Utah Deceased Joint Tenancy

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

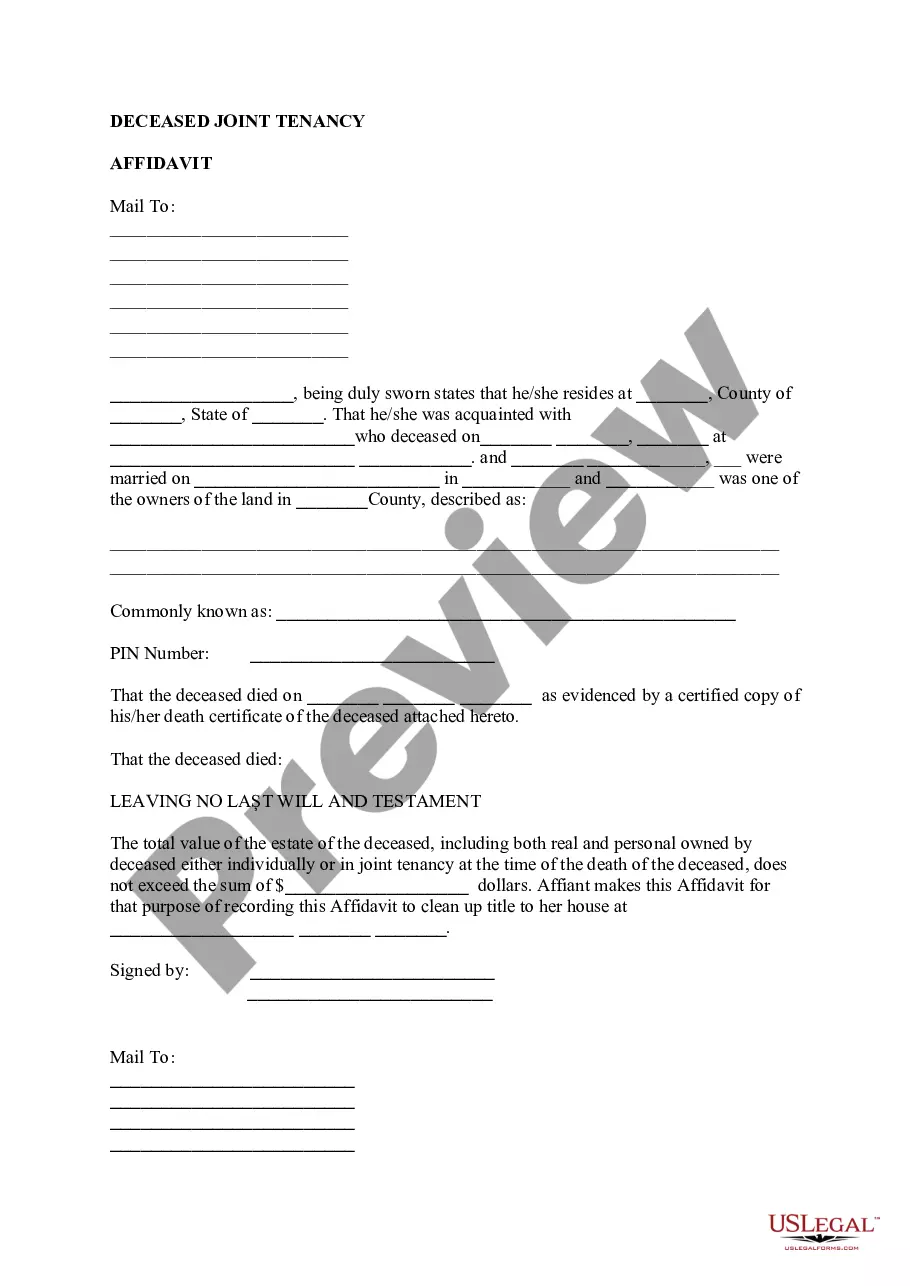

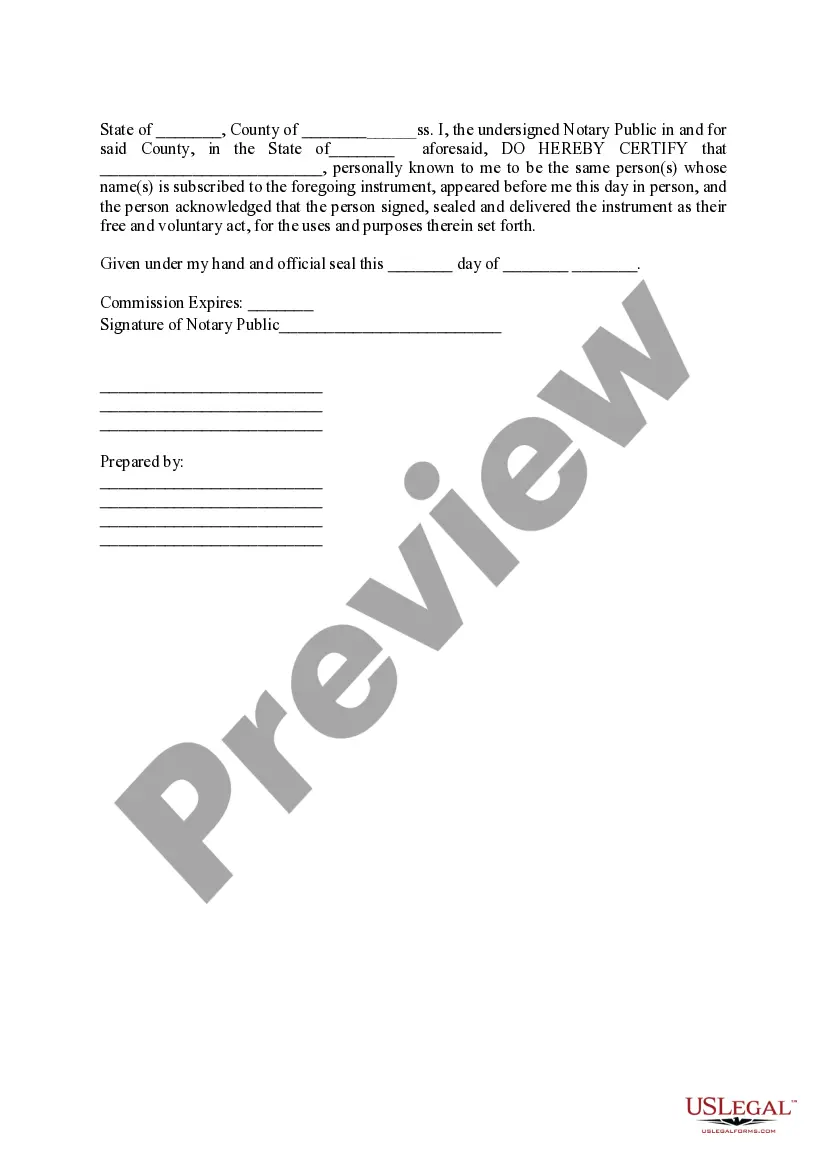

How to fill out Utah Deceased Joint Tenancy?

Searching for a Utah Deceased Joint Tenancy on the internet might be stressful. All too often, you find papers that you believe are ok to use, but discover later they’re not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Get any document you are searching for within minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will automatically be added in to your My Forms section. In case you don’t have an account, you have to sign-up and pick a subscription plan first.

Follow the step-by-step recommendations listed below to download Utah Deceased Joint Tenancy from the website:

- See the form description and press Preview (if available) to check if the form suits your requirements or not.

- In case the document is not what you need, get others with the help of Search engine or the provided recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- Right after getting it, you are able to fill it out, sign and print it.

Get access to 85,000 legal forms from our US Legal Forms catalogue. In addition to professionally drafted samples, customers may also be supported with step-by-step guidelines regarding how to find, download, and fill out forms.

