Credit Card Form Statement Without Bank In Salt Lake

Description

Form popularity

FAQ

Proof of Income Salaried individuals may need to provide: Recent Salary Slips. Form 16 or Income Tax Returns. Bank Statement from the last 3 to 6 months.

The most common types are paper statements mailed to account holders, electronic statements that can be accessed online or through mobile apps, and consolidated statements for accounts held across many financial institutions.

If you use a Credit Card, you will receive a statement every month, which records all the transactions you have made during the previous one month. Depending on how you have opted to receive it, you will get the Credit Card statement via courier at your correspondence address or as an email statement or both.

You may be asked to provide recent financial documents (such as payslips or bank statements) when applying.

Statements printed in branch should be stamped and dated by the bank, however if the printed statement clearly states it has been 'printed in branch' the bank stamp and date is not required.

The short answer is: Yes, but with limitations. Credit card statements are considered secondary evidence that can help prove you incurred an expense. They show important details such as the date, amount, and vendor of a transaction, which can be valuable when you're missing receipts.

No, you cannot use a credit card statement in place of a bank statement. They document different financial activities and are used for distinct purposes, such as proving your income or spending habits.

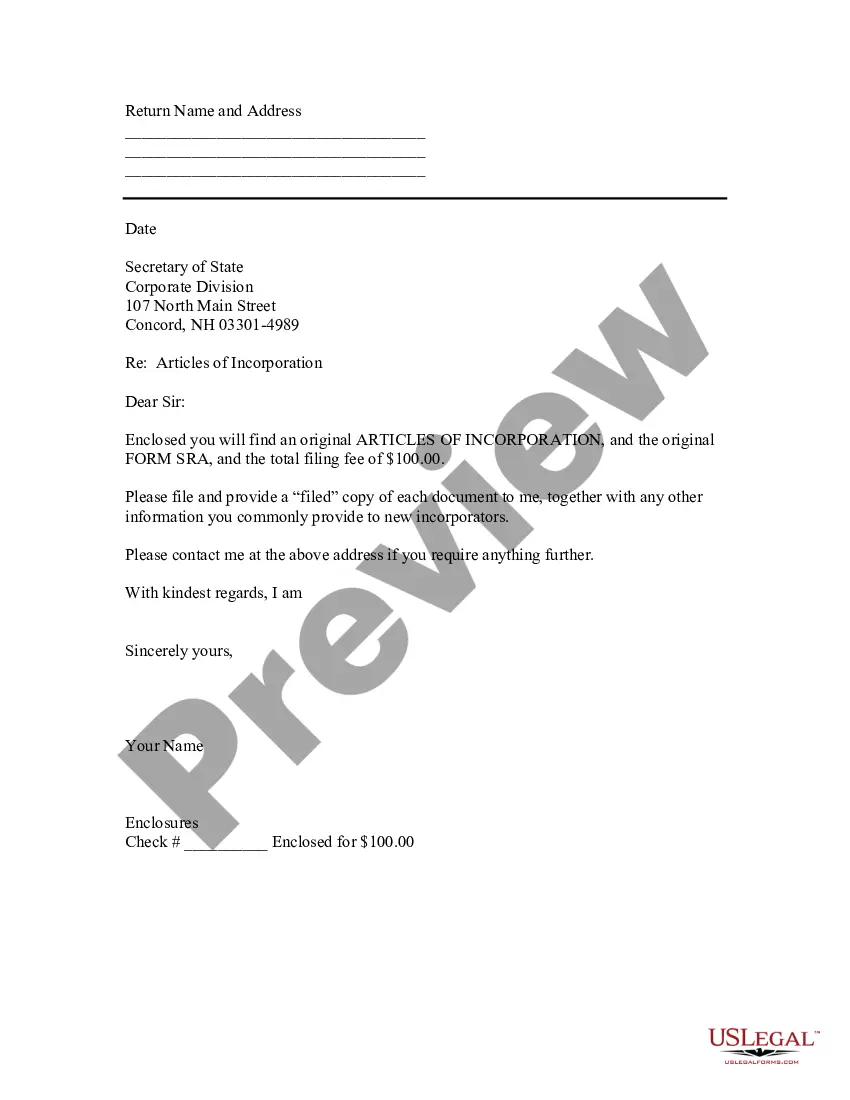

How to fill out the Letter of Credit-i Application Form Instructions? Gather all required documents before starting. Fill in the applicant and beneficiary details accurately. Select the type of Letter of Credit-i you need. Review all information for accuracy before submission.

How to fill out the Credit Card Application Form Instructions? Gather all necessary personal and financial information. Complete the personal information section, including name and address. Fill in your financial details, such as income and rent/mortgage payments.

Follow these simple steps to fill out your application: Fill out the application form from the credit card company. Enter your legal name. Provide your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN). Enter your date of birth. Give your address. Report your income.