Agreement Between Partnership With Llc In Los Angeles

Description

Form popularity

FAQ

If your LLC is taxed as a disregarded entity, and you add a member you will then be taxed as a partnership. The result of this is that you will need to close your books and records for the applicable year in question and file a short-year return to cover the period in which the LLC only had one member.

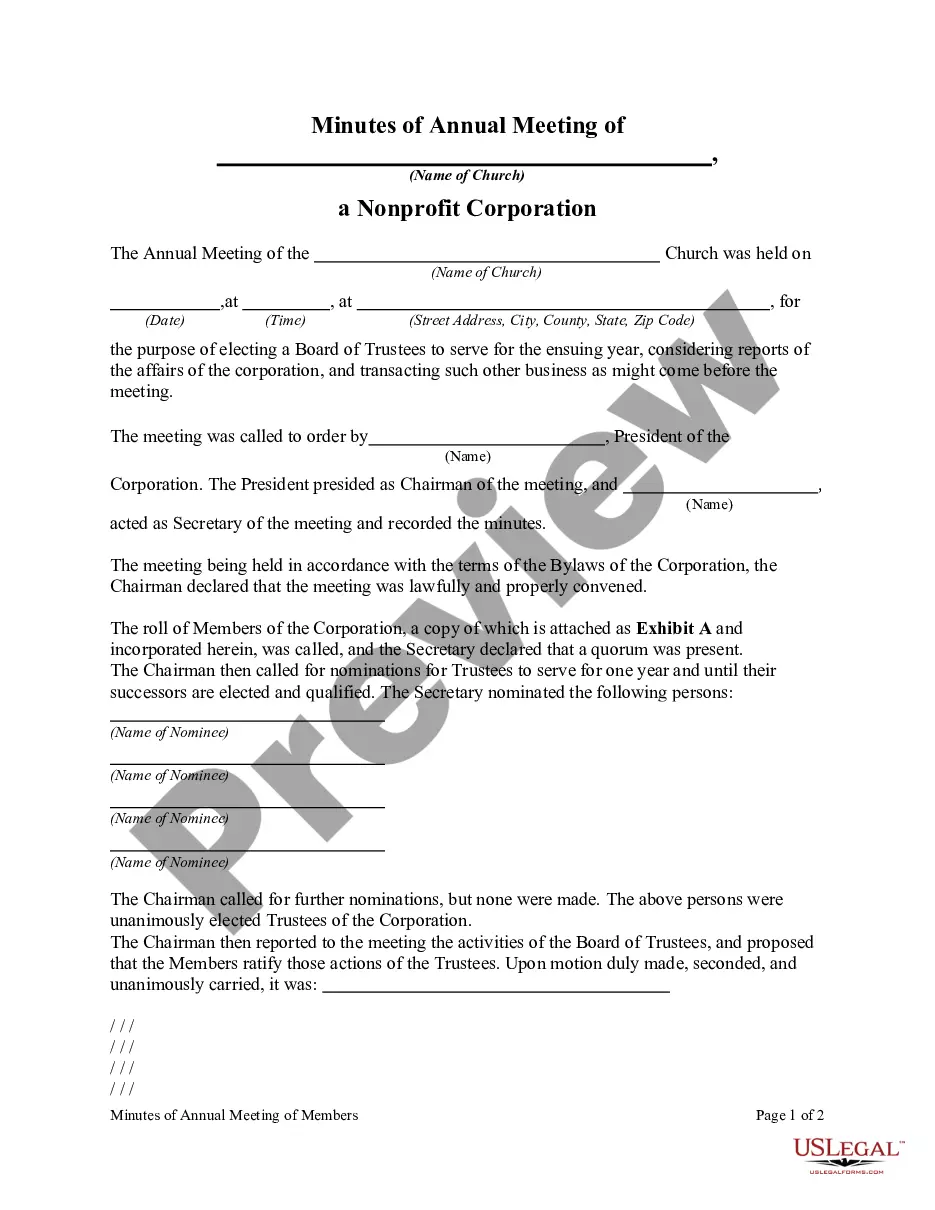

How to create an LLC operating agreement in 9 steps Decide between a template or an attorney. Include your business information. List your LLC's members. Choose a management structure. Outline ownership transfers and dissolution. Determine tax structure. Gather LLC members to sign the agreement. Distribute copies.

An LLC lets you take advantage of the benefits of both the corporation and partnership business structures. LLCs protect you from personal liability in most instances, your personal assets — like your vehicle, house, and savings accounts — won't be at risk in case your LLC faces bankruptcy or lawsuits.

Your LLC needs a partnership agreement if you want personal liability protection while retaining the flexibility to operate as a partnership. Forming an LLC requires filing documents with your Secretary of State's Office and providing them with information about your company.

An LLC can consist of one or more members and has a certain set of rules and regulations that must be followed to achieve official business entity status. That status also comes with benefits such as liability protection. If you started an LLC on your own but want to add a partner later, you can do that too.

How to Add a Member to an LLC Step 1: Revisit your operating agreement. Step 2: Get approval from the other members. Step 3: Update your operating agreement to finalize the deal. Step 4: File an amendment to your Articles of Organization. Step 5: File tax documents.

An LLC partnership agreement outlines how the LLC's profits and losses will be divided among members. This can be based on the ownership percentage or another agreed-upon formula.

From an LLC to a general partnership, let's break down what you need to do now to prepare to add a partner to your business. Create a written partnership agreement. File for an EIN. Amend an LLC operating agreement. Ask yourself: is this the right partner for my business?

How to Form a Limited Liability Partnership in California Step 1: Register with the California Secretary of State (required) ... Step 2: Draft and Execute a Partnership Agreement. Step 3: Obtain Local Business License and Comply with Local Laws (required) ... Step 4: Obtain an Employer Identification Number (EIN) (required)

If you cancel your LLC within one year of organizing, you can file Short form cancellation (SOS Form LLC-4/8) with the SOS. Your LLC will not be subject to the annual $800 tax for its first tax year.