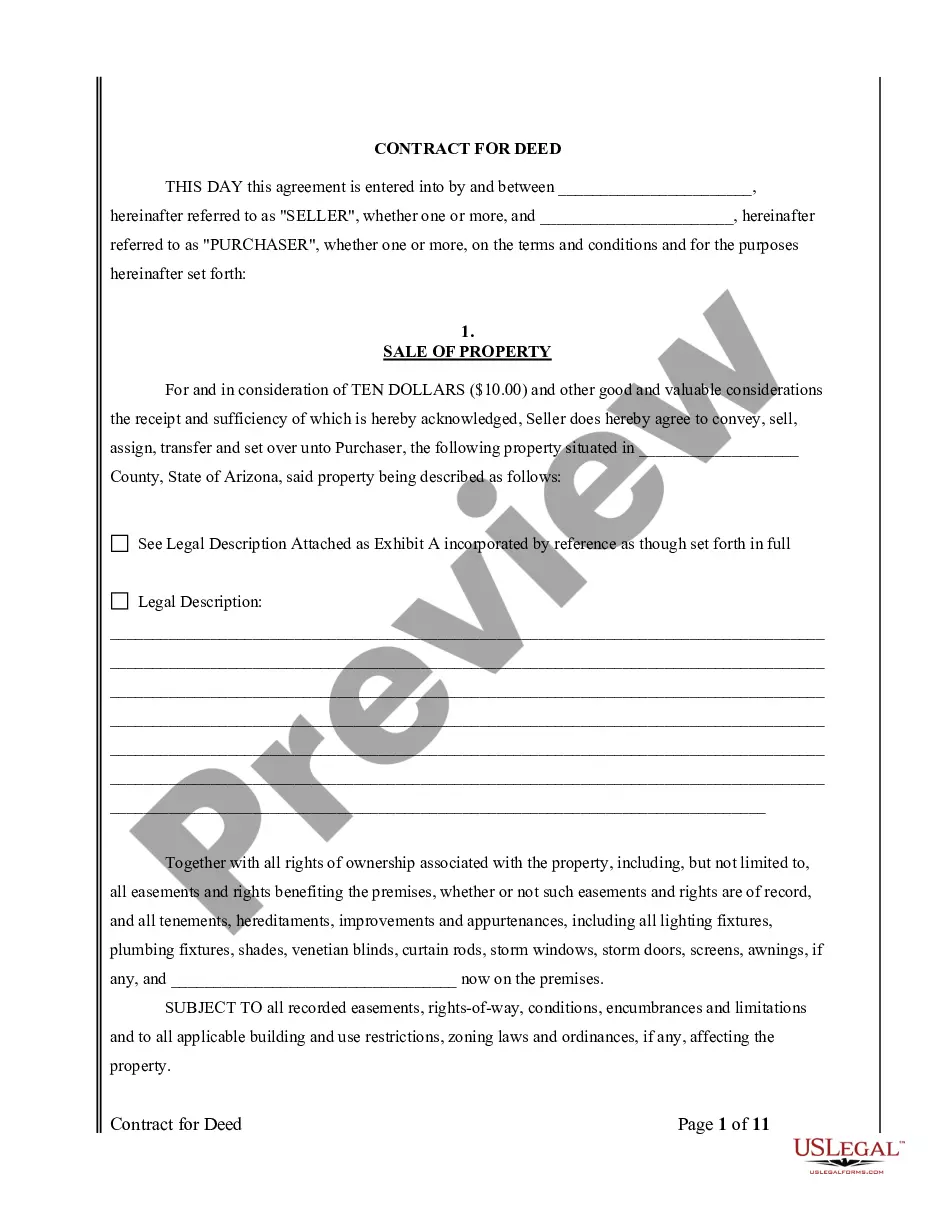

This form grants to a realtor or broker the sole and exclusive right to list and show the property on one ocassionsell the commercial property described in the agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Listing Agreement For Commercial Lease In Maricopa

Description

Form popularity

FAQ

Currently, there is no state or county tax imposed on residential rentals. Therefore, Arizona cities are not be able to impose a tax on residential rentals from and after December 31, 2024.

Review the Lease Agreement. The assignor (current tenant) should review the existing lease agreement to understand the terms and conditions associated with the lease assignment. Obtain Landlord's Consent. Negotiate Terms. Deed of Assignment. Land Registry Notification. Completion and Handover.

There are five counties in the state of Arizona that require you to collect and remit county taxes for commercial leases. Those counties are Coconino, Gila, Maricopa, Pima and Pinal.

Effective January 1, 2025, Arizona property owners will no longer be required to collect and remit city Transaction Privilege Tax (TPT) on residential rental income for long-term stays of 30 consecutive days or more.

Arizona rental tax ban in 2025 Arizona's residential rental tax is a type of transaction privilege tax (TPT). Rent TPTs are sales taxes that most landlords transfer to their renters. However, beginning Jan. 1, 2025, Arizona property owners will stop collecting this rent tax.

An assignment is a full transfer of the lease between the tenant and the assignee. Therefore, since the tenant no longer has any ownership interest in the property, there is no longer any relationship between the landlord and the tenant as far as the property ownership is concerned.

An assignment transfers one party's interest and obligations under a lease to another party. During these tenant transfers, the new tenant takes on the lease responsibilities, including paying rent and property maintenance of the leased premises, and the original tenant is released from most of their duties.

Businesses may consider lease assignment for various reasons, such as relocation, financial constraints, or changes in business needs. For instance, a company experiencing rapid growth may seek more extensive premises, making lease assignment an attractive option to exit the current arrangement.

Currently, there is no state or county tax imposed on residential rentals. Therefore, Arizona cities are not be able to impose a tax on residential rentals from and after December 31, 2024.