Consultant Work Contract For Taxes In Maricopa

Description

Form popularity

FAQ

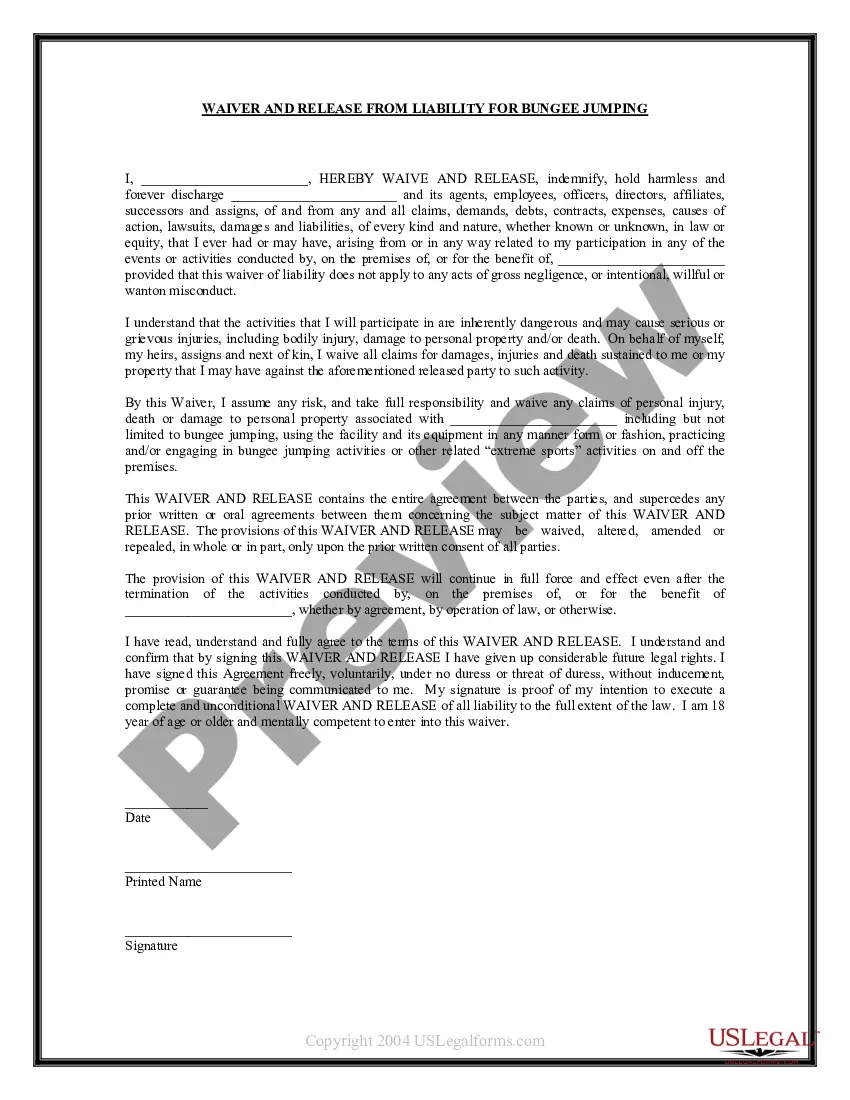

Services are generally not taxable in Arizona, with the following exceptions: amusements. personal property rentals. contracting.

