Agreement Between Partnership Without In Montgomery

Description

Form popularity

FAQ

The business profits (or losses) are usually divided among the partners based on the partnership agreement. Like a sole proprietorship, a partnership is easy to form. In fact, a simple verbal agreement is enough to form a partnership.

Kickstart your new business in minutes There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

What does a Partnership Agreement do? It is not required by law to create a formal Partnership Agreement. However, if business owners enter into a partnership without one, their arrangement will be governed by the Partnership Act 1890 (the “1890 Act”).

However, if you have no written business agreement in place, you may be unable to carry out the day-to-day tasks of the partnership, like paying yourself a salary. Instead, you and your partner may need to wait until the end of each year and split the partnership's profits and losses equally.

How do I create a Partnership Agreement? Provide partnership details. Start by specifying the industry you're in and what type of business you'll run. Detail the capital contributions of each partner. Outline management responsibilities. Prepare for accounting. Add final details.

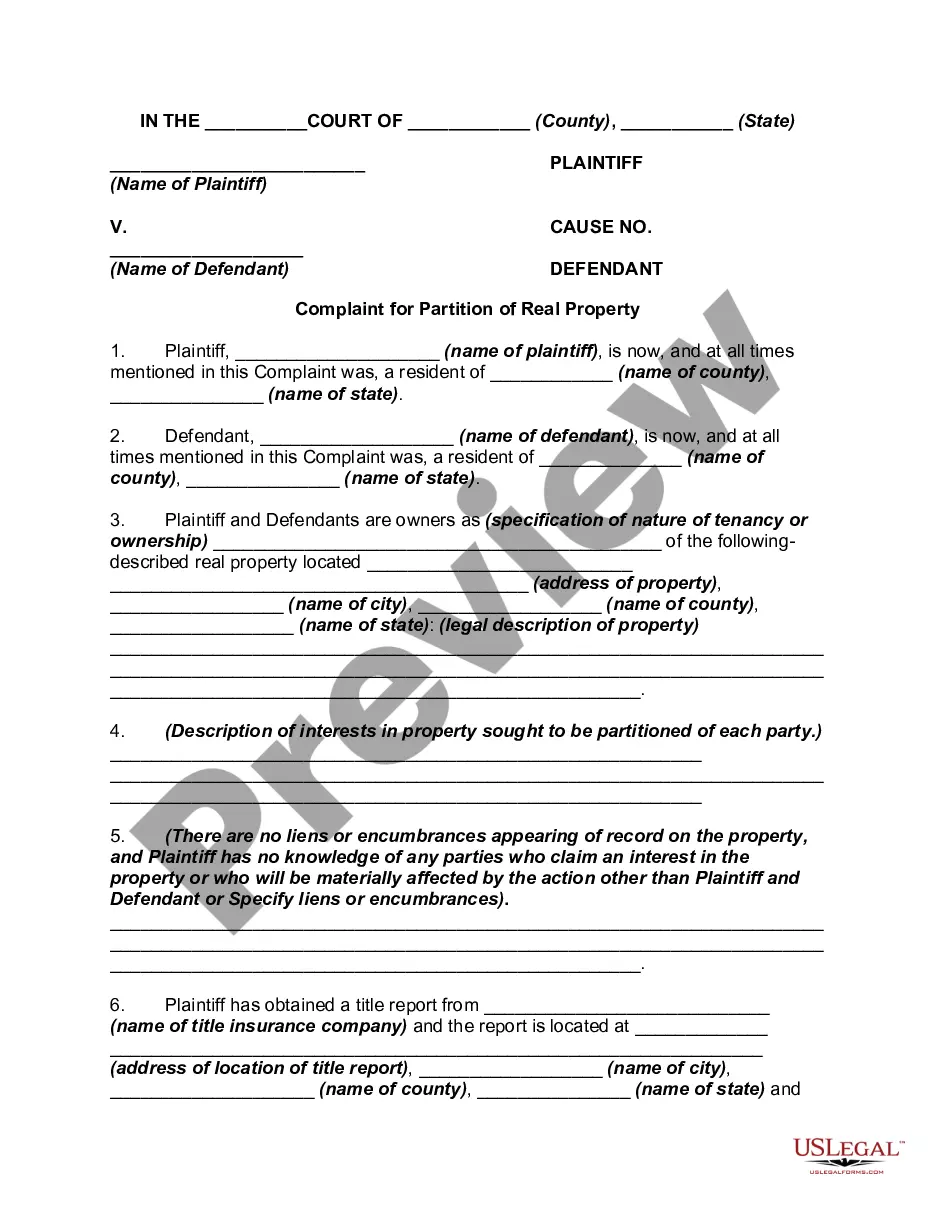

The parties hereto hereby form a Partnership under the name and style of _______________________________________________ (hereafter referred to as "the Partnership") to own real property, develop real property, and thereafter to manage, operate, develop, mortgage, lease or sell real property and do all other lawful ...

A partnership agreement need only be a contract/agreement signed by the parties (sometimes referred to as a simple contract 'under hand') unless there is some part of the agreement that relates to the transfer of property, in which case the agreement must take the form of a deed note 5.

Although by law the partners do not need to enter into a partnership agreement in order to form and conduct business as a partnership, as with any other legal relationship, a comprehensive partnership agreement is critical to the smooth functioning of any partnership.

If, as a Partnership, there has been no Partnership Agreement drawn up, the default provisions may come as a surprise, including to some of the actual Partners! Examples of some default provisions of the Act include: Partners must share equally in capital and profits (regardless of their initial capital contributions);