Bylaws Of A Corporation With Ordinary Income In Utah

Description

Form popularity

FAQ

Business Judgment Rule Where a director's decision is a reasonable one in light of all the circumstances about which the director knew or ought to have known, courts will not interfere with that decision.

Most management actions are protected from judicial scrutiny by the business judgement rule: absent bad faith, fraud, or breach of a fiduciary duty, the judgement of the managers of a corporation is conclusive.

The owners of a corporation are shareholders (also known as stockholders) who obtain interest in the business by purchasing shares of stock. Shareholders elect a board of directors, who are responsible for managing the corporation.

"The business judgment rule is a presumption that in making a business decision, the directors of a corporation acted on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the company.

The board of directors make up the governing body of the nonprofit corporation and are committed to the purpose and success of the organization. The IRS requires a minimum of three unrelated individuals and Utah law requires them to be 18 years of age or older.

How to Start A Corporation In Utah Name Your Corporation. Designate a Registered Agent. Submit Articles of Incorporation. Get an EIN. File the Beneficial Ownership Information Report. Write Corporate Bylaws. Hold an Organizational Meeting. Open a Corporate Bank Account.

It's a principle of corporate law that protects board directors and other corporate leaders from legal liability or “frivolous lawsuits” should their actions negatively impact a corporate stakeholder. But remember, they need to have acted ing to their fiduciary duty, in the shareholders' best interests.

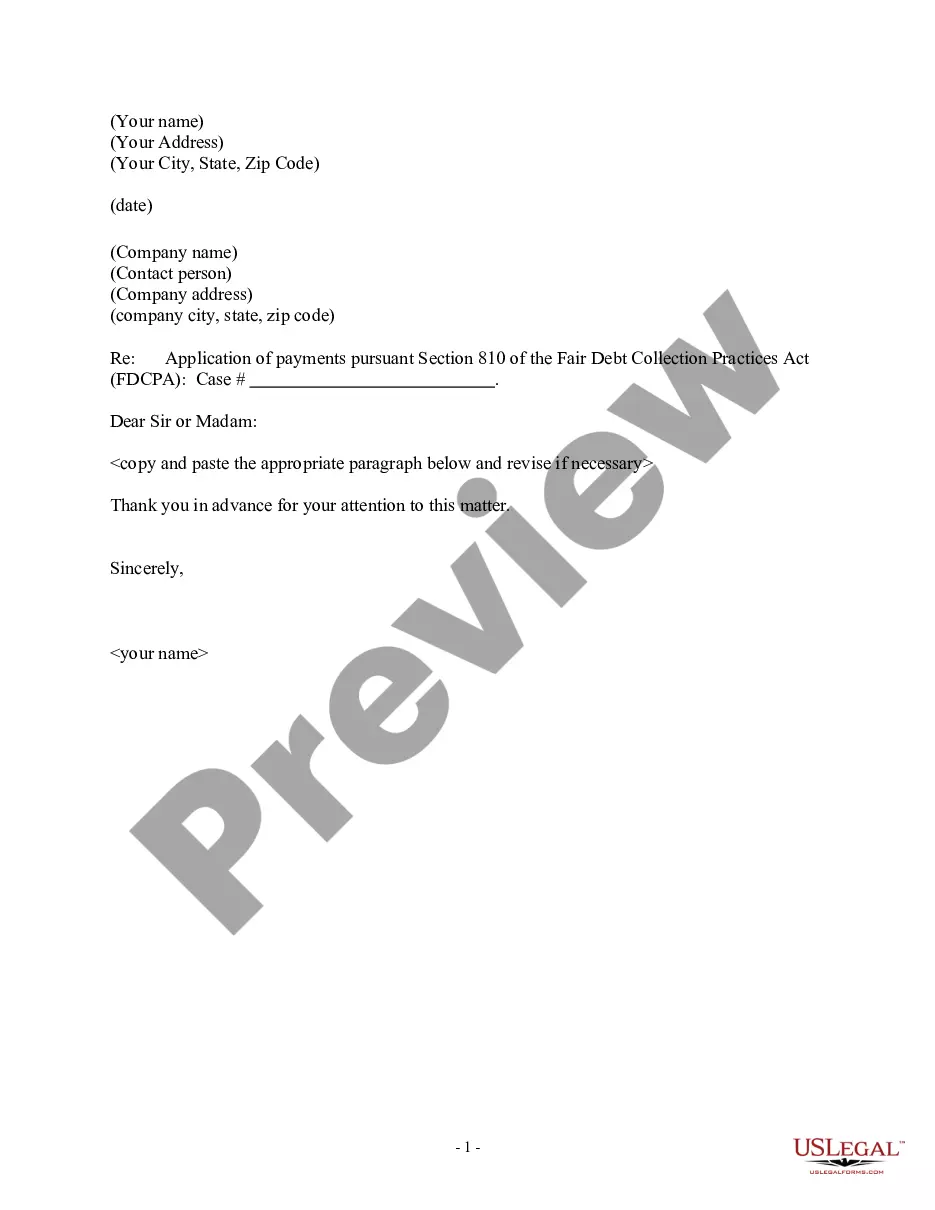

Corporate bylaws are a company's foundational governing document. They lay out how things should run day-to-day and the processes for making important decisions. They serve as a legal contract between the corporation and its shareholders, directors, and officers and set the protocol for how the organization operates.

The countries with the highest corporate tax rates in the world are Comoros (50 percent), Puerto Rico (37.5 percent), and Suriname (36 percent), while the countries with the lowest corporate rates are Turkmenistan (8 percent), Barbados, United Arab Emirates, and Hungary (all at 9 percent).

Utah Tax Rate: The 2024 Utah Legislature passed SB 69, lowering the corporate income tax rate from 4.65 percent to 4.55 percent.