Agreement Letter For Borrowing Money In Orange

Description

Form popularity

FAQ

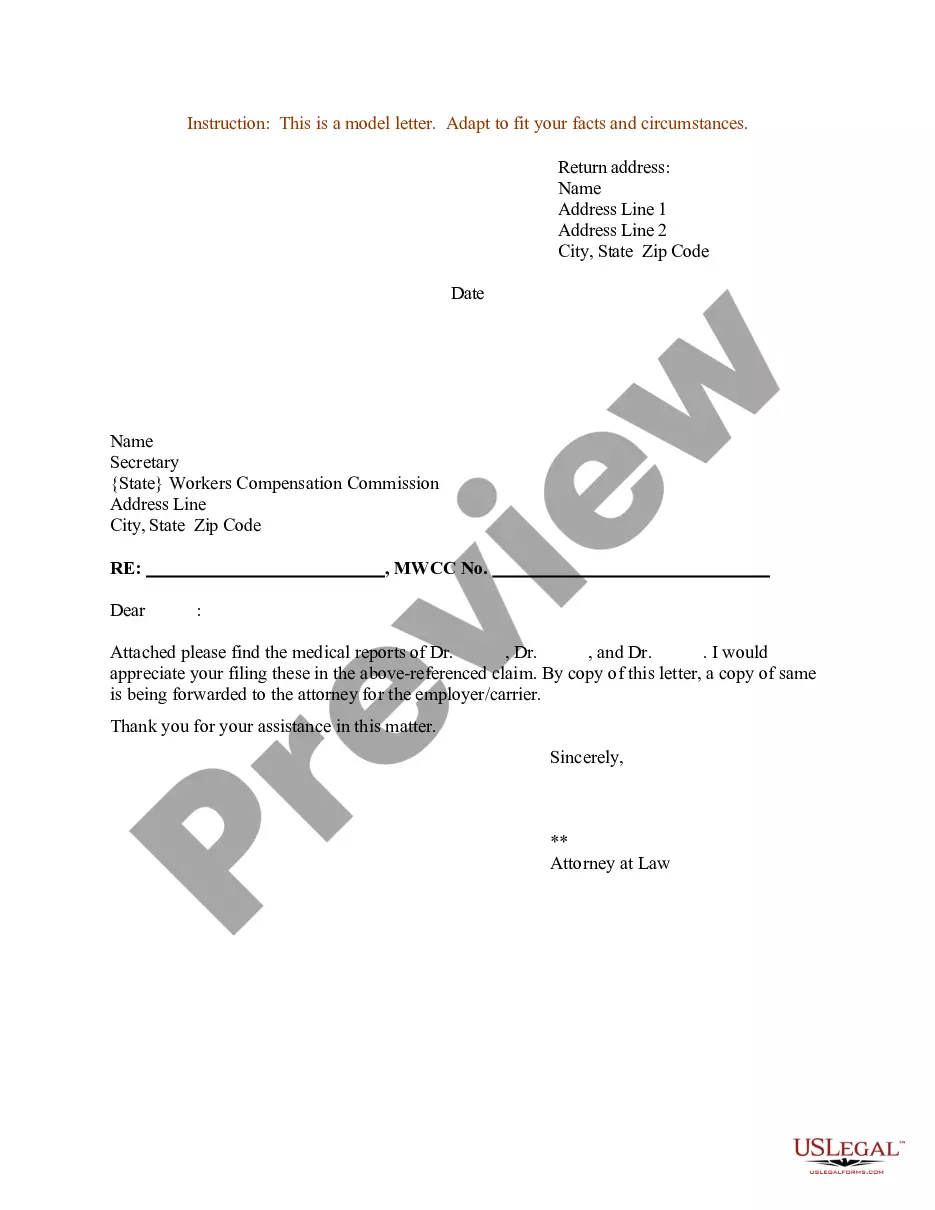

How to write an agreement letter Title your document. Provide your personal information and the date. Include the recipient's information. Address the recipient and write your introductory paragraph. Write a detailed body. Conclude your letter with a paragraph, closing remarks, and a signature. Sign your letter.

At a bare minimum, an IOU should include the borrower's name, the lender's name, the amount of the debt, the current date, the date the debt is due, and the borrower's signature. In addition, it's recommended that IOUs contain: How the debt is to be repaid (lump sum or installments)

Promissory notes are contracts and contracts don't make dishonest people honest. A DIY contract is likely a mistake. You can buy a promissory note off of a site like or use a local attorney.

