Consignment Agreement In Arabic In Bexar

Description

Form popularity

FAQ

Bexar County Appraisal District will schedule a hearing to give you the opportunity to protest your taxes. At the hearing you will speak to a panel and explain why you think the taxes should be lower. You can attend the hearing in person, virtually or telephone conference phone call.

State homestead protection laws help prevent people from becoming homeless in the event of a foreclosure or change in economic circumstances. In Texas, every family and every single adult person is entitled to a homestead exempt from seizure passed on the claims of creditors, except for a pre-existing mortgage or lien.

You may file the following exemptions on the Online Services Portal: General Residence Homestead, Disabled Person, Person Age 65 or Older (or Surviving Spouse), 100 Percent Disabled Veteran (or Surviving Spouse), Donated Residence of Partially Disabled Veteran (or Surviving Spouse), Surviving Spouse of an Armed ...

Texas Property Tax Rates CountyMedian Home ValueAverage Effective Property Tax Rate Bexar County $222,300 1.88% Hays County $335,700 1.85% Williamson County $370,100 1.83% Wichita County $129,000 1.83%70 more rows

Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home.

Ing to the Comptroller, there is no provision for the cessation of property taxes at any stage. However, there is a Texas property tax exemption for people over the age of 65, which offers temporary tax relief for seniors. At the age of 65, seniors can apply for an exemption from Texas property taxes.

Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home. The Over-65 exemption is for property owners who claim their residence as their homestead - this exemption is a maximum of $85,000 of taxable valuation.

Texas offers several types of Homestead Exemptions: Standard Homestead Exemption: Provides a $100,000 reduction in the appraised value for school district taxes. For example, a home appraised at $300,000 would have its taxable value reduced to $200,000, saving homeowners hundreds of dollars annually.

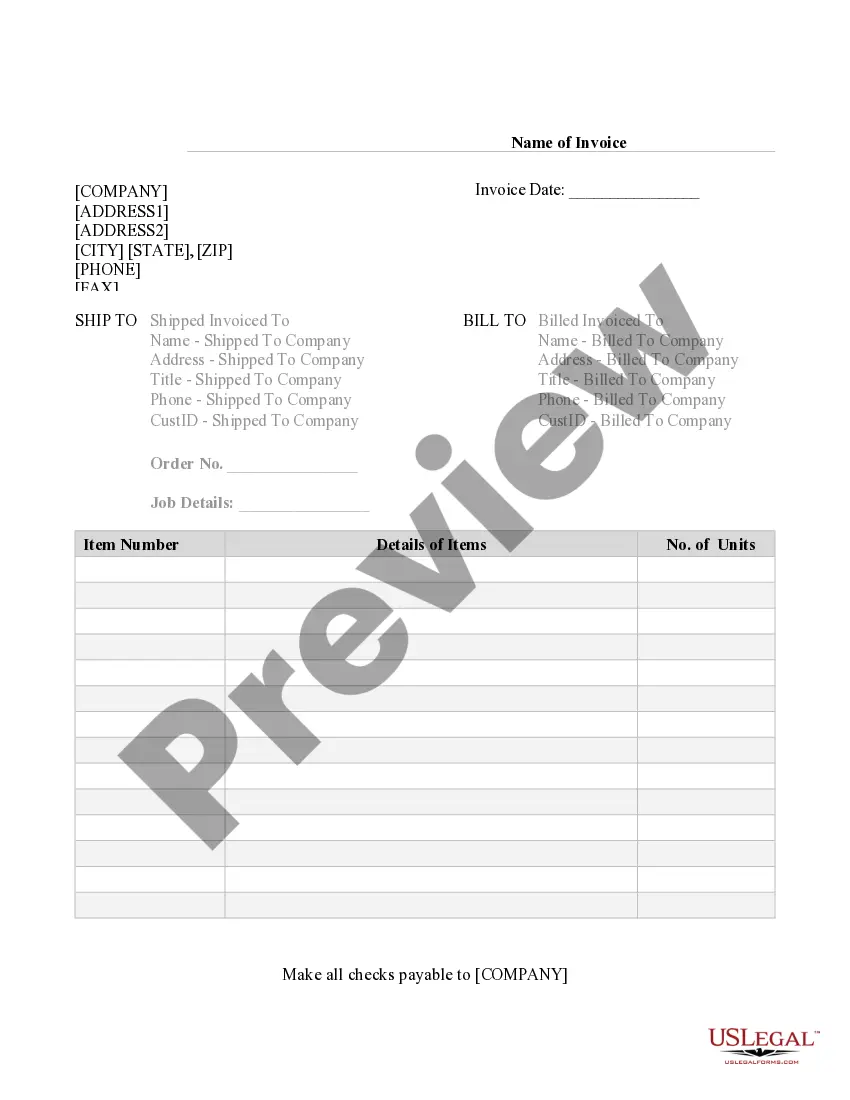

Here are the essential components to include: Parties Involved: Names and contact information of the consignor and the consignee. Consigned Goods: Detailed description of the goods being consigned, including quantities and specifications. Consignment Period: Duration of the consignment arrangement.

Art galleries are classic examples of consignment businesses. Artists (consignors) entrust their artwork to galleries (consignees). The galleries display the artwork, handle marketing and sales, and take a commission from each sale. The artist retains ownership of their work until it's sold.