Consignment Note Format Under Gst In Cook

Description

Form popularity

FAQ

Document accompanying goods that is filled by the shipper. It serves as proof that a contract for carriage has been concluded and describes its content. It also serves as a receipt when goods are picked up from the shipper and delivered to the recipient.

GST registered businesses must account for the GST on sales made through an agent, on consignment or lease arrangements. If you're registered for GST, you must account for the GST on sales made through an agent, on consignment or via a progressive transaction (such as a lease or hire arrangement).

If a consignment note is issued, it indicates that the lien on the goods has been transferred (to the transporter) and the transporter becomes responsible for the goods till its safe delivery to the consignee.

A consignment note is a document that details the goods being shipped and the terms of the consignment, while a delivery note confirms the receipt of goods at the destination.

An invoice is a commercial document that maintains the record of transactions between the buyer and the seller. On the other hand, a consignment note is an export document that serves as evidence of a concluded carriage contract.

An invoice is a commercial document that maintains the record of transactions between the buyer and the seller. On the other hand, a consignment note is an export document that serves as evidence of a concluded carriage contract.

A consignment note is a document issued by a goods transportation agency against the receipt of goods for the purpose of transporting the goods by road in a goods carriage. If a consignment note is not issued by the transporter, the service provider will not come within the ambit of the goods transport agency.

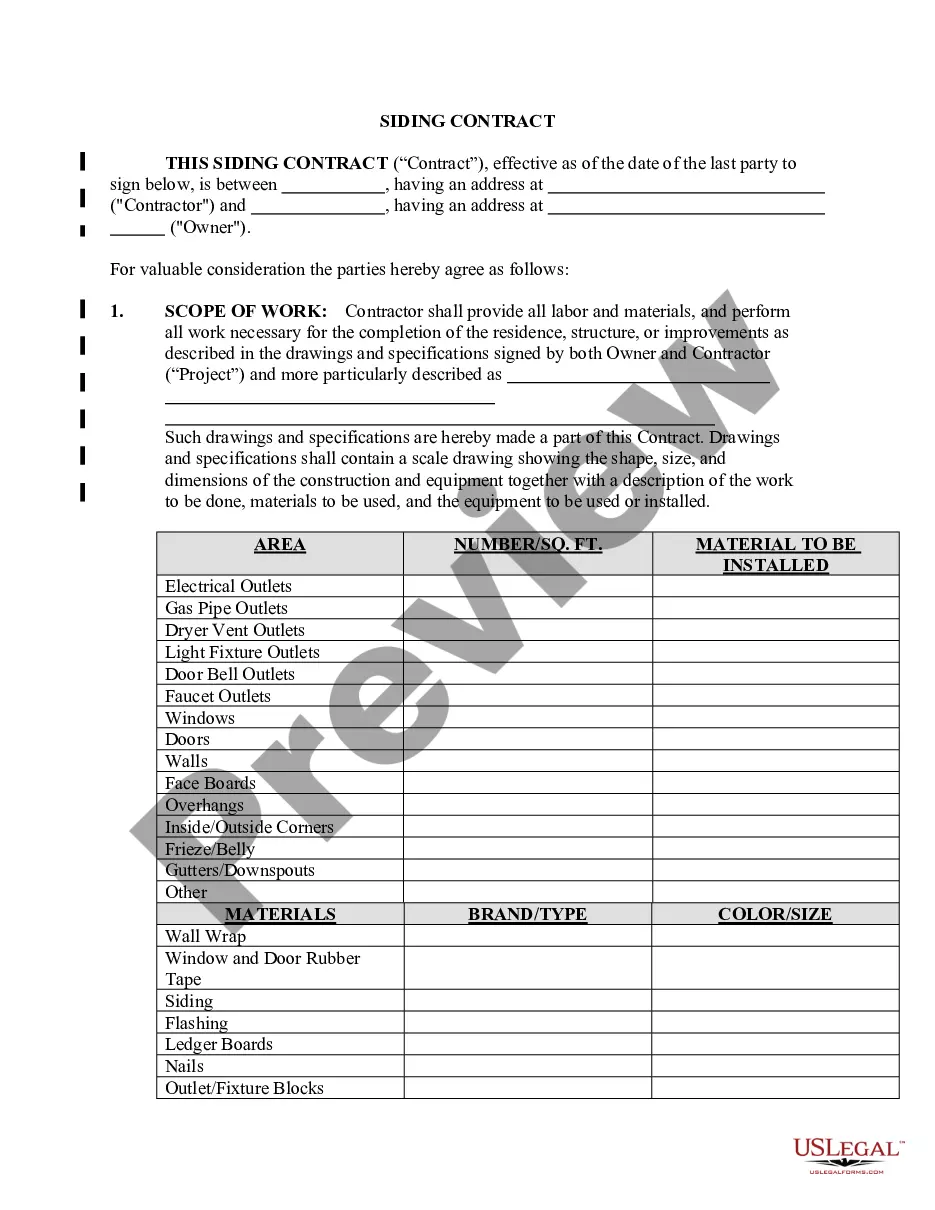

Please provide full description of goods, number of packages, gross weight and consignment dimensions. Customer reference. You can enter any internal reference code that you would like to be printed on the invoice, with a maximum of 24 characters. Delivery address. Dutiable shipment details.

An invoice is a document to record the sale of goods or services that is reported in GST returns and forms part of significant information for tax calculation. A consignment note is a document that corroborates the movement of goods during transportation from one place to another.

Is there a difference between a waybill and a consignment note? - Quora. The waybill is the shipping company's documentation. The consignment note is the sender's documentation.