S Corporation With Two Shareholders In Texas

Description

Form popularity

FAQ

Partnerships are the simplest structure for two or more people to own a business together. There are two common kinds of partnerships: limited partnerships (LP) and limited liability partnerships (LLP).

Furthermore, it must be established by at least five individuals known as incorporators. A corporation's ownership is divided into stock shares.

General partnerships are businesses with two or more owners that share profits and personal liability for the business they own. A partnership does not require you to register your business with the state.

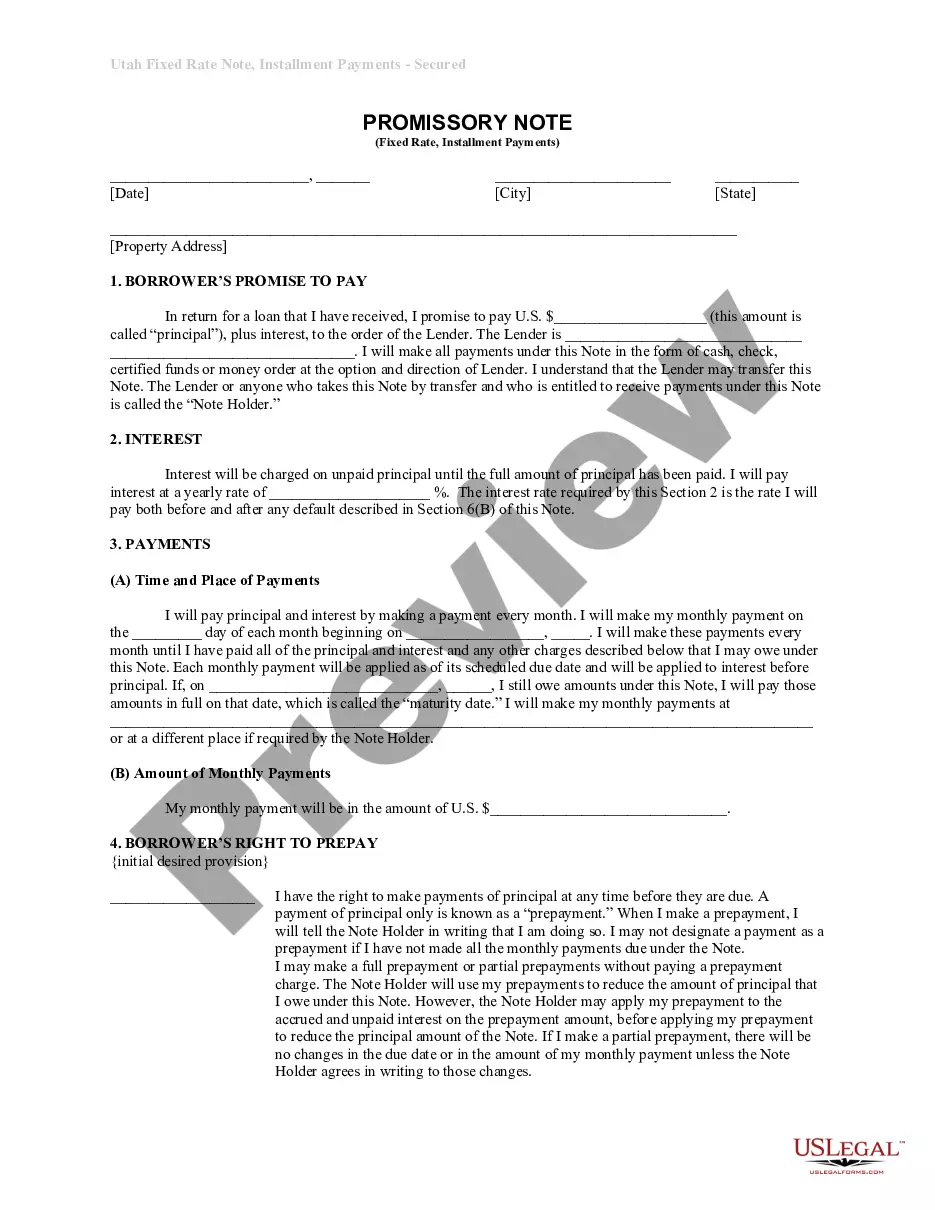

To qualify for S corporation status, the corporation must meet the following requirements: Be a domestic corporation. Have only allowable shareholders. Have no more than 100 shareholders. Have only one class of stock.

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners).

Unlike sole proprietorships, a corporation can be owned by multiple people.

There are seven steps you'll complete to start an S corp in Texas. Step 1: Check Name Availability. Step 2: Choose a Business Name. Step 3: Registered Agent. Step 4: Complete Form 201. Step 5: Bylaws and Regulations. Step 6: Obtain EIN. Step 7: File Form 2553.