Buy Sell Agreement Online Format In Travis

Description

Form popularity

FAQ

Definition: A partnership buy-in involves purchasing an equity stake in the law firm, which grants you ownership rights and a share of the firm's profits. Types of Partnerships: There are generally two types of partnerships—equity and non-equity.

Buy and Sell insurance ensures that the business is retained and the family who inherits the share receives their full value.

Buy-In Agreement. This type of an agreement is typically between a person who wants to own a part of a firm and an owner who is willing to sell a part of the firm to an acceptable partner.

in. This is an insurance policy bought in the name of the Trustee and held as an asset of the scheme. You'll remain responsible for the administration and ongoing payment to members. You decide which liabilities and benefits you want to be included in the buyin.

Below are four critical topics you and your lawyer should consider when drafting your company's buy-sell agreement. Identify the Parties Involved. Agree on the Trigger Events. Agree on a Valuation Method. Set Realistic Expectations and Frequently Review the Agreement Terms. About the Author.

sell agreement is a written contract between two or more owners of a business, or among owners of the business and the entity.

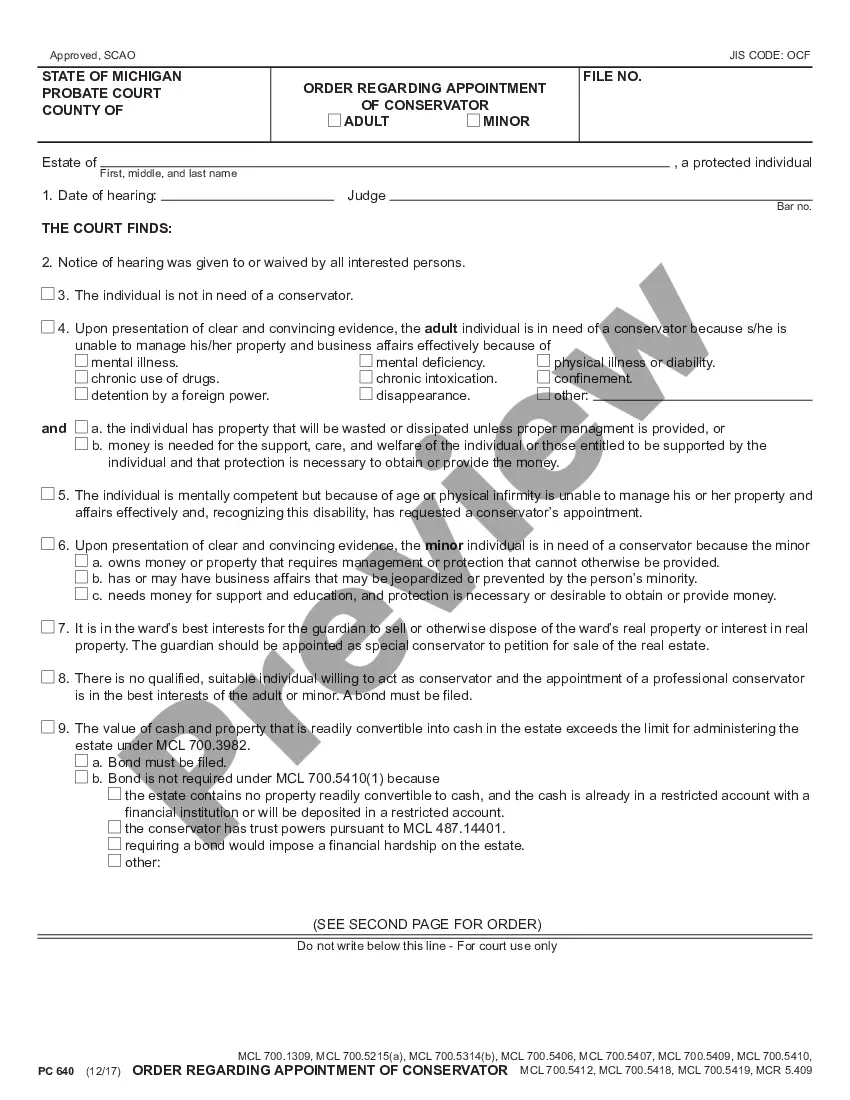

What should be included in a buy-sell agreement? Any stakeholders, including partners or owners, and their current stake in the business' equity. Events that would trigger a buyout, such as death, disability, divorce, retirement, or bankruptcy. A recent business valuation.