Form popularity

FAQ

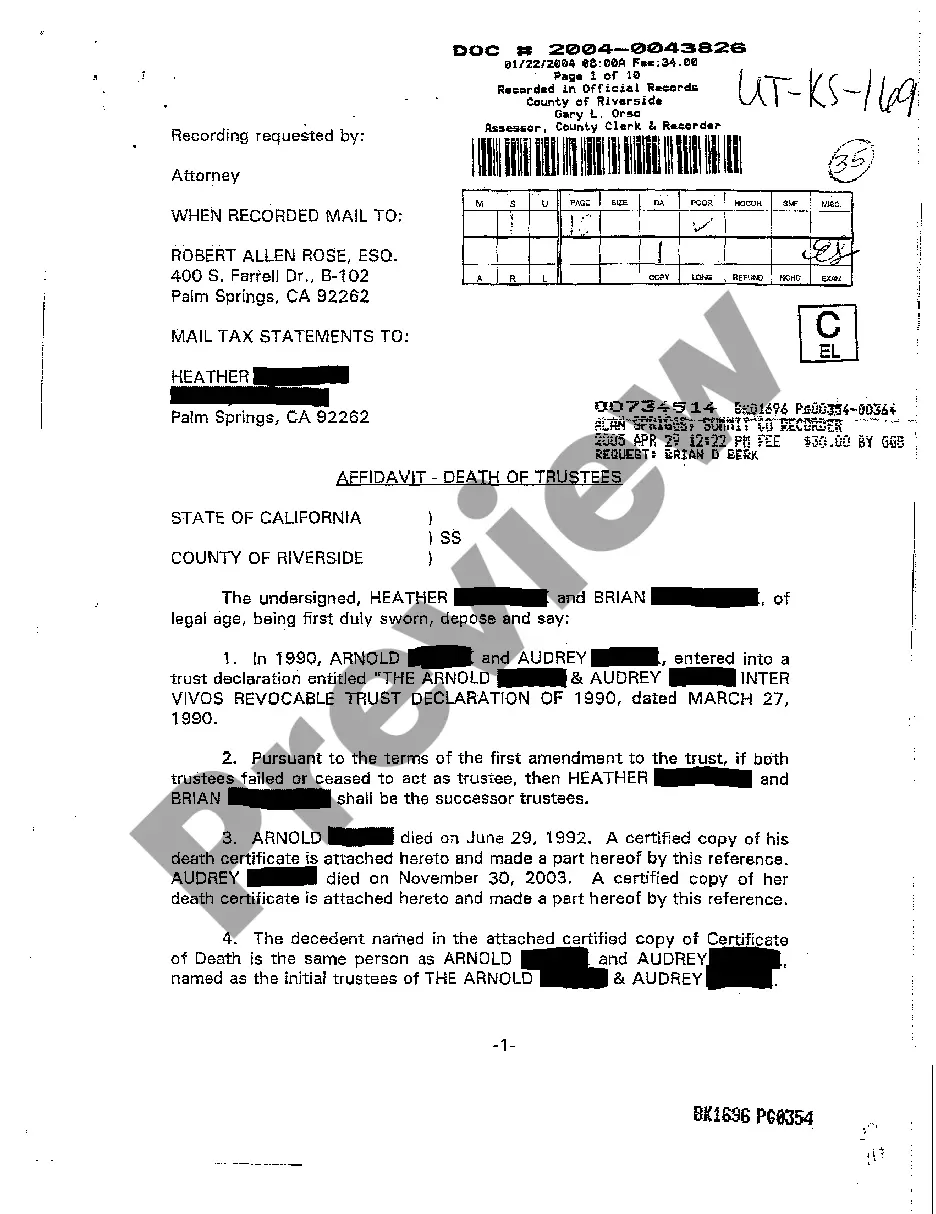

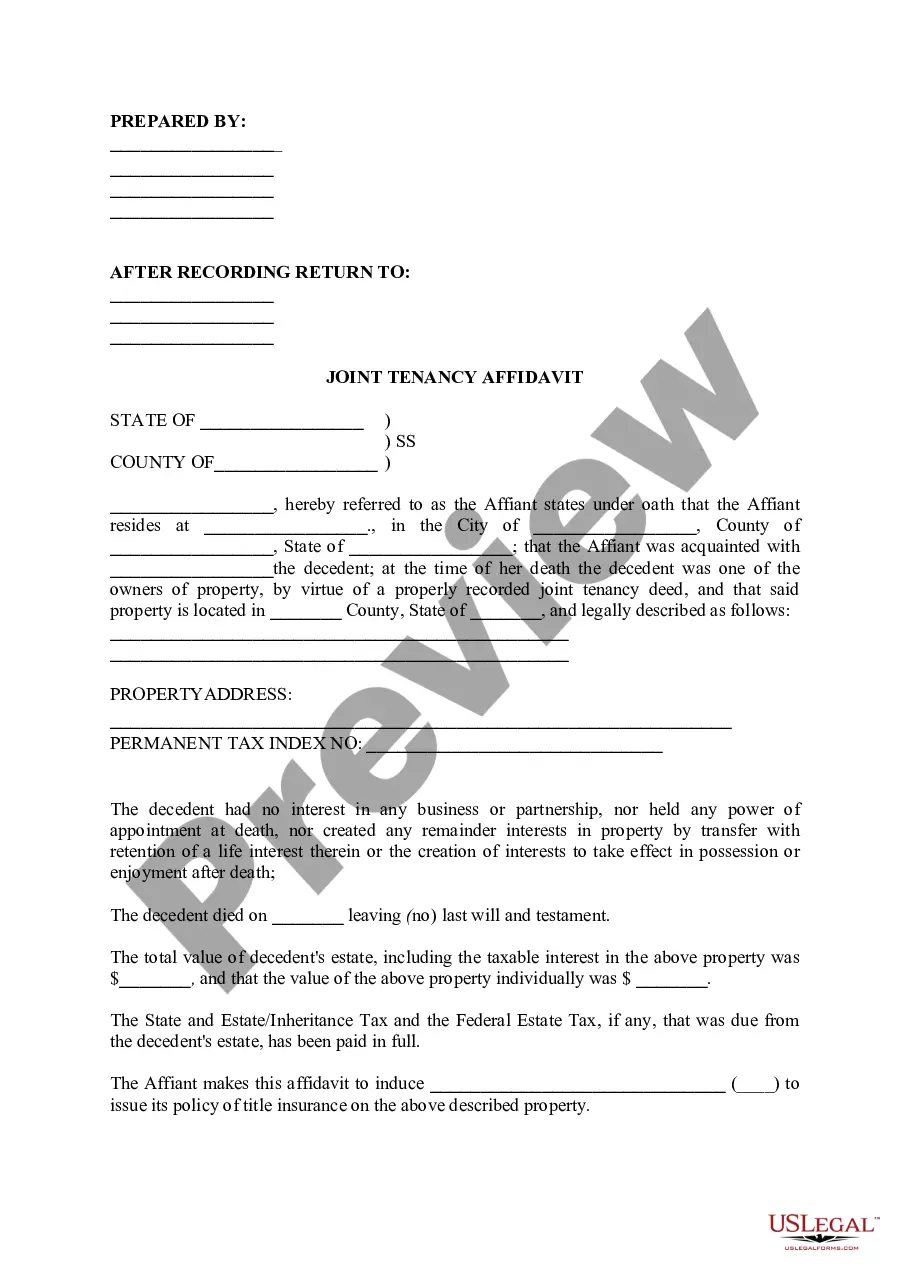

Severing the Joint Tenancy If you are a Joint Tenant, this means that on the death of one tenant, his or her share automatically passes to the surviving tenant. If you do not wish this to happen, then the Joint Tenancy must be severed to create a Tenancy in Common.

