Agreement Commercial Property With No Money Down In Queens

Description

Form popularity

FAQ

Lesson Summary. In New York the typical down payment a home buyer needs to come up with is 20%. There is no law that a buyer has to put down 20%, but this is the benchmark for conventional financing. Generally, half of these funds are held in escrow until closing.

The commercial real estate market can be volatile and influenced by economic conditions. A downturn in the economy can lead to higher vacancy rates and lower rental income, impacting your ROI. It's crucial to conduct thorough market research and consider economic trends before making an investment.

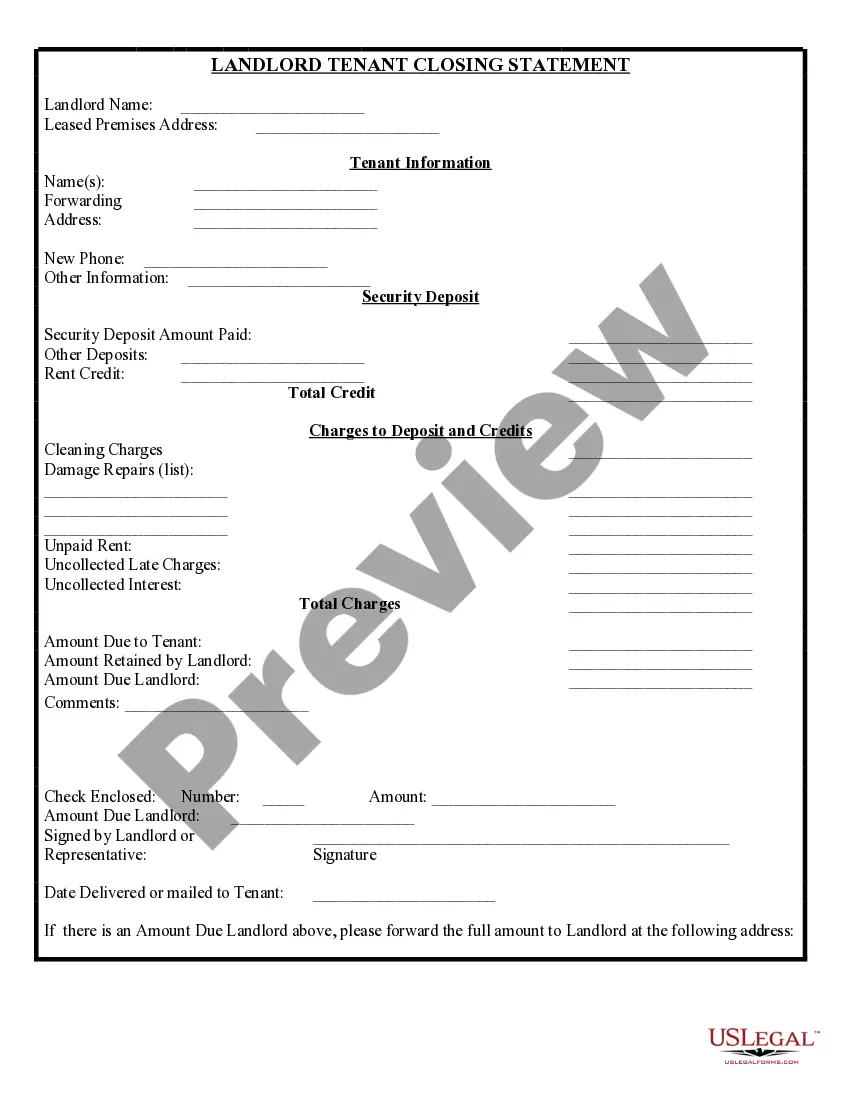

Also, commercial leases are for longer durations, ranging up to five years or more. However, residential leases are usually for 11 months. While in both cases, the tenant rents a property and pays monthly rentals, the terms and conditions differ drastically.

Commercial leases usually have a minimum period of one year, though typical leases are much longer than that. It's not uncommon to have five, ten, or fifteen year commercial leases. While shorter lease terms for some types of businesses exist, they are the exception and not the norm.

With a written lease agreement, the terms of the lease and the monthly rent are fixed for the time period specified in the agreement, usually six months or one year. As long as you follow the terms, a lease agreement prevents the landlord from raising the rent or asking you to move until the lease expires.

Commercial leases do not have specific minimum or maximum durations. However, they typically span from one to 25 years, with the majority falling within the range of three to ten years.

On stamp paper, the rental contract or rental agreement is written. In India, there are two different kinds of rent agreements, one of which is a lease with a minimum term of 12 months. Rent Control Laws established by the State Government regulate this.

The minimum requirement is typically between 660 and 680 for conventional loans, but many business loans have lower requirements. You must also show how long you have been in business, as most lenders will only lend to an established company. This means you should already be in business for one to two years, minimum.