Closure Any Property For Whole Numbers In Fairfax

Description

Form popularity

FAQ

Section 82-4-24. - Operator to give full time and attention to driving. No person shall operate a motor vehicle upon the highways of this County without giving his full time and attention to the operation of the vehicle. (3-13-63; 1961 Code, § 16-85.)

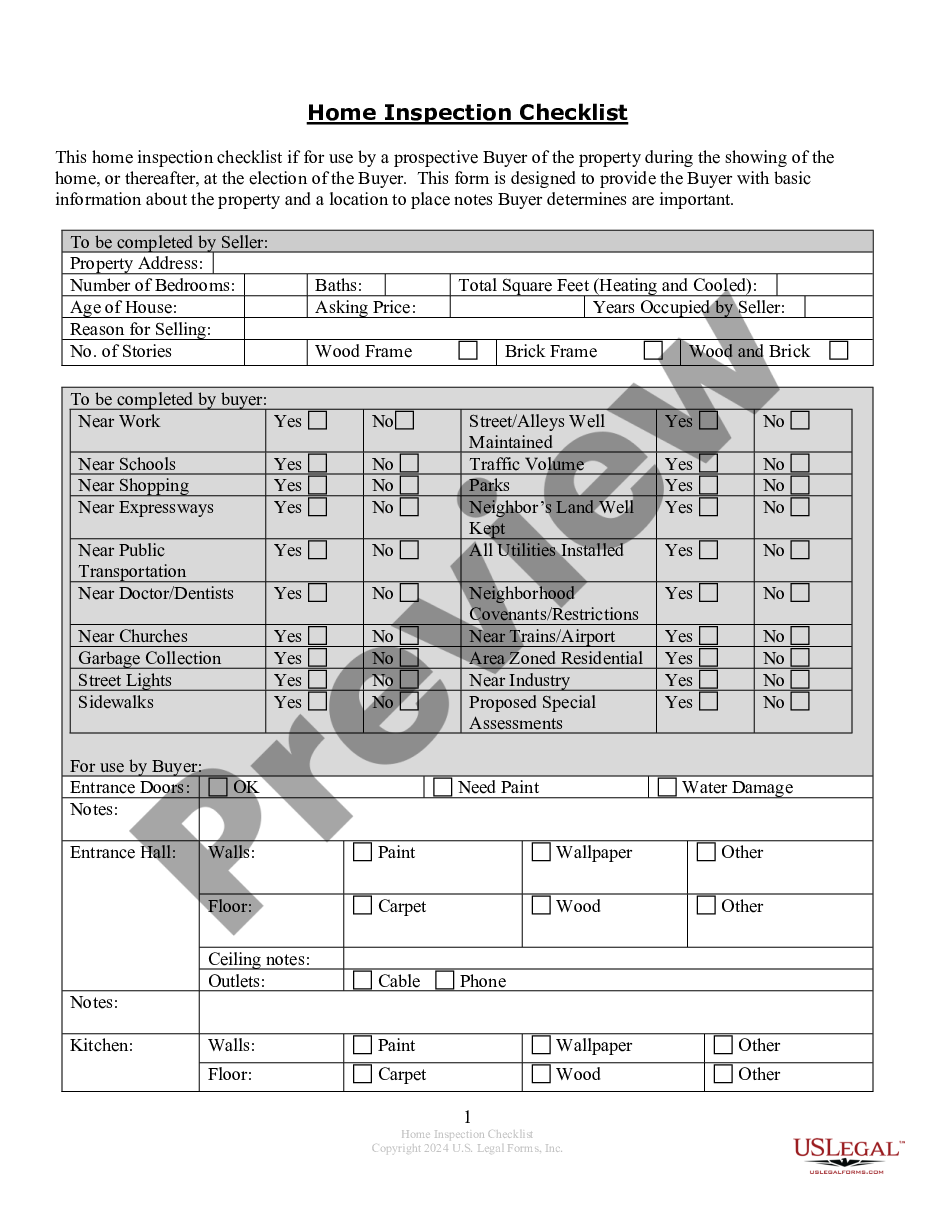

Business closures typically require documentation, which can include lease terminations, bills of sale, a copy of the business license from the new county of business, cancellation, and/or final tax returns (which must be marked as final).

Section 82-5-7 of the Fairfax County Code prohibits parking of commercial vehicles in residential districts.

Unrestricted dogs prohibited; leash law. No dog shall run unrestricted, as defined in Section 41.1-1-1, in the County. Any person who is the owner of a dog found unrestricted in the County shall be in violation of this Section.

All businesses operating in the City of Fairfax must apply for an annual license with the Commissioner of the Revenue. Business license taxes are levied annually and are typically based on a business's gross receipts.

A freestanding accessory structure that is between 8.5 feet and 12 feet in height may be located as close as five feet to any side or rear lot line.

Section 4-7.2-1. (B) Gross receipts do not include revenues that are attributable to taxable business activity conducted in another jurisdiction within the Commonwealth of Virginia and the volume attributable to that business activity is deductible pursuant to Code of Virginia Sections 58.1-3708 and 58.1-3709.

You may view your tax information online or request a copy of the bill by emailing DTARCD@fairfaxcounty or calling 703-222-8234, TTY 711.

Compliance with a notice of violation notwithstanding, the building official may request legal proceedings be instituted for prosecution when a person, firm or corporation is served with three or more notices of violation within one calendar year for failure to obtain a required construction permit prior to ...