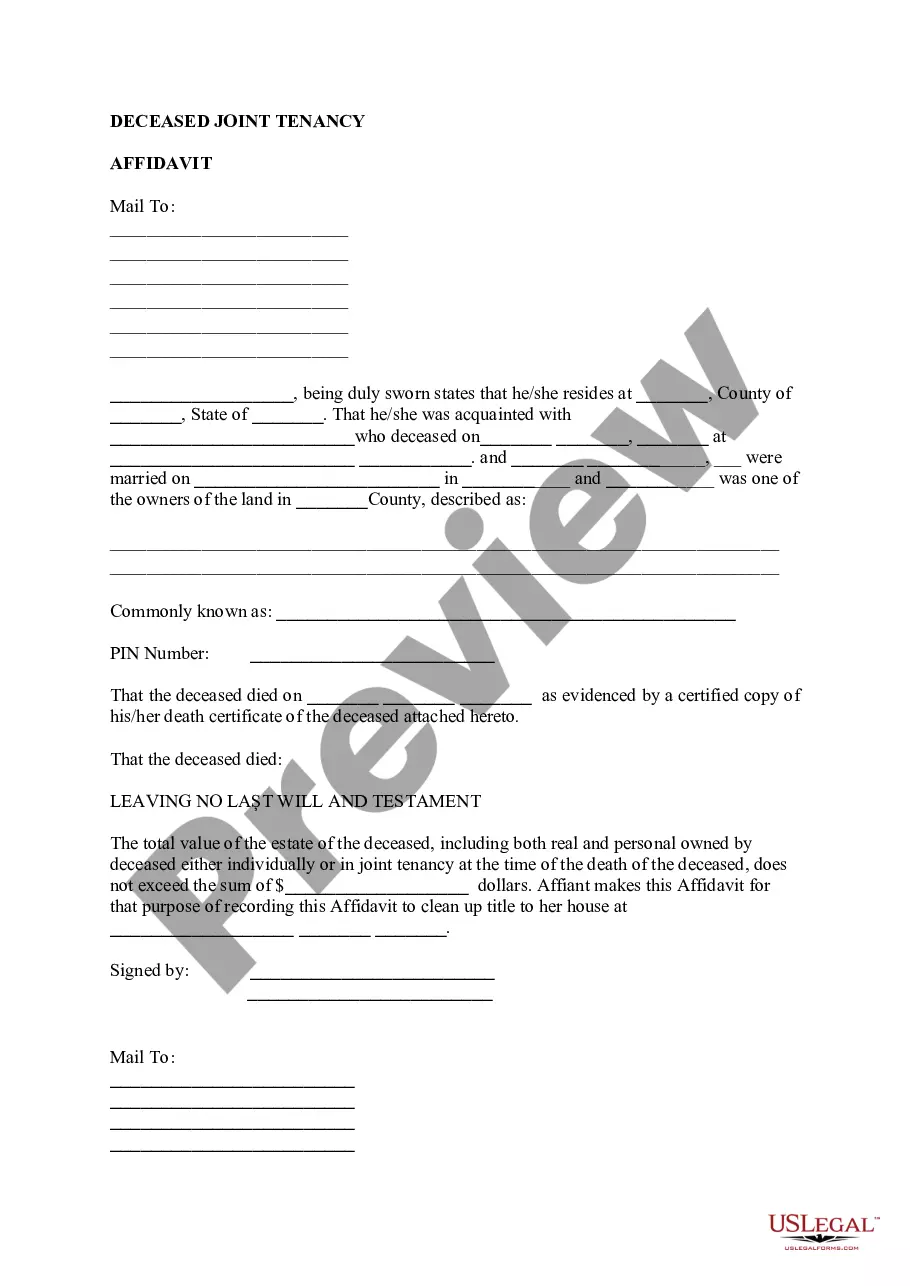

In response to a change in Florida law, the following is required when recording deeds: Government-issued photo identification of grantees and grantors. Mailing addresses noted below each witness name or signature on the document.

Record a Document You have three options for recording your documents in the Official Records: You can bring your original documents in person, along with the appropriate fees, and a self-addressed stamped envelope to the Miami-Dade County Courthouse. You can eRecord your document through one of our approved vendors.

Miami-dade County sales tax details The minimum combined 2025 sales tax rate for Miami-dade County, Florida is 7.0%. This is the total of state, county, and city sales tax rates. The Florida sales tax rate is currently 6.0%. The Miami-dade County sales tax rate is 1.0%.