Closing Property Title Format In Montgomery

Description

Form popularity

FAQ

Approximately one month after your settlement date, you should have received your original recorded deed. If, however, you have not received your original deed then you need to contact your lawyer or your title company to obtain your original deed.

Recording a deed in Montgomery County is a two step process. First, bring the deed to the County Transfer/Recordation Tax Office located at: 27 Court House Square, Suite 200, Rockville, for processing. Second, visit the Courthouse at 50 Maryland Avenue, Rockville 2nd floor Recording Office.

A deed is a record of ownership for a piece of real estate such as land or a home. They are kept in the Land Records Department. Every Maryland County and Baltimore City has a Land Records Department located in that County's Circuit Court.

In the USA, the Deed is the only definitive document that proves ownership. You can access most Tax Assessors office online and look up your property. Find the Book & Page number for the Deed usually published by the Tax Assessors. Then go to the courthouse and pull your Deed. It will have the owner's name on the Deed.

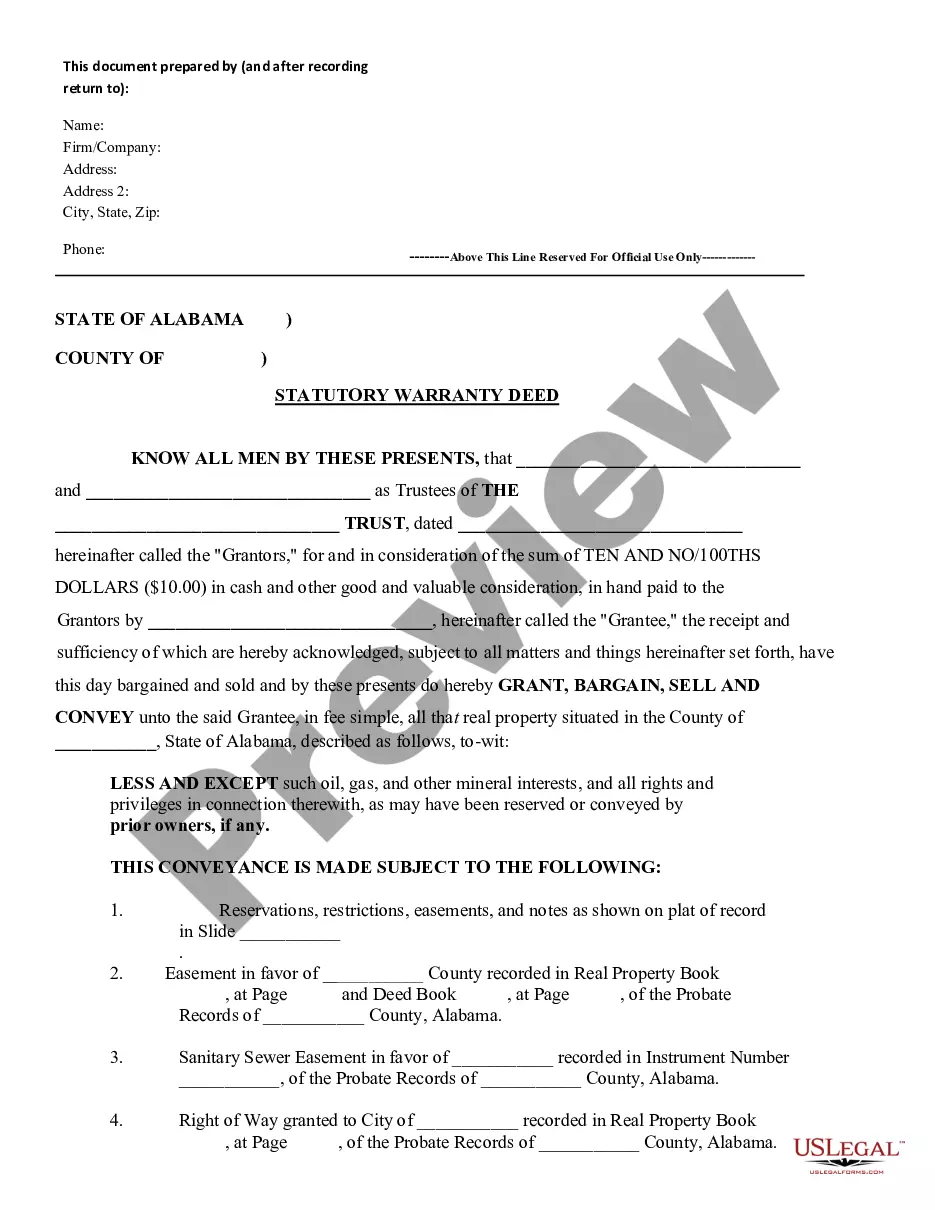

Deed or official record: Original deed, warranty deed or deed of trust to the property. A utility bill dated between April 2022 and present, must also be included. Mortgage documentation: Mortgage statement, mortgage promissory note or the closing disclosure form.

Maryland law requires all deeds to include the names of the grantor (the seller) and grantee (the buyer), a description of the property, and the interest that you intend to convey. All deeds must be recorded with the Department of Land Records in the county where the property is located.

Similarly, to add someone to a deed a new deed must be prepared to transfer the property from all current owners to all new and current owners. The new deed must then be recorded in land records. You can read about the steps to record a new deed at the People's Law Library.

A property certificate of title will tell you who legally owns a property and if there are any easements, covenants, caveats or mortgages relating to the property.

Plats is a website by the Maryland State Archives, the Administrative Office of the Courts and Maryland Circuit Court Clerks to make accessible all plats.

Have a copy mailed to you. To have a document mailed, you must make the request in writing, enclose $5.00 for a regular copy or $10.00 for a certified copy and include a self-addressed stamped envelope. Please make checks payable to: Montgomery County Recorder of Deeds.