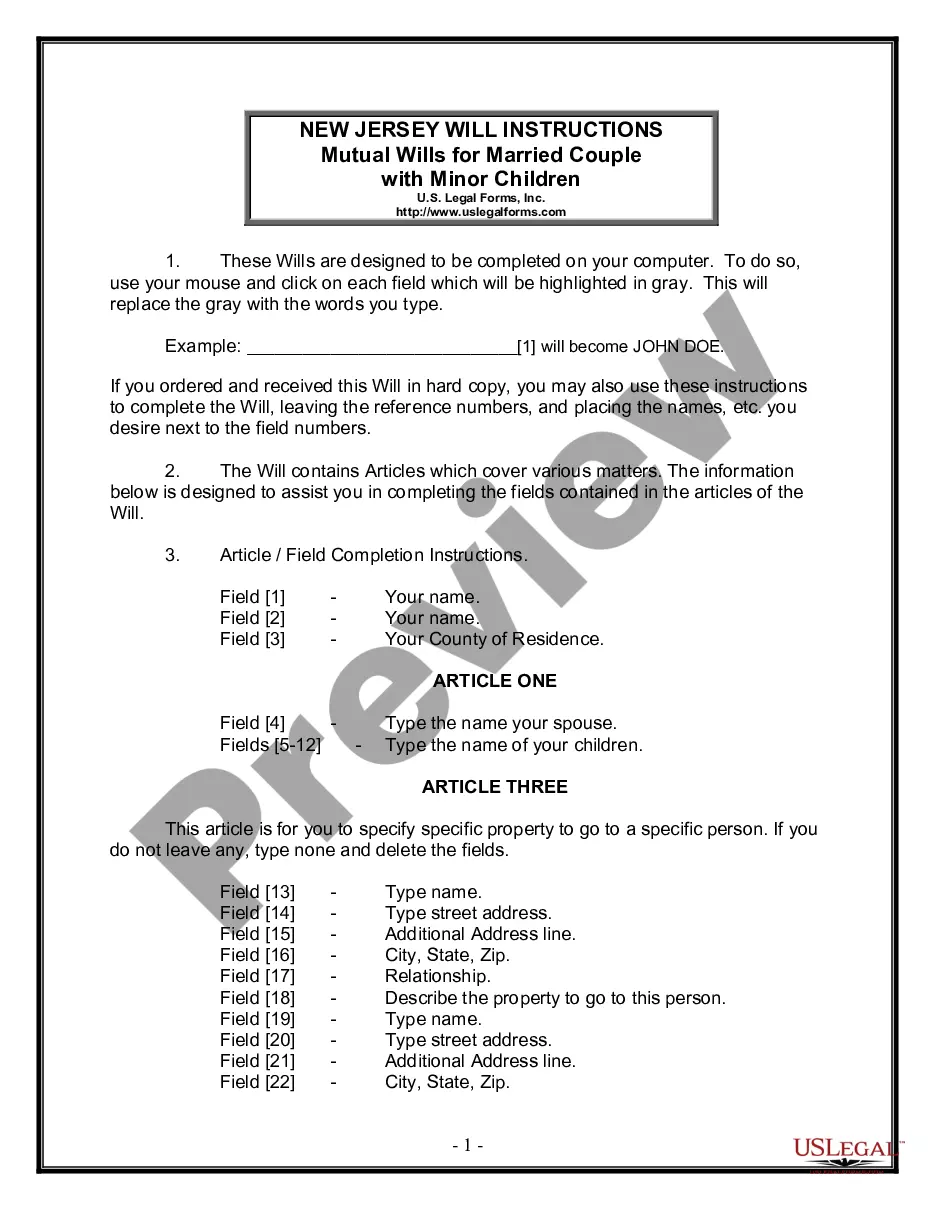

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

To write a simple contract, title it clearly, identify all parties and specify terms (services or payments). Include an offer, acceptance, consideration, and intent. Add a signature and date for enforceability. Written contracts reduce disputes and offer better legal security than verbal ones.

The five most important considerations when creating a ProfitSharing Agreement Clarify expectations. Define the role. Begin with a fixed-term agreement. Calculate how much and when to share profits. Agree on what happens when the business has losses.