Closing Property Title Forward In Texas

Description

Form popularity

FAQ

Texas – Title or Escrow companies and sometimes Lenders can handle closings as well. Utah – Title companies only. Vermont – Attorney only. Virginia – Title or Escrow companies and attorneys.

Texas – Title or Escrow companies and sometimes Lenders can handle closings as well. Utah – Title companies only. Vermont – Attorney only. Virginia – Title or Escrow companies and attorneys.

You may choose any title company you want; you don't have to use a company selected by a real estate agent, builder, or lender. Section 9 of the Real Estate Settlement Procedures Act (RESPA) prohibits sellers from conditioning the home sale on the use of a specific title insurance company.

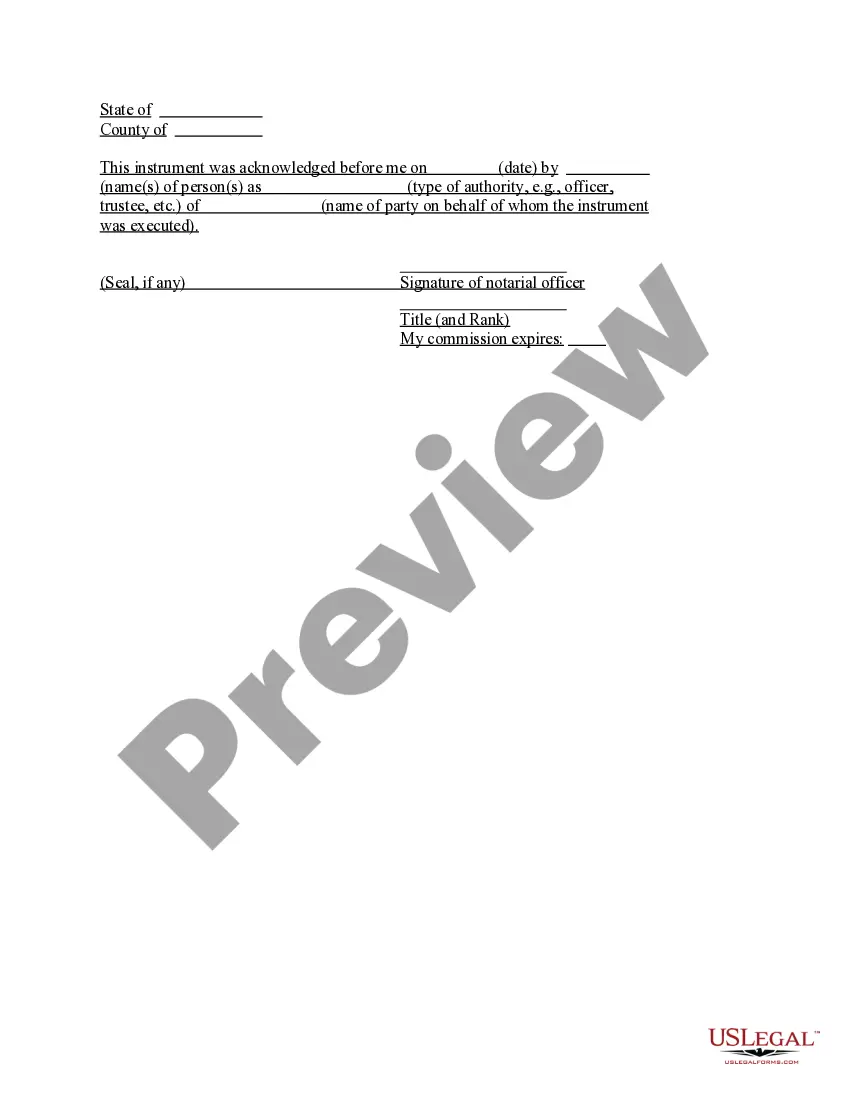

Here are the steps to follow when transferring property ownership in Texas legally: Step 1: Prepare the Deed. The first step is to prepare the deed, but what's the difference between a title vs. Step 2: Sign the Deed. Step 3: Record the Deed. Step 4: Update Property Records.

Who Chooses the Title Company? Seller's Preference: In many cases, especially in a seller's market, the seller may prefer to. Buyer's Input: In a buyer's market or in situations where the buyer has specific preferences, ... Mutual Agreement: Often, the buyer and seller come to a mutual agreement on which title.