Bylaws Of A Corporation With The State Of California In Texas

Description

Form popularity

FAQ

There are a few different ways to move your corporation out of California, each with its own pros and cons. The best way to relocate a California corporation out of state was not possible until recently. California Senate Bill 49 was put into effect January 1, 2023, which permits corporate conversion.

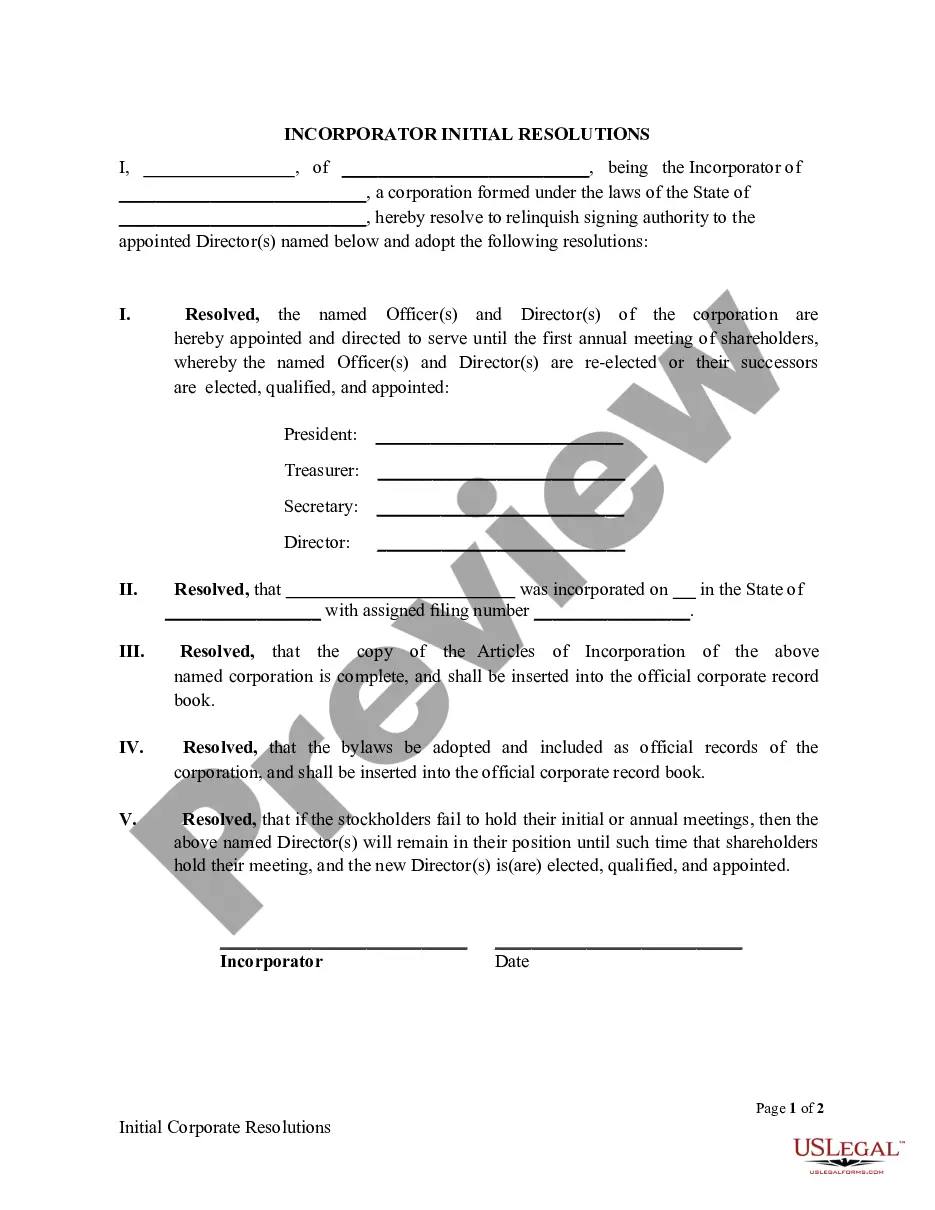

Corporations are legally required to adopt bylaws in Texas – Section 21.057 of the Texas Business Organizations Code states that the board of directors of a corporation shall adopt initial bylaws. So, if your company gets caught in a legal battle without bylaws, you could face some serious legal consequences.

Every California Corporation must adopt bylaws, and this article identifies the key components that should be included in California Corporation Bylaws; however, this article does not contain all the headings or provisions that are required to be included in California Corporation Bylaws.

Although organizations don't need to file these bylaws with the state, California law requires that the treasurer or other designated member of the organization maintains a copy on file.

No, bylaws and operating agreements (and any amendments thereto) are maintained by the business entity and are not filed with the Secretary of State. Requests for copies or information about these documents should be directed to the business entity itself.

California corporate bylaws are the agreed-upon rules for your corporation's operations. Bylaws create an organizational structure for your company and outline policies for appointing directors and officers, holding shareholder and board meetings, and handling conflicts of interest, among other issues.

(b) Bylaws may be adopted, amended or repealed by approval of the members (Section 5034); provided, however, that such adoption, amendment or repeal also requires approval by the members of a class if such action would: (1) Materially and adversely affect the rights, privileges, preferences, restrictions or conditions ...

LLCs are not required to have bylaws. However, they are governed by an operating agreement which is like a corporation's bylaws.

Yes. Non-U.S. corporations, LLCs, LPs and financial institutions must register with the secretary of state before transacting business in Texas. Such entities are subject to state franchise tax and federal income tax on certain income. For more information about federal taxes, visit .IRS or call (800) 829-3676.