Confidentiality Agreement Format With Vendor In Texas

Description

Form popularity

FAQ

Absolutely. Texas businesses can and should continue to protect their interests through legally compliant nonsolicitation and nondisclosure agreements. The key is ensuring that these agreements are drafted to meet legal standards for reasonableness and necessity.

Under Texas law, a non-disclosure agreement is enforceable even if it is coupled with an unenforceable non compete agreement or invalid non-solicitation provision.

Depending upon person and method of execution, a witness signature may be required for a deed to be valid. A deed, rather than a contract, should be used where there is a want of consideration (i.e. no quid pro quo). In the case of NDAs, even unilateral NDAs, consideration isn't usually a problem.

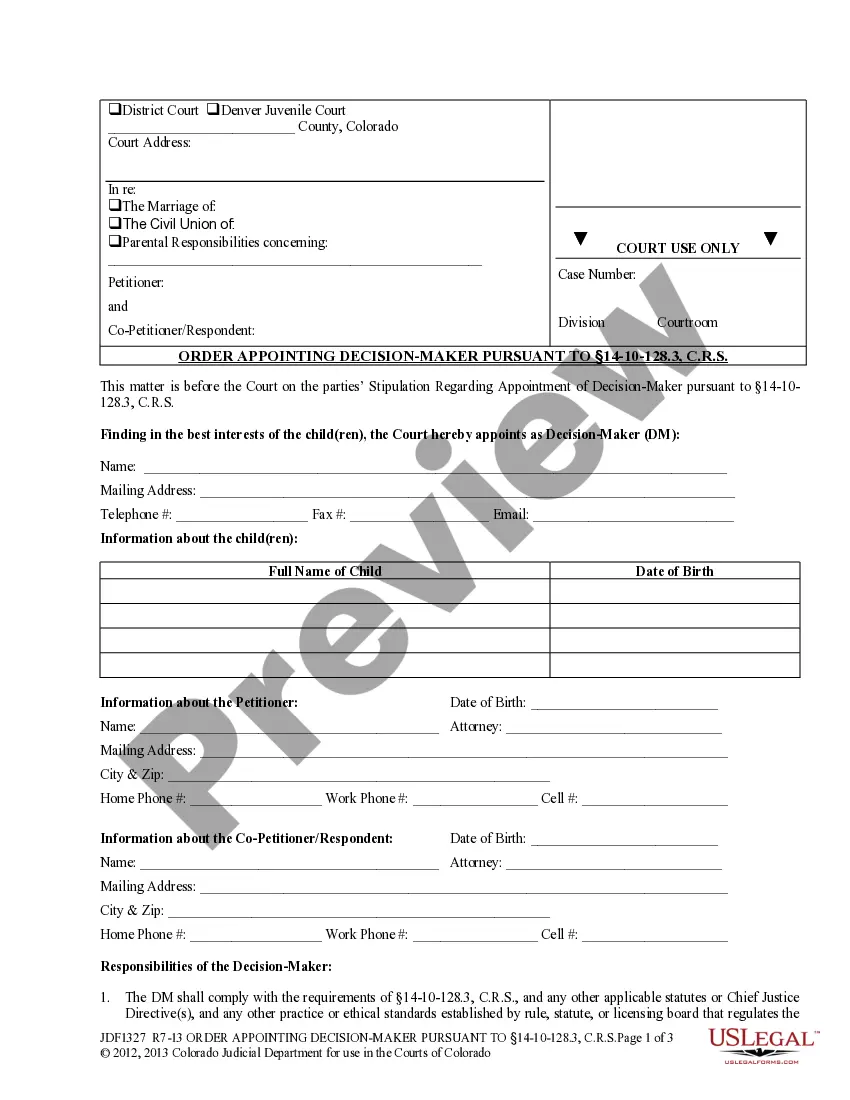

A confidentiality agreement should include the names and addresses of the parties to the contract. Consider also including: Reason for the agreement: Explain why you're sharing this information. The information disclosed: Be specific about the subject matter and what exactly is included in the agreement.

Generally, the types of documents that require a notary are those that have legal or financial significance. Some common types of documents that require notarization are as follows: Legal documents: Like affidavits and power of attorney forms.

Both parties must enter into the NDA voluntarily and with a clear understanding of its terms. If there was coercion or deception involved, the agreement may not be valid.

A confidentiality agreement is intended to protect the trade secrets and other confidential information between two or more parties, such as you and your vendor.

It doesn't need to be notarized or filed with any state or local administrative office.

Confidentiality clauses protect sensitive information exchanged during the vendor relationship, such as proprietary data or business strategies. These clauses are essential for maintaining the integrity and confidentiality of business operations.