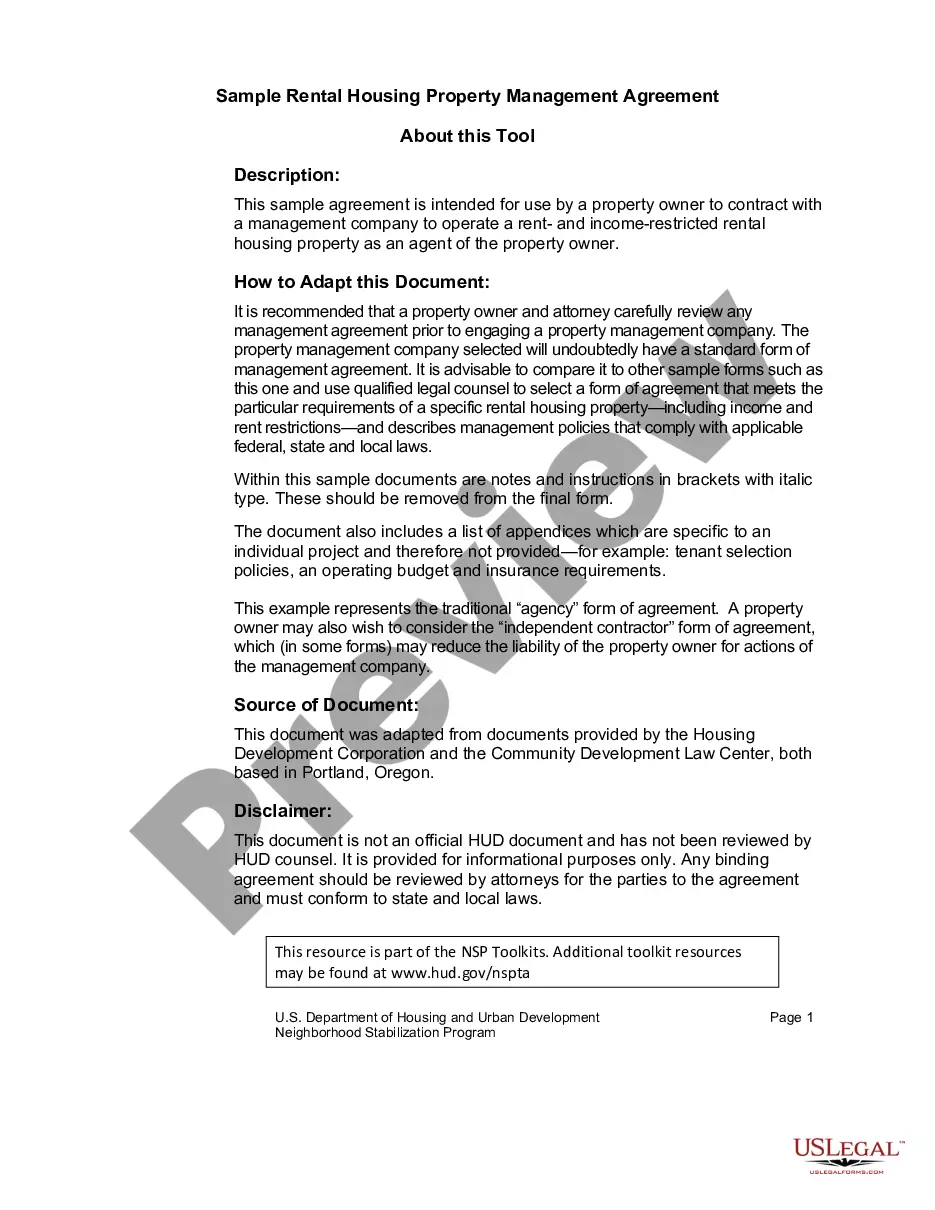

A total Transaction Privilege (Sales) Tax rate of 8.35%, (6.35% State and County, 2.00% Prescott), is imposed on the gross income of any person engaging in Construction Contracting. If tax has been neither separately charged nor separately collected, factoring of tax is allowed in computing taxable income.

Which services are taxable in Arizona? Generally, Arizona imposes a sales tax on services if they are considered to be tangible personal property repair, replacement, or maintenance services.

Services are generally not taxable in Arizona, with the following exceptions: amusements. personal property rentals. contracting. severance (metal mining) transporting. nonmetal mining. job printing. publishing.

Construction contracting (business code 015)

How does the transaction privilege tax (TPT) apply to prime contracting? The TPT is imposed on the business activity of performing contracting work as a prime contractor. The tax base is sixty-five percent of the gross receipts derived from the business.