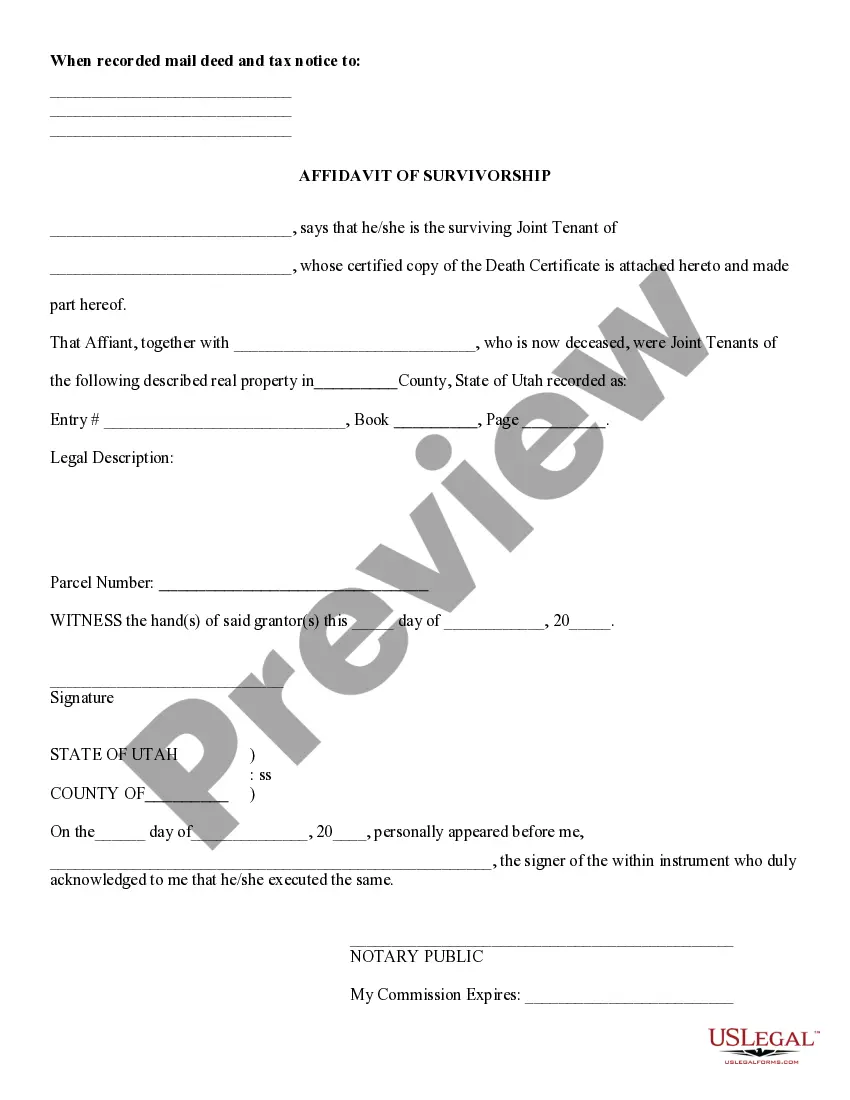

When one joint owner (called a joint tenant, though it has nothing to do with renting) dies, the surviving owners automatically get the deceased owner's share of the joint tenancy property.The surviving joint tenant will automatically own the property after your death.

Converting a property share in a joint tenancy to a TIC is known as "unilateral conversion." California and other states allow owners in joint tenancies to unilaterally convert their shares to TICs simply by transferring their property interests to themselves.

A survivorship deed, or a joint tenancy with right of survivorship, is much more difficult to contest than a will bequeathing property to beneficiaries. However, one circumstance in which a survivorship might be successfully contested is when the document granting right of survivorship has not been properly drafted.

When a property is owned by joint tenants with survivorship, the interest of a deceased owner automatically gets transferred to the remaining surviving owners. For example, if four joint tenants own a house and one of them dies, each of the three remaining joint tenants ends up with a one-third share of the property.

