Contingency Removal Form With Decimals In Massachusetts

Description

Form popularity

FAQ

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

If you were under 65 at the end of 2024 If your filing status is:File a tax return if your gross income is: Single $14,600 or more Head of household $21,900 or more Married filing jointly $29,200 or more (both spouses under 65) $30,750 or more (one spouse under 65) Married filing separately $5 or more1 more row •

A taxpayer makes the election by checking box 5a on Schedule A of Form 1040. If you elect to deduct state and local general sales taxes, you can use either your actual expenses or the optional sales tax tables.

Tax deductions for moving expenses For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This change is set to stay in place for tax years 2018-2025.

Schedule A is required in any year you choose to itemize your deductions. The schedule has seven categories of expenses: medical and dental expenses, taxes, interest, gifts to charity, casualty and theft losses, job expenses and certain miscellaneous expenses.

Contracts for the Rotating Site changes as the operation rotates, and from C.C. Barrenland, must be unlocked by clearing the respective operation with a certain threshold of Risk: Clearing the operation for the first time unlocks all Level 1 Contracts. Clearing the operation with Risk 2 unlocks all Level 2 Contracts.

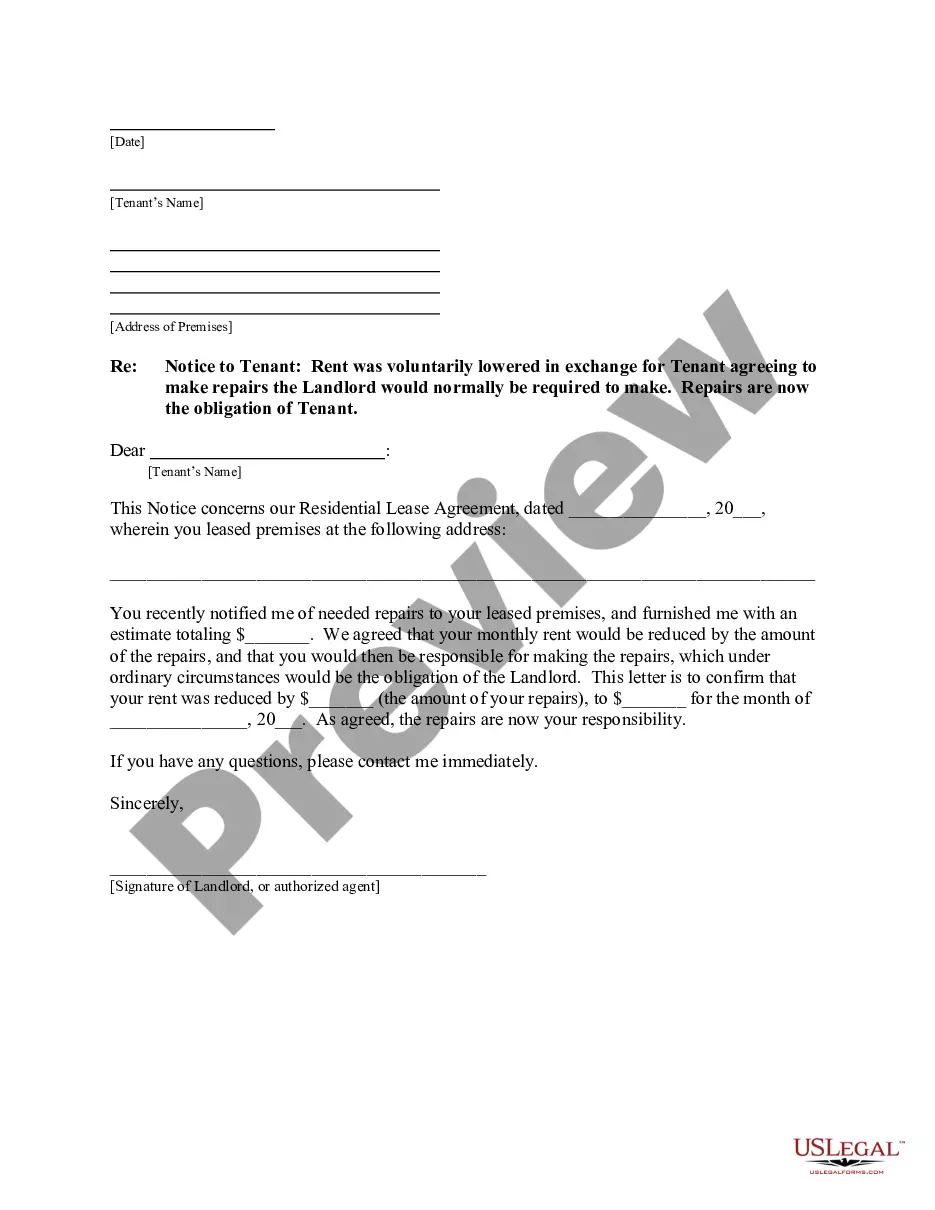

One such contract is the contingency contract, which adds an element of flexibility and risk mitigation. Contingency contract is a legally binding document that specifies a condition that needs to be met before the contract can be executed.

India Code: Section Details. Contingent contracts to do or not to do anything if an uncertain future event happens cannot be enforced by law unless and until that event has happened. If the event becomes impossible, such contracts become void.

The buyer has to provide one, or more, signed Contingency Removal forms. Each one removing, or more, of the contract contingencies. Once the buyer has removed all of them in writing, they may no longer receive a refund of their deposit.