Letter Settlement Estate Sample With Land In Riverside

Description

Form popularity

FAQ

Local Rule 3116 further provides that “failure to file a timely declaration may constitute an admission by the responding party that there are no meritorious grounds on which to oppose the action that is the subject of the Order to Show Cause.

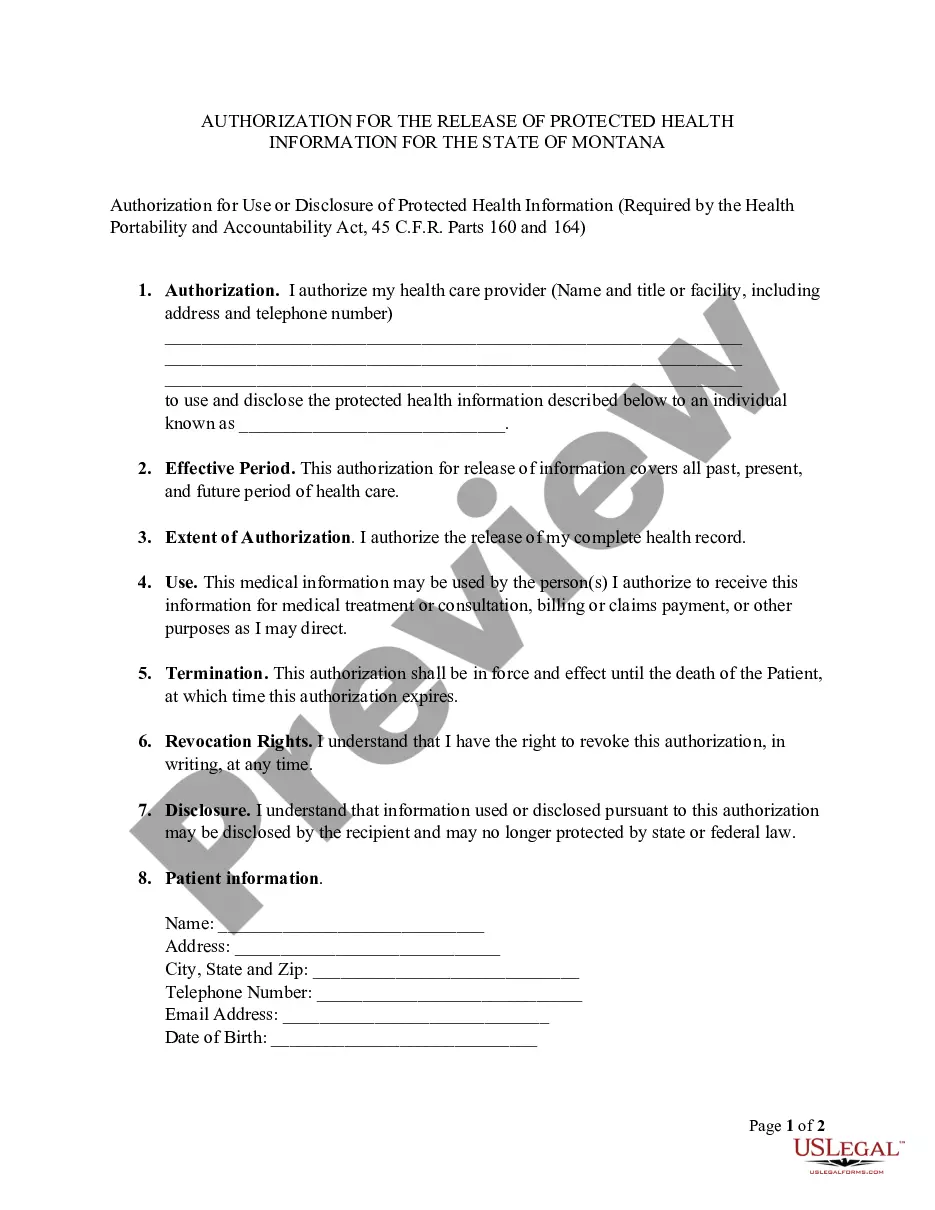

Ask the County Clerk or search online for your county's probate forms. Fill out the forms with the requested details, such as the decedent's full name, address, date of birth, and date of death; their personal representatives' contact details; heirs; estate value; and more. Then return the forms to the County Clerk.

In the event you were not able to appear on your scheduled summons date for jury service, you will need to contact our office via email or by phone in order to avoid receiving a Failure to Appear notice that can result in a fine, imprisonment or both, pursuant to C.C.P. 209.

This rule is essentially forcing parties to try to settle issues in their case before going to trial. If Local Rule 5153 is not complied with, the Court will not allow your case to go forward until these procedures are met.

The document needs to state the following: The name of the person who died. The date and location of the death. That 40 days have passed since the death. That probate has not been initiated. That the estate value does not exceed $166,250. A description of assets to transfer. Names of other successors.

Comply with Local Rule 3116, which provides that a written response to any OSC be filed with the Court at least 5 days in advance of the hearing (although the Court encourages filing any response at least 10 days in advance of the OSC where possible).

LOCAL RULE 7-3: Local Rule 7-3 requires counsel to engage in a pre- filing conference “to discuss thoroughly, preferably in person, the substance of the contemplated motion and any potential resolution.” L.R.

Prior to 2020, the maximum amount for avoiding probate through a small estate affidavit was $150,000. In 2020 the limit was increased from $150,000 to $166,250. The on April 1, 2022 the limit increased again. For those who died on or after April 1, 2022, the limit increased to $184,500.