Rules For Document Retention In Orange

Description

Form popularity

FAQ

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained", irrespective of format (paper, electronic, or other).

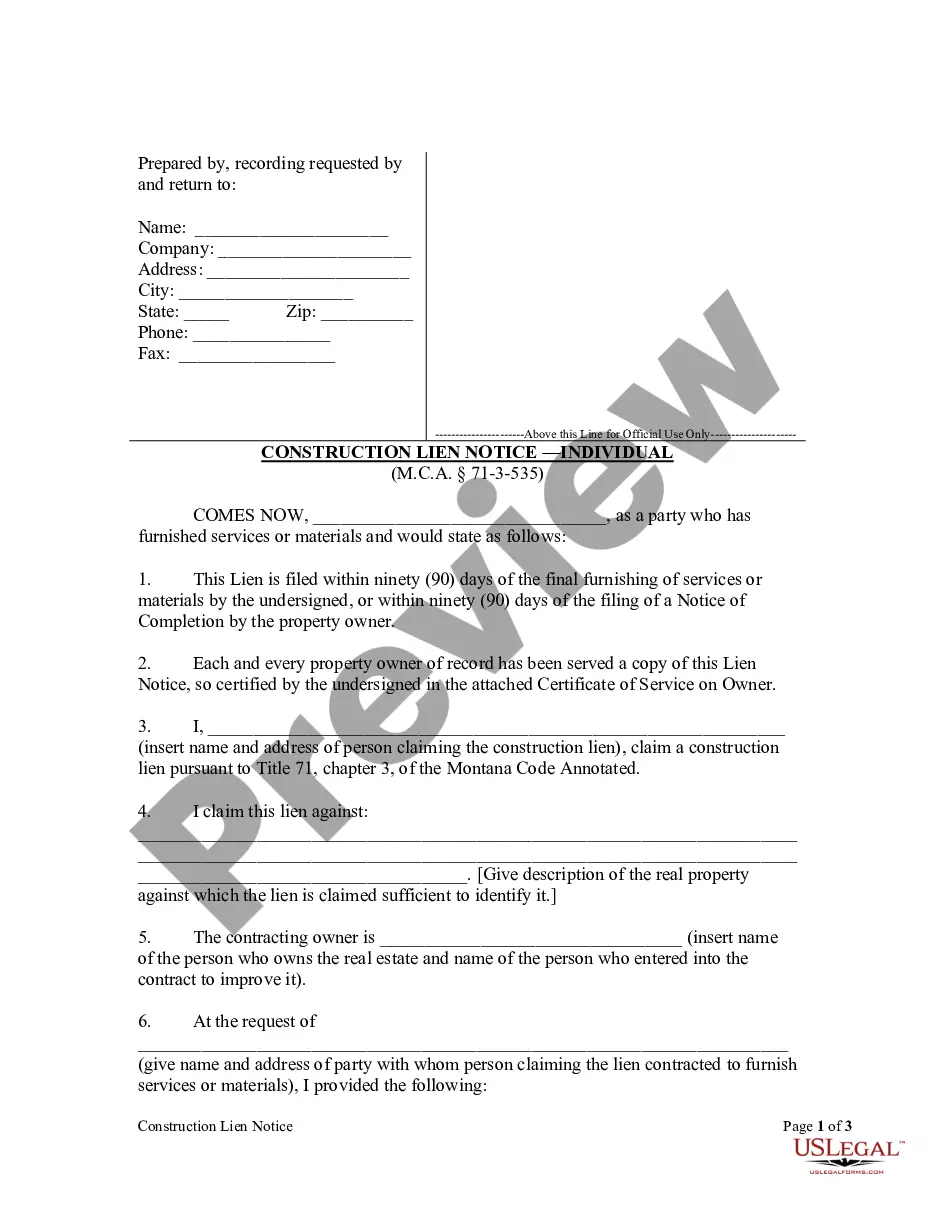

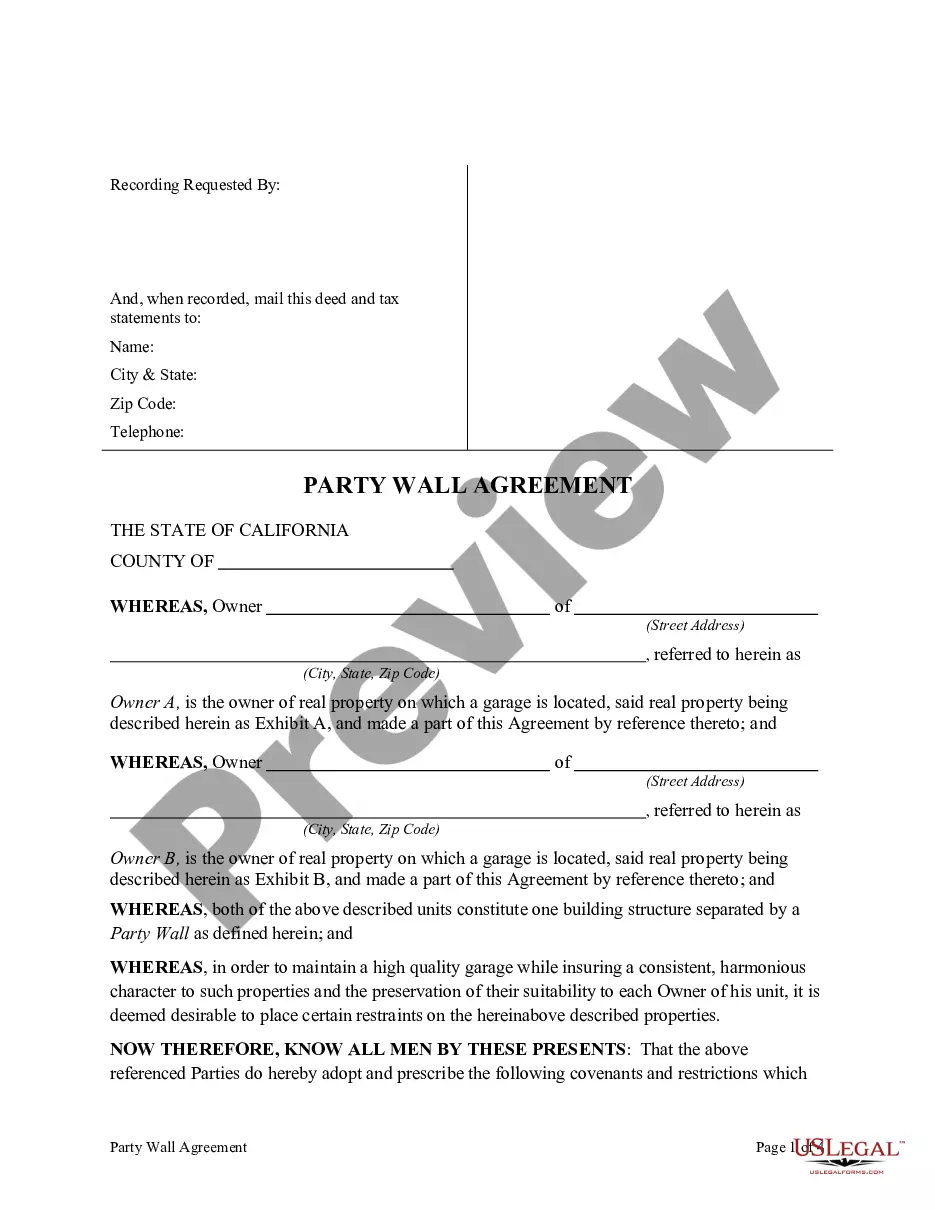

