Construction Contracts Types For Insurance

Description

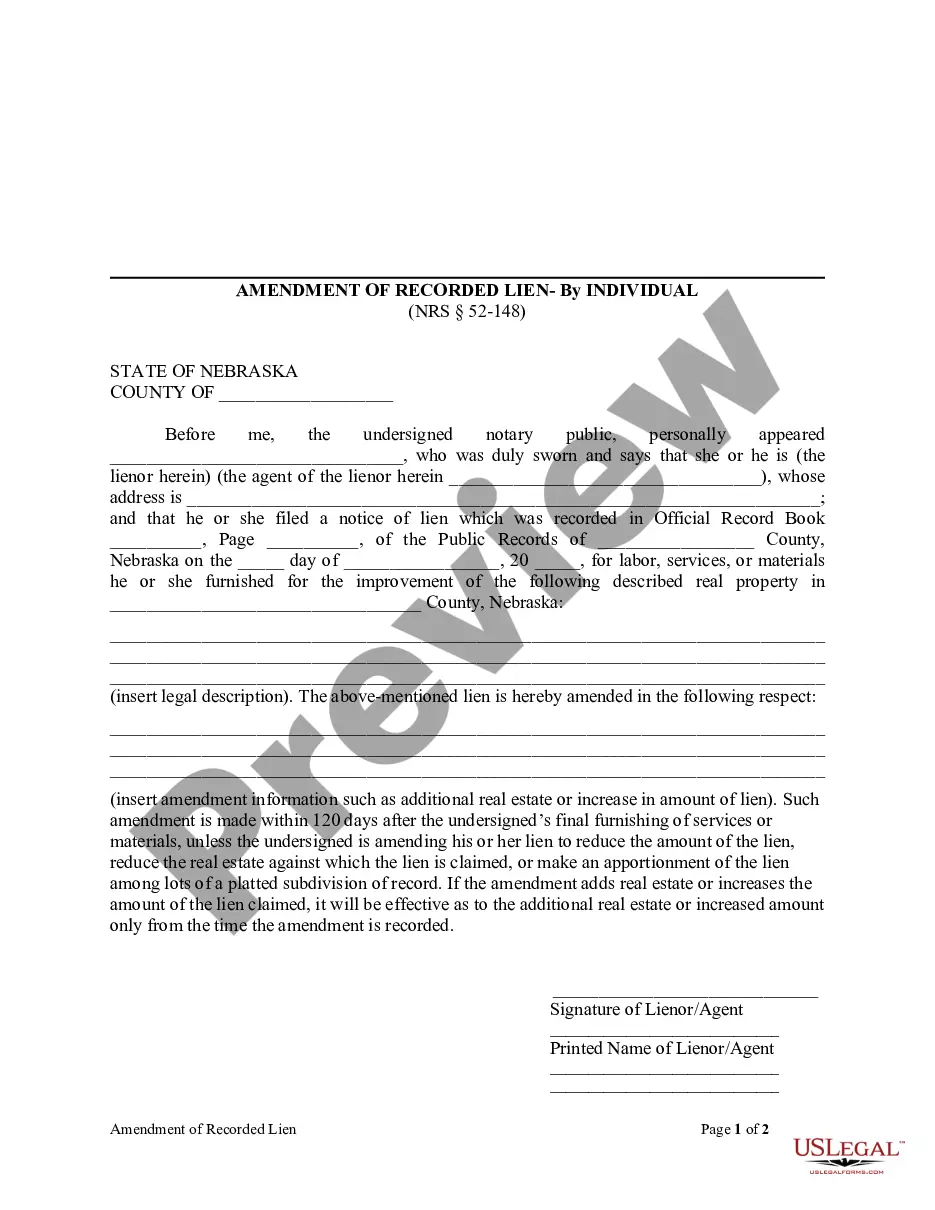

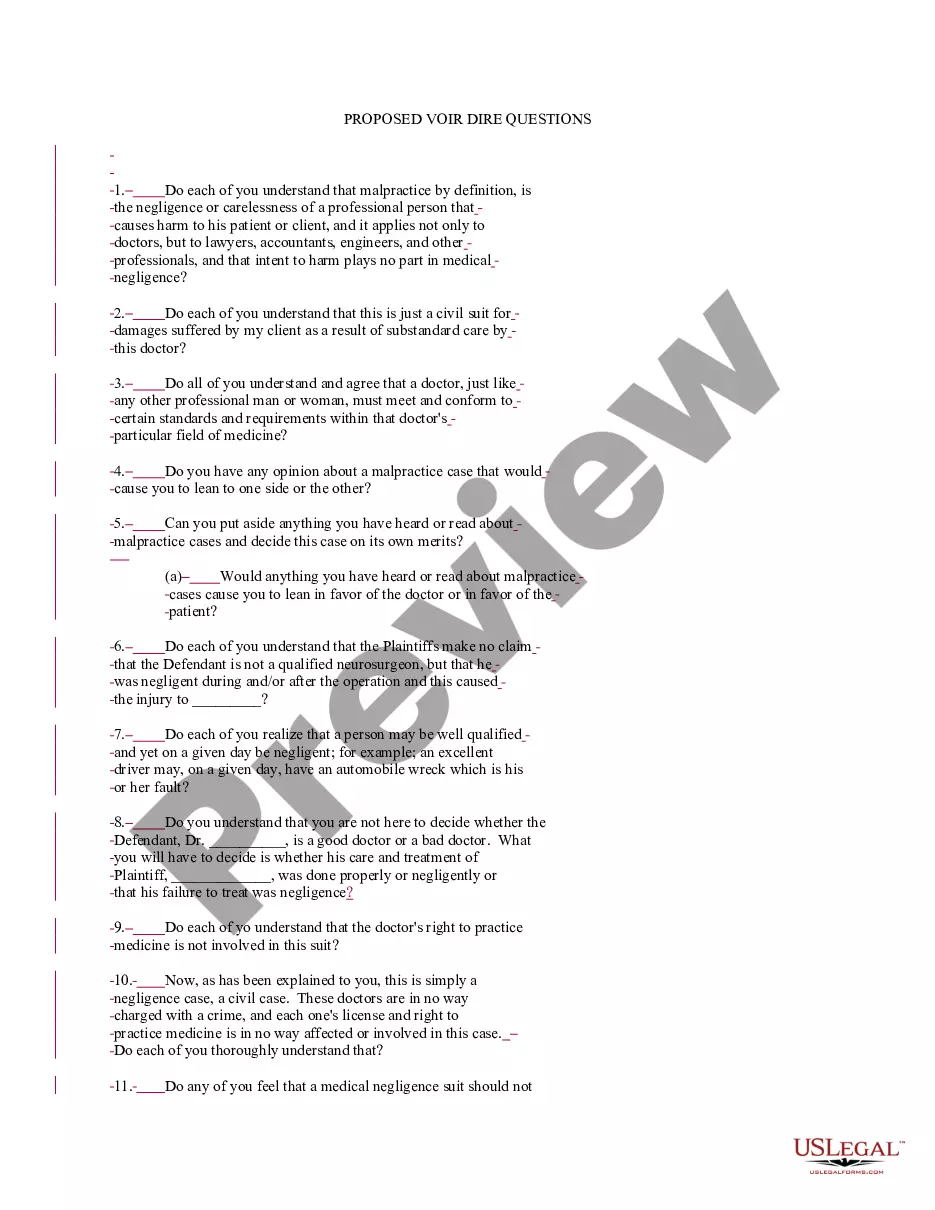

How to fill out Construction Contract For Home - Fixed Fee Or Cost Plus?

Handling legal documentation can be perplexing, even for the most skilled professionals.

When seeking various Construction Contracts Types for Insurance and lacking the time to invest in finding the right and current version, the process can be challenging.

US Legal Forms encompasses all your needs, from personal to corporate paperwork, all in one place.

Make use of advanced tools to complete and manage your Construction Contracts Types for Insurance.

Here are the steps to follow after obtaining the required form.

- Access a valuable repository of articles, guides, and resources that are pertinent to your situation and needs.

- Save time and energy searching for the forms you require, using US Legal Forms’ innovative search and Preview tool to locate Construction Contracts Types for Insurance and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to review the documents you've previously downloaded and organize your folders as you desire.

- If this is your initial experience with US Legal Forms, create a free account and gain unlimited access to all the platform’s advantages.

- Utilize a robust online form library that can transform the way you manage these situations.

- US Legal Forms is a leader in internet legal forms, offering more than 85,000 state-specific legal documents accessible at any time.

- Access state- or county-specific legal and business documents.

Form popularity

FAQ

Construction contracts serve as essential agreements that outline the terms and conditions between parties involved in a construction project. These contracts specify various construction contracts types for insurance, defining responsibilities, timelines, and payment structures. Understanding the basics ensures that both contractors and clients have aligned expectations, promoting transparency and reducing disputes. By using USLegalForms, you can access reliable templates that help you draft clear and enforceable construction contracts tailored to your needs.

