Sell Of Partnership In Contra Costa

Description

Form popularity

FAQ

Contra Costa County sales tax details The minimum combined 2025 sales tax rate for Contra Costa County, California is 8.75%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%.

If you own and occupy your home as your principal place of residence on January 1, you may apply for an exemption of $7,000 off your assessed value for an annual savings of approximately $70 on your property taxes. New property owners will automatically receive an exemption application.

If you own and occupy your home as your principal place of residence on January 1, you may apply for an exemption of $7,000 off your assessed value for an annual savings of approximately $70 on your property taxes. New property owners will automatically receive an exemption application.

Homeowners' Exemption versus Homestead Exemptions With an approximate 1% property tax rate, the exemption provides roughly a $70 annual saving off your property taxes. Homestead Exemption is a civil code provision, which may protect part of the homes equity from creditors.

If you own and occupy your principal place of residence on January 1, you may apply for a Homeowner's Exemption that would exempt $7,000 of your home's assessed value from taxation. This would result in a savings of approximately $70 per year on your property tax bill.

You must occupy the dwelling as your principal residence as of January 1 of each year to qualify for the Homeowners' Exemption for that year.

How Long Is a Seller's Permit Valid in California? A California seller's permit remains valid as long as your business is actively engaged in selling or leasing taxable goods or services. There is no expiration date on the permit itself, and you are not required to renew it annually.

The first step you need to take in order to get a resale certificate, is to apply for a California Seller's Permit. This permit will furnish a business with a unique California sales tax number, otherwise referred to as a Sales Tax ID number. Once you have that, you are eligible to issue a resale certificate.

Submit application: Complete the application form for a resale certificate provided by your state's taxing authority. This may require details about your business, including its structure, operations, and tax ID number.

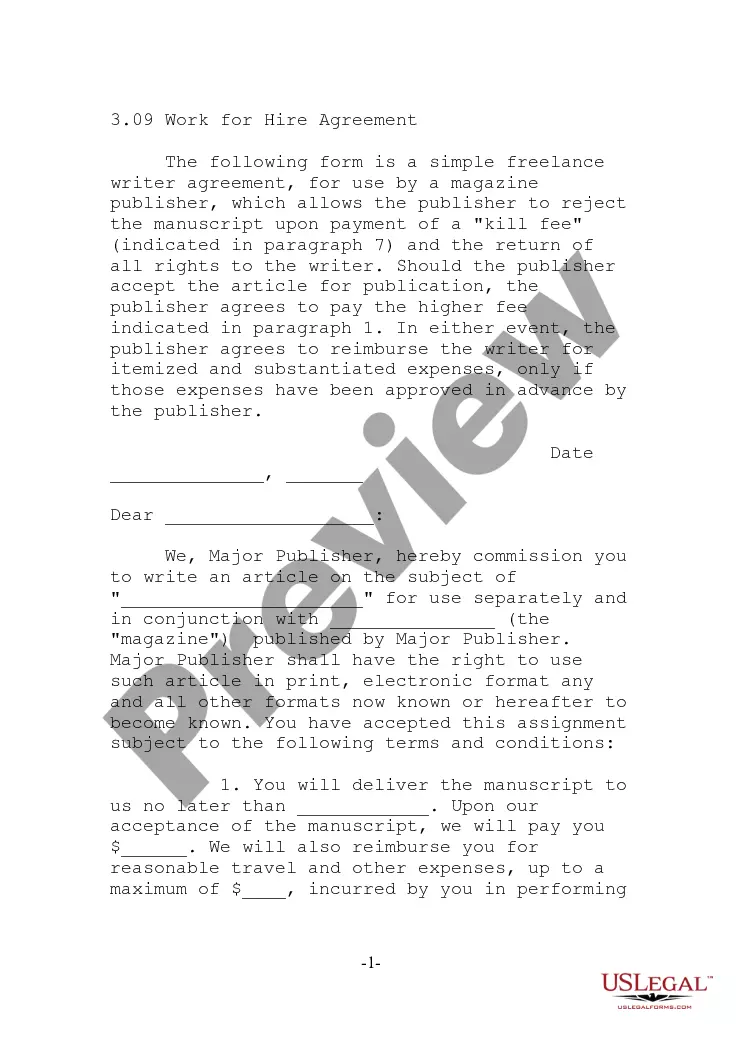

The Partnership Buyout Agreement Your path to an ownership sale will be simpler if you created a clear and thorough partnership buyout agreement when you started your company. The agreement should discuss what might lead to one of the partners wanting to sell her share and state the terms and timing that would apply.