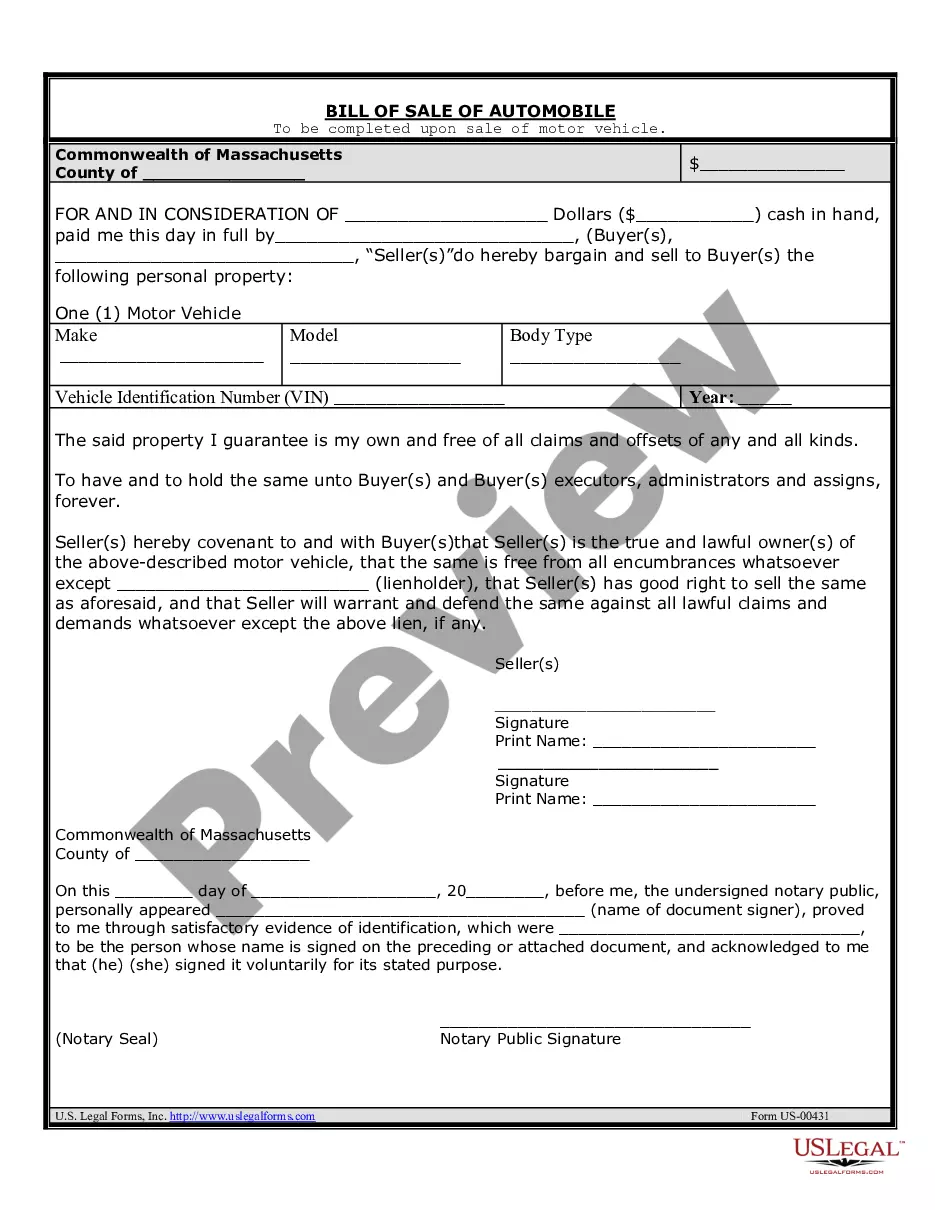

Record Retention Schedule for Businesses DocumentRetention Period Contracts and leases (expired) 7 years Correspondence, general 2 years Correspondence, legal and tax related Permanently Deeds, mortgages and bills of sale Permanently36 more rows

Generally, the rule of thumb is to keep records for at least six years.

Generally, the rule of thumb is to keep records for at least six years. This includes records of all your income, expenses, and any other transactions related to your business.

