Consultant Work Contract For Taxes In Travis

Category:

State:

Multi-State

County:

Travis

Control #:

US-00449BG

Format:

Word;

Rich Text

Instant download

Description

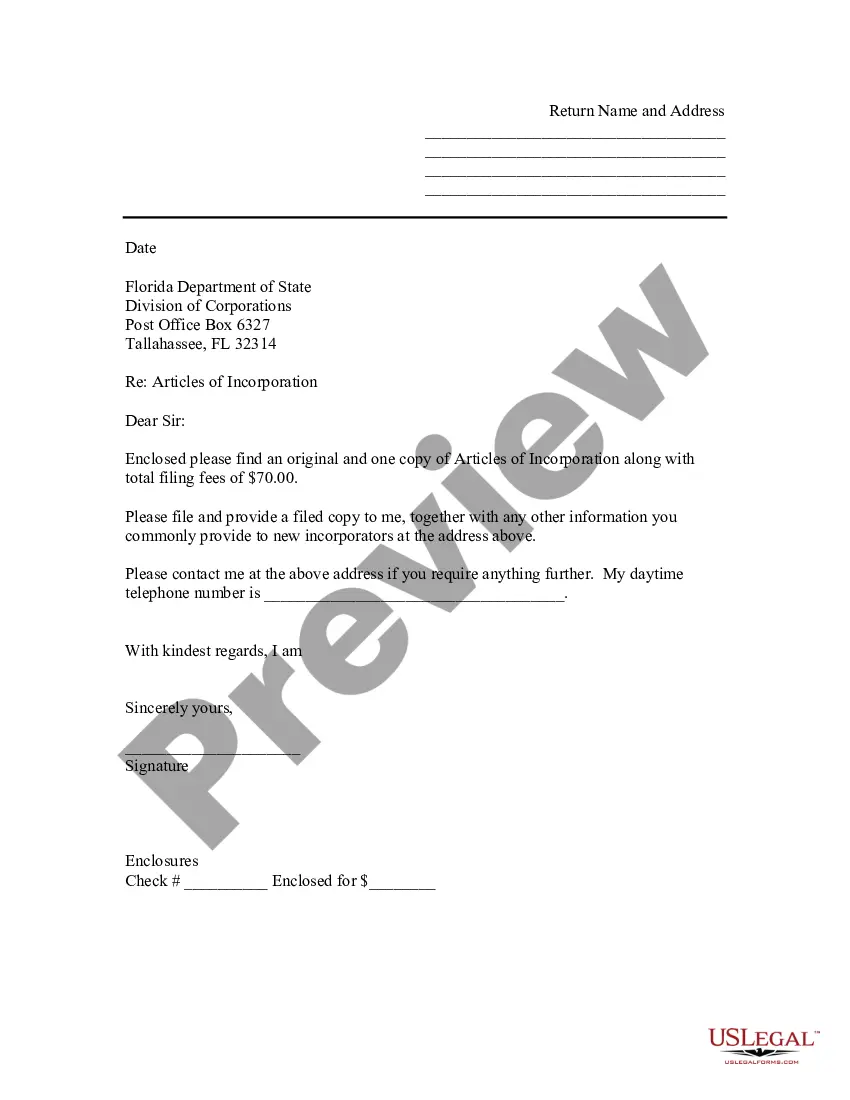

The Consultant Work Contract for Taxes in Travis outlines the agreement between a corporation and a consultant tasked with teaching workshops. Key features include the nature of work, specifying the consultant's teaching responsibilities and location; time devoted, which varies based on workshop needs; and payment terms, with the consultant receiving a percentage of fees collected. It also outlines the contract's duration and clarifies the independent contractor status of the consultant, meaning they are not entitled to employee benefits and can work for others. Indemnification clauses protect the corporation from liabilities arising from the consultant’s actions. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in organizing educational workshops or consulting services, as it provides a structured agreement that ensures accountability and clarity regarding the consultant's obligations and compensation.

Free preview

Form popularity

FAQ

Most consultants receive 1099 forms because they work for multiple companies, while an in-house consultant would receive a W-2.

Answer: Independent contractors generally report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if your net earnings from self-employment are $400 or more.

No, if you are an independent consultant or distributor for a direct sales or multi-level marketing company you are also required to report your income on Schedule C (Form 1040). As explained earlier, if you have net profits of at least $400 you'll also need to file Schedule SE.