Contingency Removal Form With 2 Points In Pima

Description

Form popularity

FAQ

Remember that waiving contingencies means you're taking on financial and legal risk. Waiving contingencies can help a buyer, but it can trigger a bidding war if everyone starts doing it. Ask your realtor or lender what contingencies you should waive to close the deal.

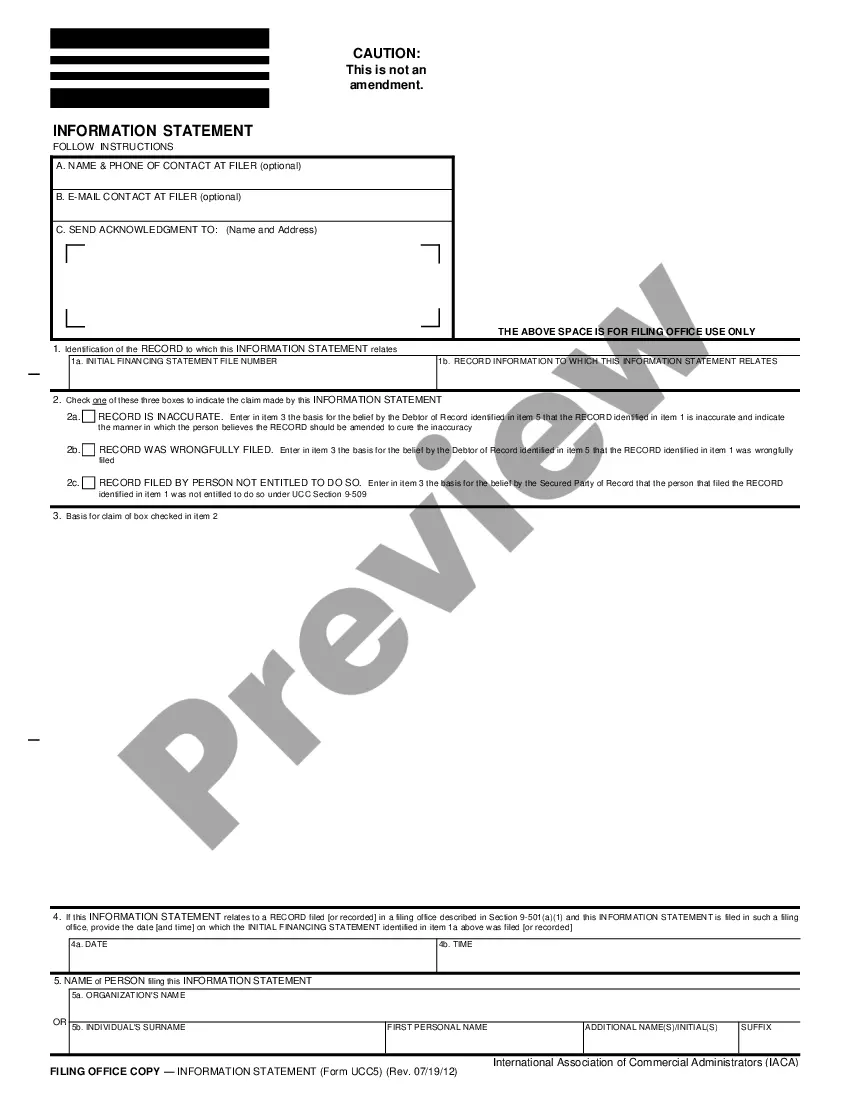

The buyer has to provide one, or more, signed Contingency Removal forms. Each one removing, or more, of the contract contingencies. Once the buyer has removed all of them in writing, they may no longer receive a refund of their deposit.

Contingent reinforcement is based on specific behaviors, while noncontingent reinforcement is delivered on a set schedule, regardless of behavior. Imagine you're working with a learner who struggles with disruptive behaviors during class time.

Contingencies are conditions that must be met for the sale to proceed. These could include inspections, such as a home or termite inspection, financing, or selling another property. Removing contingencies ensures that these conditions have been satisfied or waived, taking an active role in the transaction.

Passive contingency removal means that when the deadline passes and the party in question has not cancelled the agreement, by default they have removed their contingency. That is why it is called “passive.” If you do nothing, you are deemed to have removed your contingency.

Contingent contracts usually occur when negotiating parties fail to reach an agreement. The contract is characterized as "contingent" because the terms are not final and are based on certain events or conditions occurring. A contingent contract can also be viewed as protection against a future change of plans.