S Corporation Without Payroll In San Jose

State:

Multi-State

City:

San Jose

Control #:

US-0046-CR

Format:

Word;

Rich Text

Instant download

Description

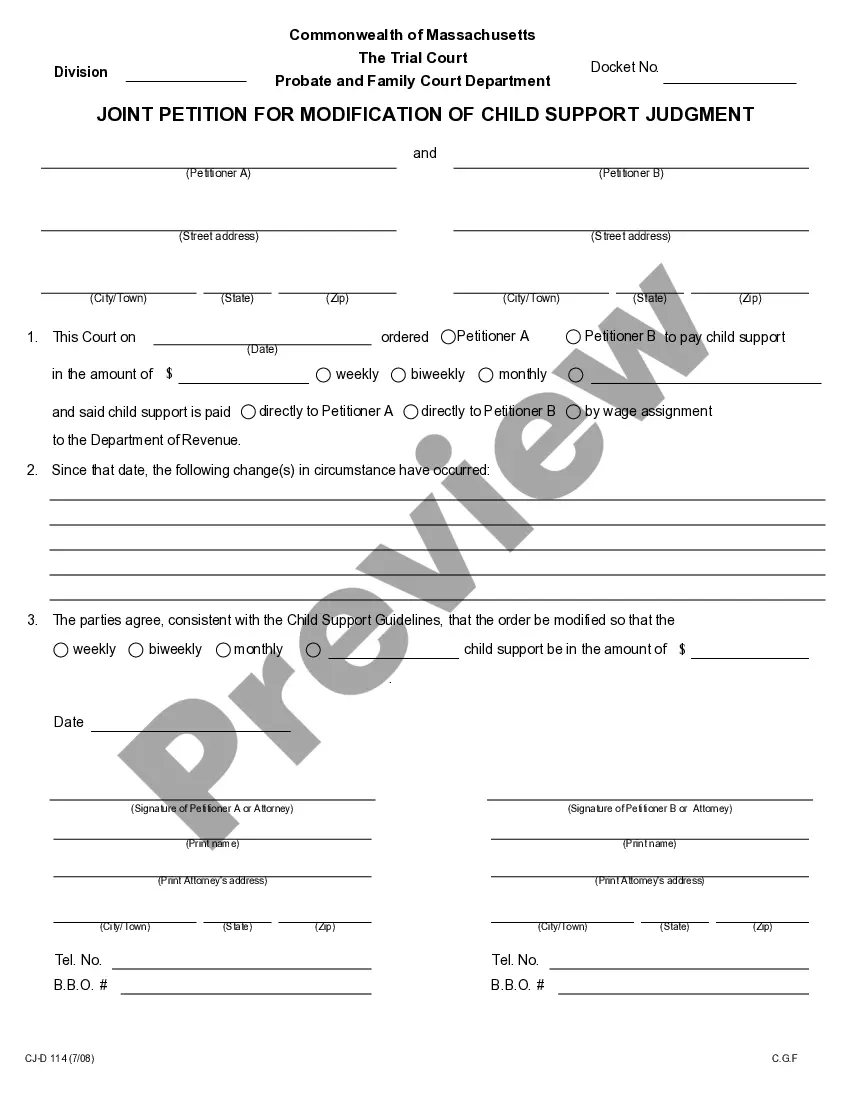

The form titled Resolution of S Corporation without payroll in San Jose outlines the necessary steps for a corporation to elect S corporation tax treatment under the Internal Revenue Code and state tax law. Key features of this form include authorizations for corporate officers to execute required documentation and resolutions, as well as provisions for ratifying actions taken prior to the resolution's adoption. Users will need to fill in specific details such as the corporation's name, state, and dates. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this form particularly useful for ensuring compliance with tax regulations and facilitating the transition to S corporation status. Clear instructions guide users in completing and editing the document, making it accessible even for those with limited legal experience. It's advisable for users to retain a copy of the final resolution for corporate records, as it serves as a critical document in maintaining corporate compliance and governance.

Free preview

Form popularity

FAQ

A small business corporation elects federal S corporation status by filing federal Form 2553 (Election By a Small Business Corporation) with the Internal Revenue Service. When a corporation elects federal S corporation status it automatically becomes an S corporation for California.