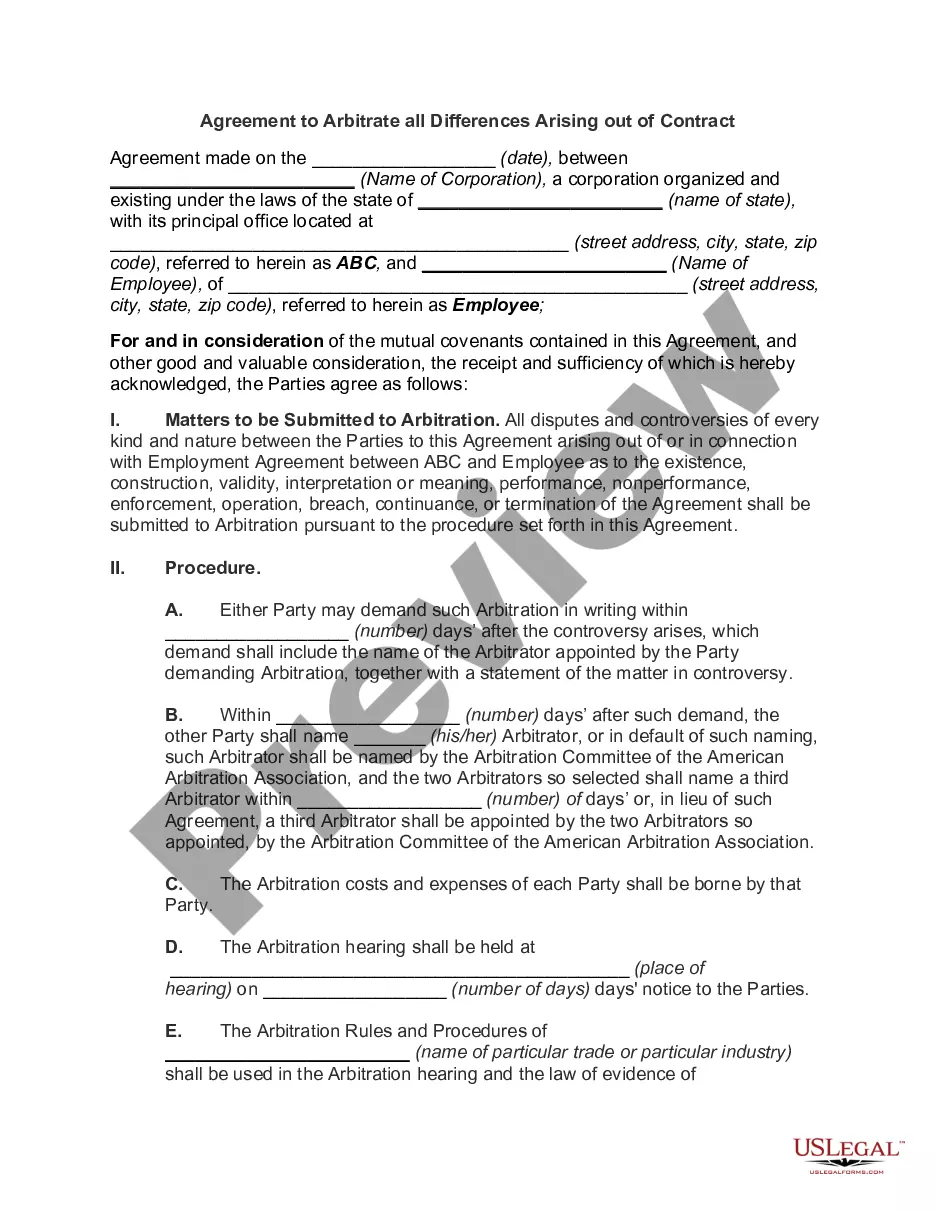

The promissory note is issued by the lender, signed by the borrower, and then witnessed and initialized by the lender. Once signed, it becomes a legally enforceable document. The payment terms can be whatever the borrower and lender agree to.

A commitment is not synonymous with an approval. While receiving a firm commitment or a conditional commitment are both positive pieces of news on your homebuying journey (especially the firm letter), this isn't the end of the application process.

Letters of Funding Commitment should be printed on official letterhead, signed by authorized representatives, and provided with the application materials. The letter must provide details of the funds or resources committed to the project, and briefly address how the funds and/or resources will benefit the project.