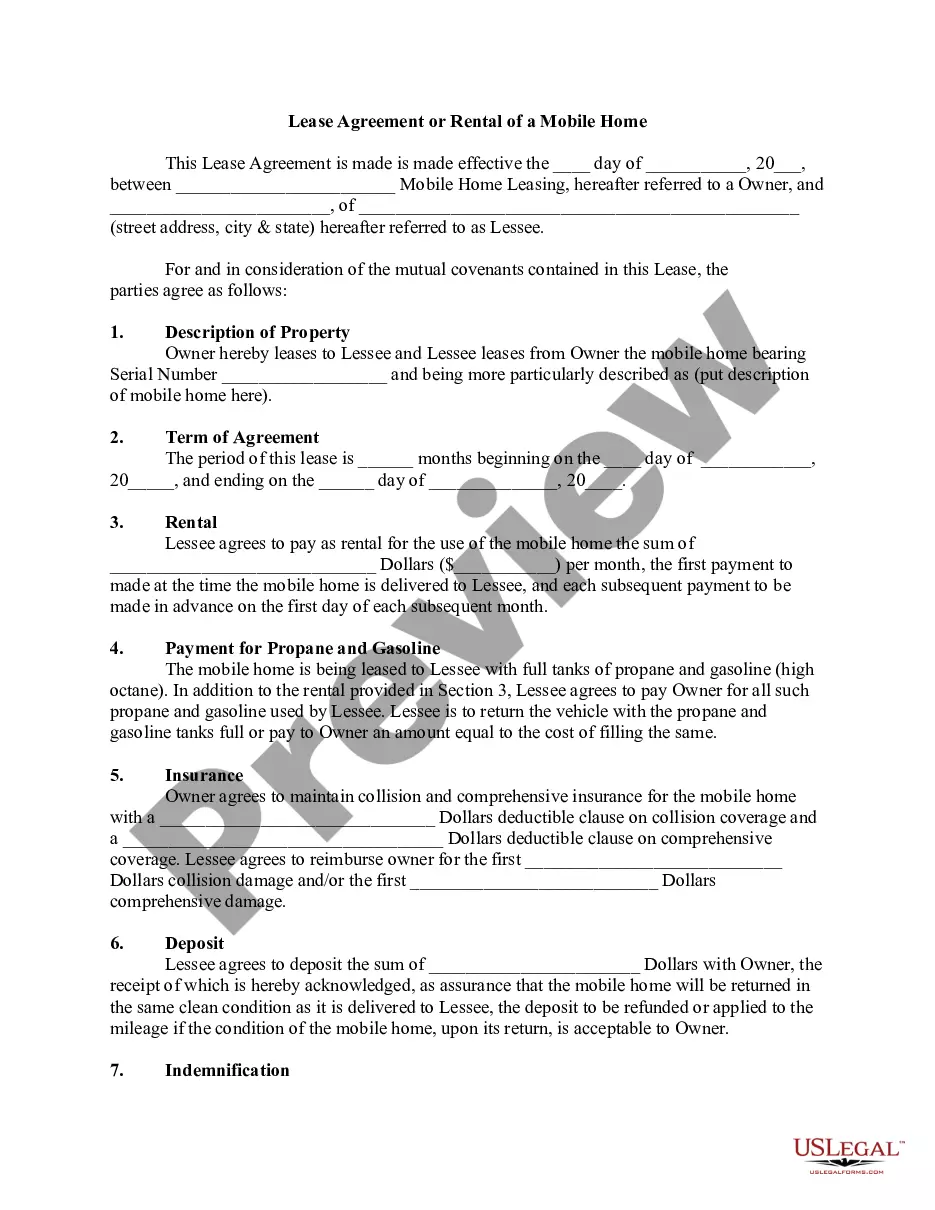

This applies to licensees that are registered and have filed using business code 045 indicating that license is engaged in the business classification of residential rental. Residential rental is the rental of real property for a period of 30 or more consecutive days for residential (i.e. noncommercial) purposes only.

Your rental activity should be reported under the 014 (personal property rental) business code. Your business' sales should be reported under the 017 (retail) business code because your business has physical nexus with Arizona.

"Prime contractor" means a contractor who supervises, performs or coordinates the modification of any building, highway, road, railroad, excavation, manufactured building or other structure, project, development or improvement, including the contracting, if any, with any subcontractors or specialty contractors and who ...