Agreement Letter For Loan In Philadelphia

Description

Form popularity

FAQ

What does Notice mean? In a contractual context, a notice may be to terminate the agreement, or may be the notice required to do a certain thing under the contract. Notices usually must comply with certain formalities set out in the contract, and certain time limits.

The current Real Estate Tax rate is 1.3998%. The rate hasn't changed since 2016 and will remain the same in 2025. The tax rate is determined by two separate taxes imposed on all real estate in Philadelphia: one by the City and one by the School District.

The Longtime Owner Occupants Program (LOOP) is a Real Estate Tax relief program. You may be eligible if your property assessment increased at least 50% over last year, or at least 75% over the past five years.

Get Real Estate Tax relief Get the Homestead Exemption. Real Estate Tax freezes. Set up an Owner-occupied Real Estate Tax payment agreement (OOPA) ... Get a property tax abatement. Apply for the Longtime Owner Occupants Program (LOOP) ... Active Duty Tax Credit. Enroll in the Real Estate Tax deferral program.

The OOPA program allows people who own and live in their home to make affordable monthly payments on property taxes that are past due. There is no down payment required and your monthly payments will be based on a percentage of your monthly income. or call (215) 686-6442.

Find or get a copy of a deed In-person (same-day service) — Visit the Department of Records in person at City Hall Room 154 from Monday through Friday, a.m. to p.m. Mail (slowest option) — Mail your request with payment to Department of Records, City Hall, Room 154, 1400 John F.

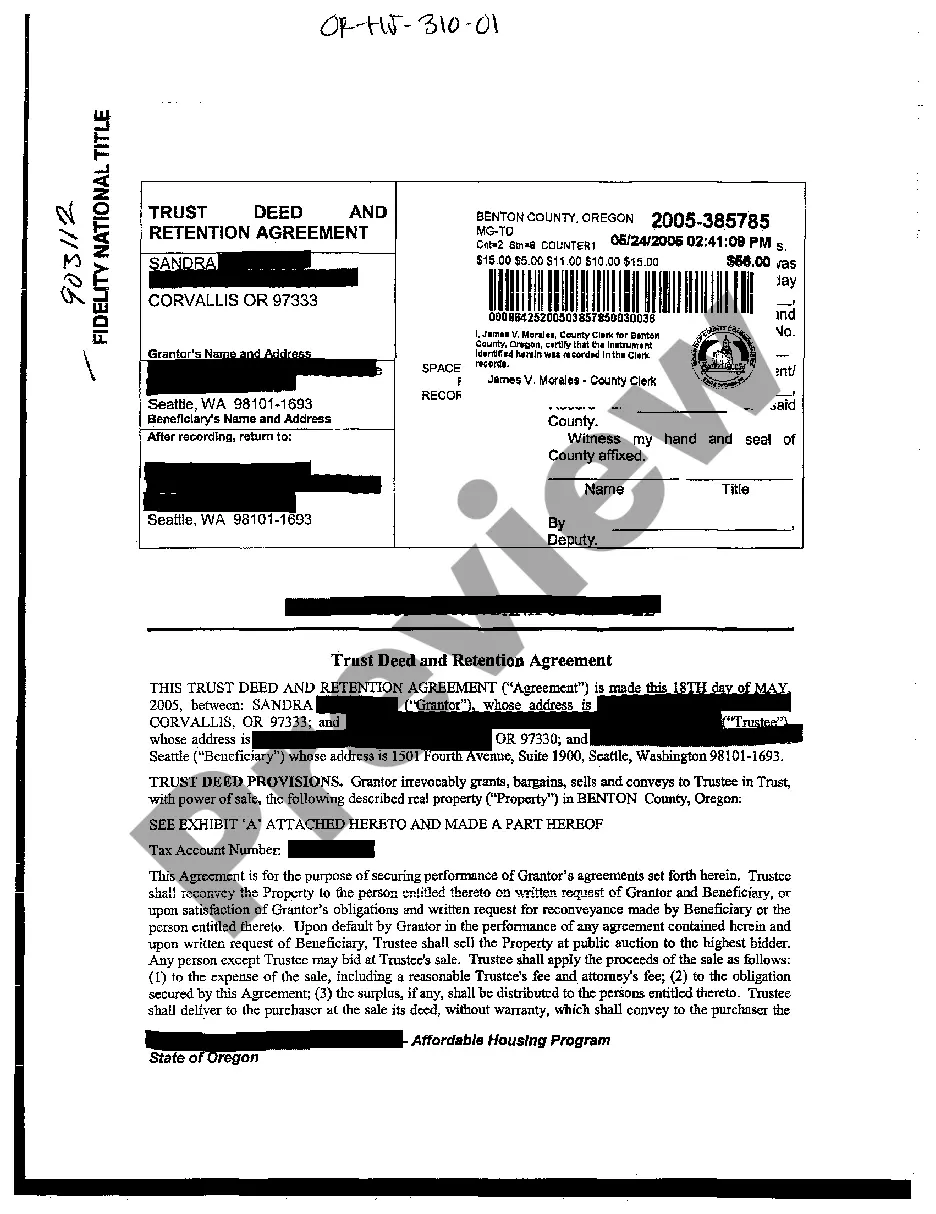

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

Ing to Boundy (2012), typically, a written contract will include: Date of agreement. Names of parties to the agreement. Preliminary clauses. Defined terms. Main contract clauses. Schedules/appendices and signature provisions (para. 5).

The assignor must agree to assign their rights and duties under the contract to the assignee. The assignee must agree to accept, or "assume," those contractual rights and duties. The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.