Consultant Work Contract For 1099 In Allegheny

Description

Form popularity

FAQ

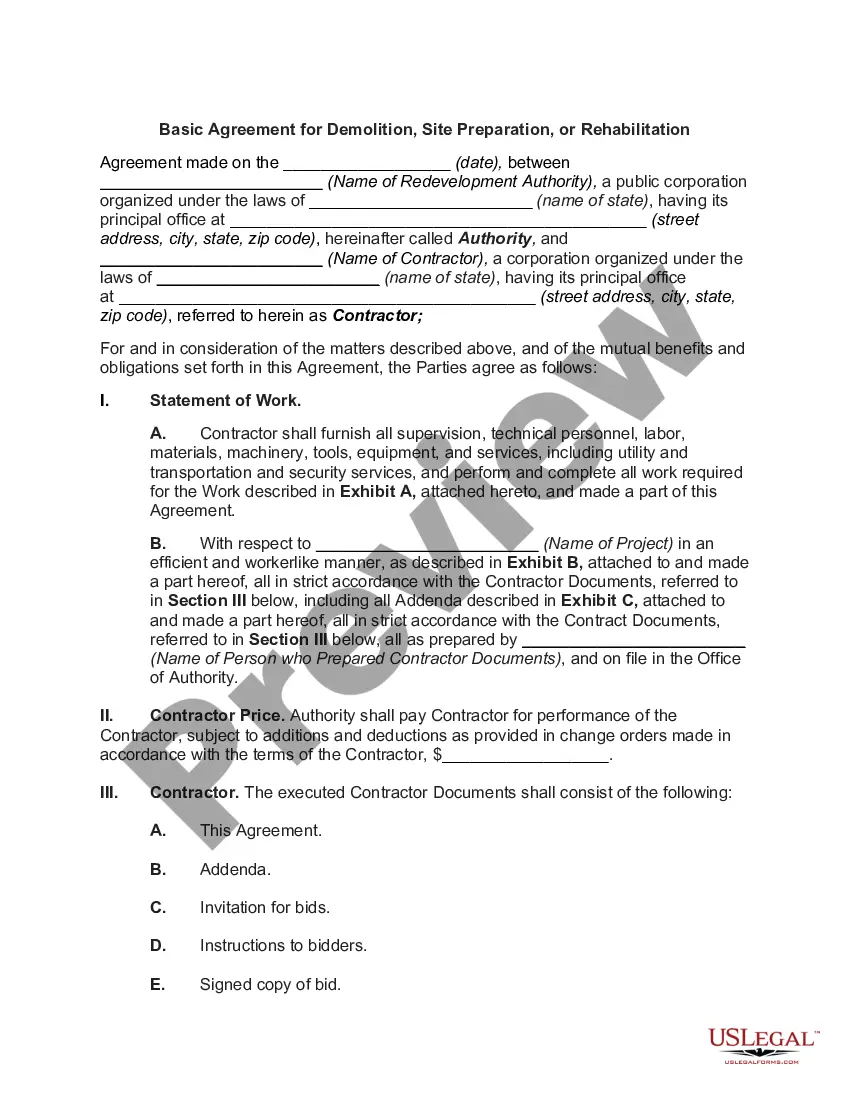

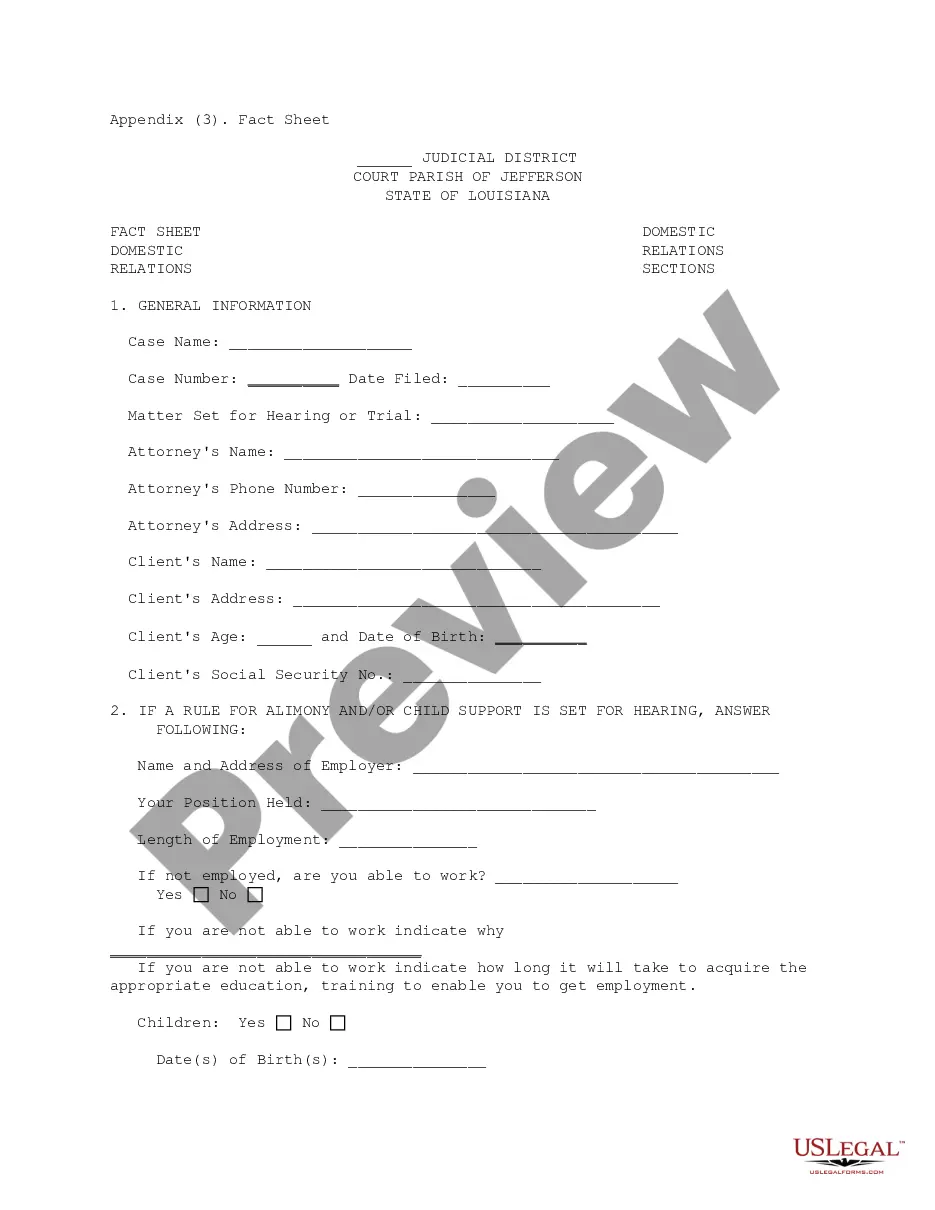

Here are six best practices to write a consulting contract that defines your project scope and protects both you and your business. Define Duties, Deliverables, and Roles. Prepare for Potential Risk. Specify Project Milestones and Engagement Time. Identify Expenses and Outline Payment Terms. Specify Product Ownership.

A consultancy agreement will delineate what both sides want from the relationship regarding targets and payment on either side. It may also include a sub consultancy agreement whereby a consultant intends to subcontract out any of the services that they are providing.

Consulting Agreements detail the terms of specific engagements, ensuring that both parties are aligned on expectations, deliverables, and compensation. SOWs, on the other hand, provide granular detail on project tasks, timelines, and milestones, making them indispensable for project management and accountability.

Here are six best practices to write a consulting contract that defines your project scope and protects both you and your business. Define Duties, Deliverables, and Roles. Prepare for Potential Risk. Specify Project Milestones and Engagement Time. Identify Expenses and Outline Payment Terms. Specify Product Ownership.

While employment contracts establish a traditional employer-employee relationship with greater control and benefits, consulting agreements offer flexibility, independence, and project-based arrangements.

To write a simple contract, title it clearly, identify all parties and specify terms (services or payments). Include an offer, acceptance, consideration, and intent. Add a signature and date for enforceability. Written contracts reduce disputes and offer better legal security than verbal ones.