Retain CRR for at least 3 years after completion of research as per HHS 45 CFR Part 46.115 (b) AND Follow the strictest of any applicable requirements for record retention (such as local, institutional, etc.)

Accounting records Type of recordRetention period Bank statements and deposit slips 7 years Production and sales reports 7 years Employee expenses reports 7 years Annual financial statements Permanently3 more rows

ISO 27001 Data Retention Requirements – 3 years The ISO 27001 compliance framework requires organizations to retain data logs for at least three years.

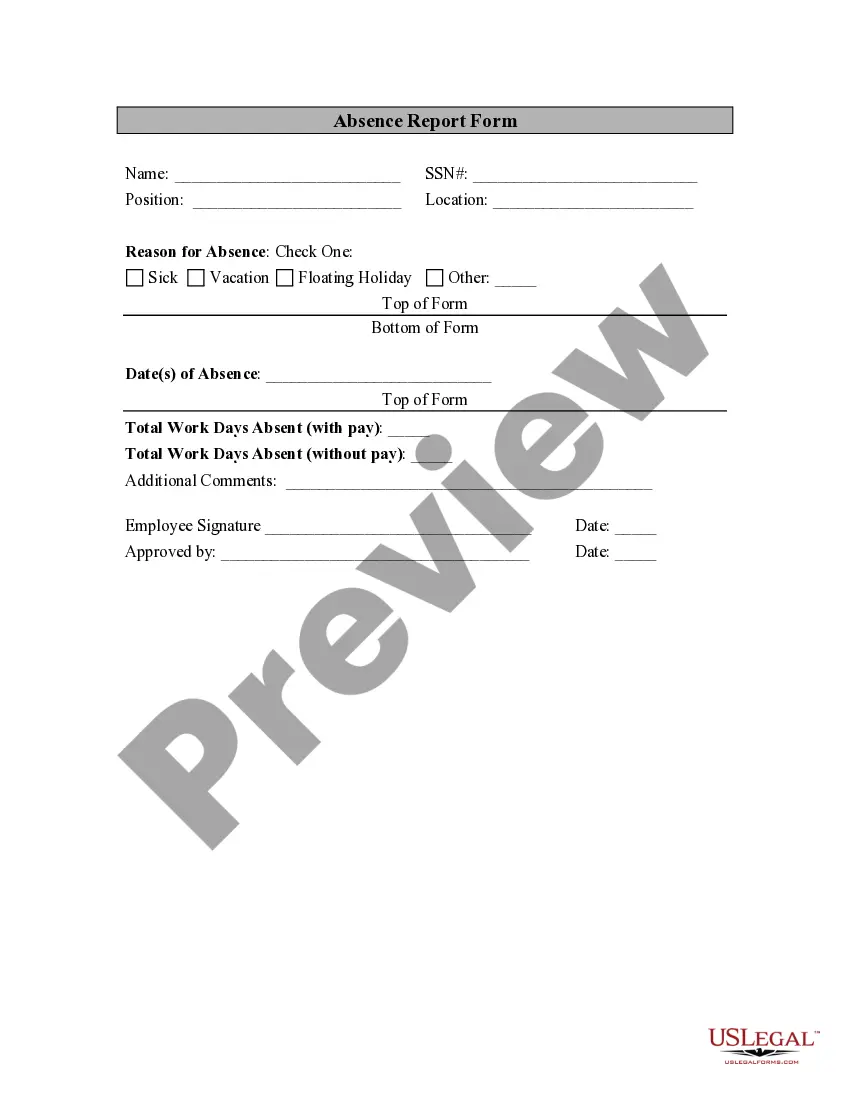

Retention periods refer to how long you should keep physical or electronic documents before you destroy them. Different document types have varying retention requirements dictated by legal, regulatory or business considerations.

Essential documents should be retained until at least 2 years after the last approval of a marketing application in an ICH region and until there are no pending or contemplated marketing applications in an ICH region or at least 2 years have elapsed since the formal discontinuation of clinical development of the IP.