Property held in joint tenancy, tenancy by the entirety, or community property with right of survivorship automatically passes to the survivor when one of the original owners dies. Real estate, bank accounts, vehicles, and investments can all pass this way. No probate is necessary to transfer ownership of the property.

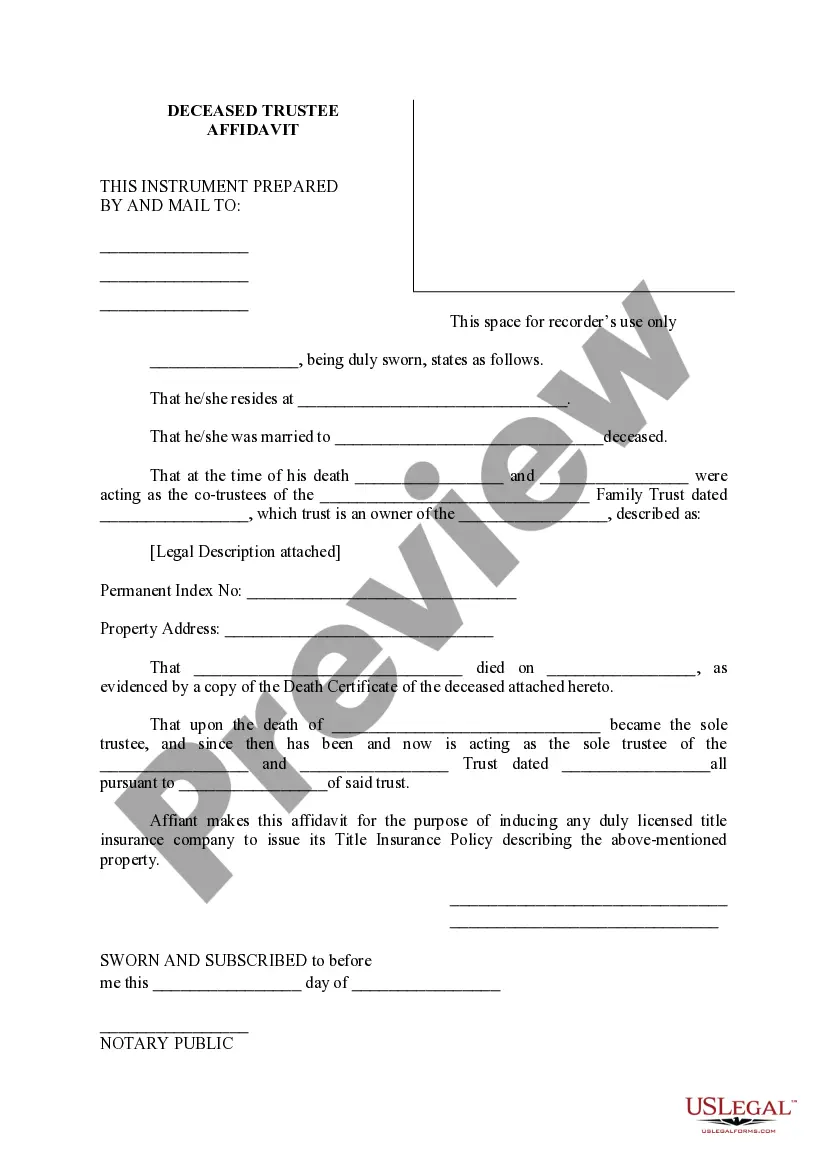

Joint tenancy avoids probate. 2. Title to real property can be cleared after a death by filing an affidavit of death of joint tenant. The surviving joint tenant then owns the property with no further proceedings or paperwork required.

This is known as 'Severing the Joint Tenancy'. It requires service of a written notice of change the 'severance'. It can be done without the other owner's cooperation or agreement. It is recorded at the Land Registry, and the other owner will know it has been done but only 'after the event' so to speak.

When a property is owned by joint tenants with survivorship, the interest of a deceased owner automatically gets transferred to the remaining surviving owners. For example, if four joint tenants own a house and one of them dies, each of the three remaining joint tenants ends up with a one-third share of the property.