Who Must Apply for a Dealer License and How? A person is "engaged in the business of buying, selling, exchanging, offering to negotiate, negotiating or advertising the sale of vehicles" if that person: Buys vehicles for the purpose of resale; Sells more than 5 vehicles in any 12 month period; or.

How to Sell a Car in New Hampshire Step 1: Allow the buyer to have the car inspected by a third party. Step 2: Organize and gather all related vehicle documentation. Step 3: Bill of Sale. Step 4: Transfer the title. Step 5: Remove your plates and cancel your insurance.

The irony in New Hampshire is that it prides itself in having no income or sales tax, yet it ranks high on property taxes. That means New Hampshire relies most heavily on the property tax to fund local services and public education.

In ance with RSA 23-b "Unlicensed Sales Prohibited" - No person may sell 5 or more vehicles at retail to the general public in any consecutive 12-month period unless the person has an established place of business and a valid dealer license issued under RSA 23-a.

A presumption exists that all court records are subject to public inspection. The public right of access to specific court records must be weighed and balanced against nondisclosure interests as established by the Federal and/or New Hampshire Constitution or by statutory provision granting or requiring confidentiality.

You can obtain a PACER login on-line or by calling (800) 676-6856. If you have a PACER account, you may login to the court's electronic case files. You may also view the court's electronic case files free of charge at the public terminals in the clerk's office.

Original Criminal background check of each owner from New Hampshire and state of residency. Dealer license fee of $125.00, due at the time of application. Successful completion of the title/dealer class is required upon approval.

If you buy or sell a car in New Hampshire as a private party, a title transfer is required to verify the change in ownership. Buyers also need to obtain a current registration. To transfer ownership of a motor vehicle that is exempt from titling, the buyer and seller must complete a bill of sale.