Bylaws Of A Corporation With Ordinary Income In Virginia

Description

Form popularity

FAQ

In a corporate setting, ordinary income comes from regular day-to-day business operations, excluding income gained from selling capital assets.

The tax rate is 6% of Virginia taxable income. Corporations that conduct business in more than one state must allocate and apportion their income, using Virginia Schedule A.

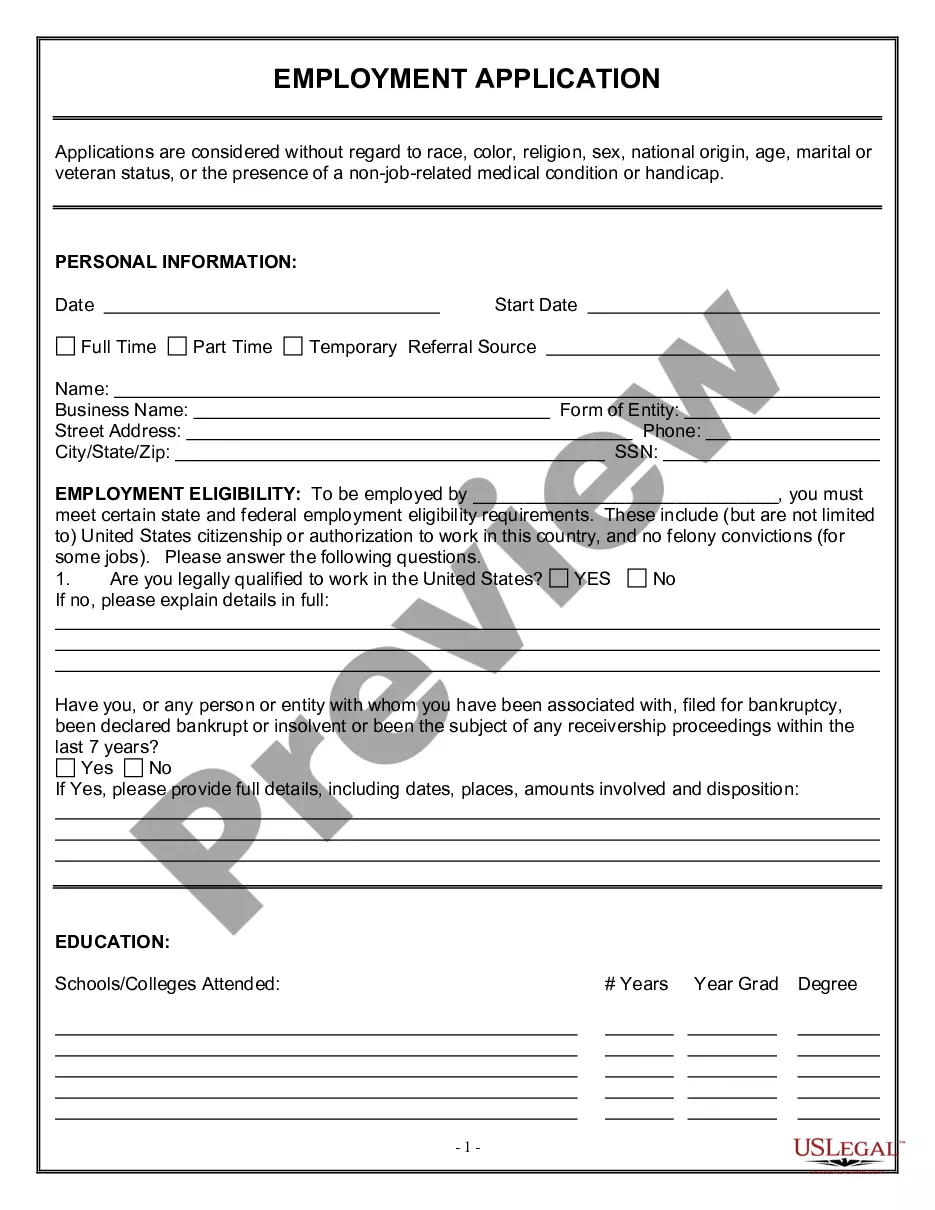

Corporate bylaws are legally required in Virginia. The law doesn't specify when bylaws must be adopted, but usually this happens at the organizational meeting.

Religious, educational, benevolent and other corporations not organized or conducted for pecuniary profit which by reason of their purposes or activities are exempt from income tax under IRC § 501(c) are exempt from the Virginia income tax to the same extent that they are exempt from federal income tax.

You must file taxes if you have a Virginia adjusted gross income above $11,950 (single, or married filing separately) or $23,900 (married and filing jointly).

Virginia has a 6.0 percent corporate income tax rate. Virginia also has a 4.30 percent state sales tax rate, a 1 percent mandatory, statewide, local add-on sales tax rate, and an average combined state and local sales tax rate of 5.77 percent.

Minimum corporate income tax. A minimum corporate income tax (MCIT) of two percent is imposed on the gross income of domestic and resident foreign corporations annually. It is imposed from the beginning of the fourth taxable year immediately following the commencement of the business operations of the corporation.

Age 65 or over: Each filer who is age 65 or over by January 1 may claim an additional exemption. When a married couple uses the Spouse Tax Adjustment, each spouse must claim his or her own age exemption. Blindness: Each filer who is considered blind for federal income tax purposes may claim an additional exemption.

Virginia S Corp Filing Requirements Specifically, to qualify for S corporation status, an entity must: Be a domestic LLC or corporation. Only have one class of stock. Not be an ineligible corporation, such as certain financial institutions, insurance companies, and domestic international sales corporations.