Compra Venta Contrato Withholding In California

Description

Form popularity

FAQ

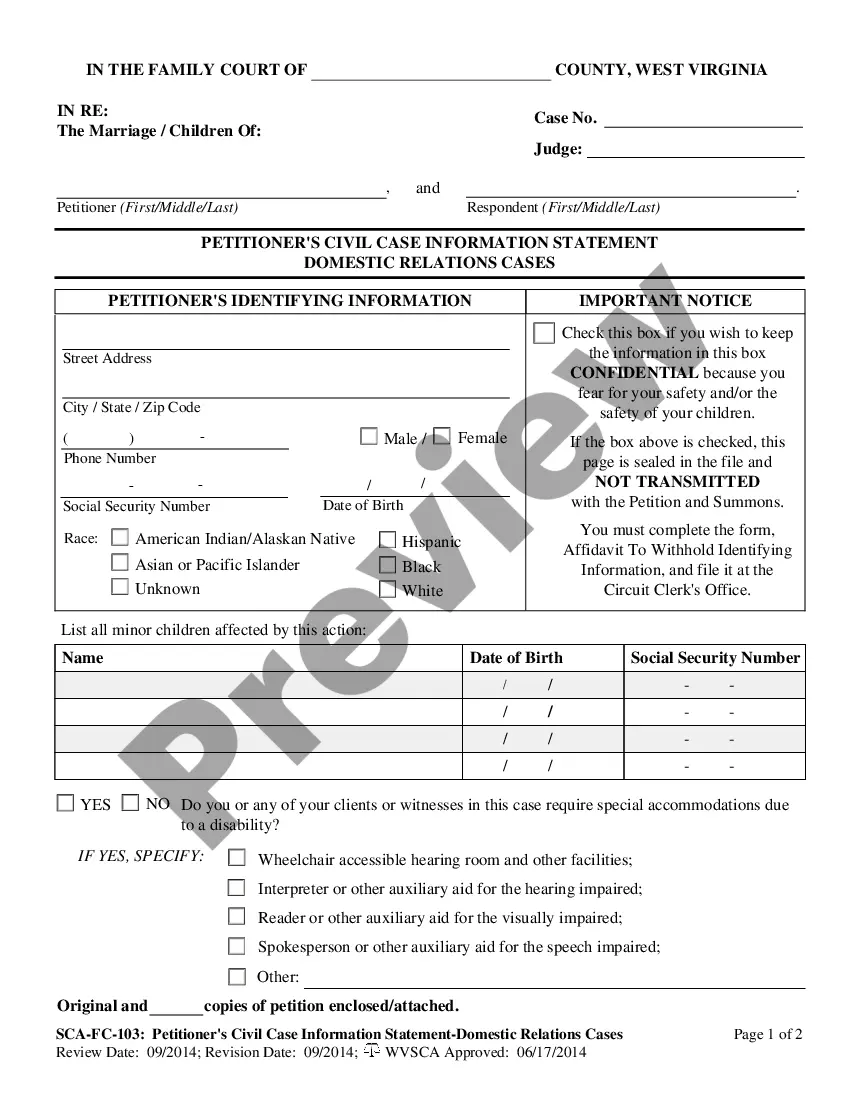

Claim your nonwage withholding credit on one of the following: Form 540, California Resident Income Tax Return. Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. Form 541, California Fiduciary Income Tax Return.

Some exemptions require an exemption application through Covered California. Other exemptions do not require an application: Instead, you can claim them when you file your state tax return.

Form 593, also known as the “Real Estate Withholding Certificate,” is a document used in California real estate transactions. It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property.

In order to claim exemption from state income tax withholding, employees must submit a W-4 or DE-4 certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

Use Form 588, Nonresident Withholding Waiver Request, to request a waiver from withholding on payments of California source income to nonresident payees. Do not use Form 588 to request a waiver if you are a foreign (non-U.S.) partner or member.

EXEMPTION FROM WITHHOLDING: If you wish to claim exempt, complete the federal Form W-4. You may claim exempt from withholding California income tax if you did not owe any federal income tax last year and you do not expect to owe any federal income tax this year.

In order to claim exemption from state income tax withholding, employees must submit a W-4 or DE-4 certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

Single Tax Withholding Table If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be: Over $24,684 but not over $38,959 $428.51 plus 4.4% of excess over $24,684 Over $38,959 but not over $54,081 $1,056.61 plus 6.6% of excess over $38,9598 more rows •

Number of regular allowances claimed on DE-4 or W-4. Determine the additional withholding allowance for itemized deductions (AWAID) by applying the following guideline and subtract this amount from the gross annual wages. AWAID = $1,000 x Number of Itemized Allowances Claimed for Itemized Deductions on DE-4 or W-4.

Withholding agents are required to withhold 7% on payments or distributions to nonresident payees when the total payments or distributions of CA source income exceeds $1,500 for the calendar year.