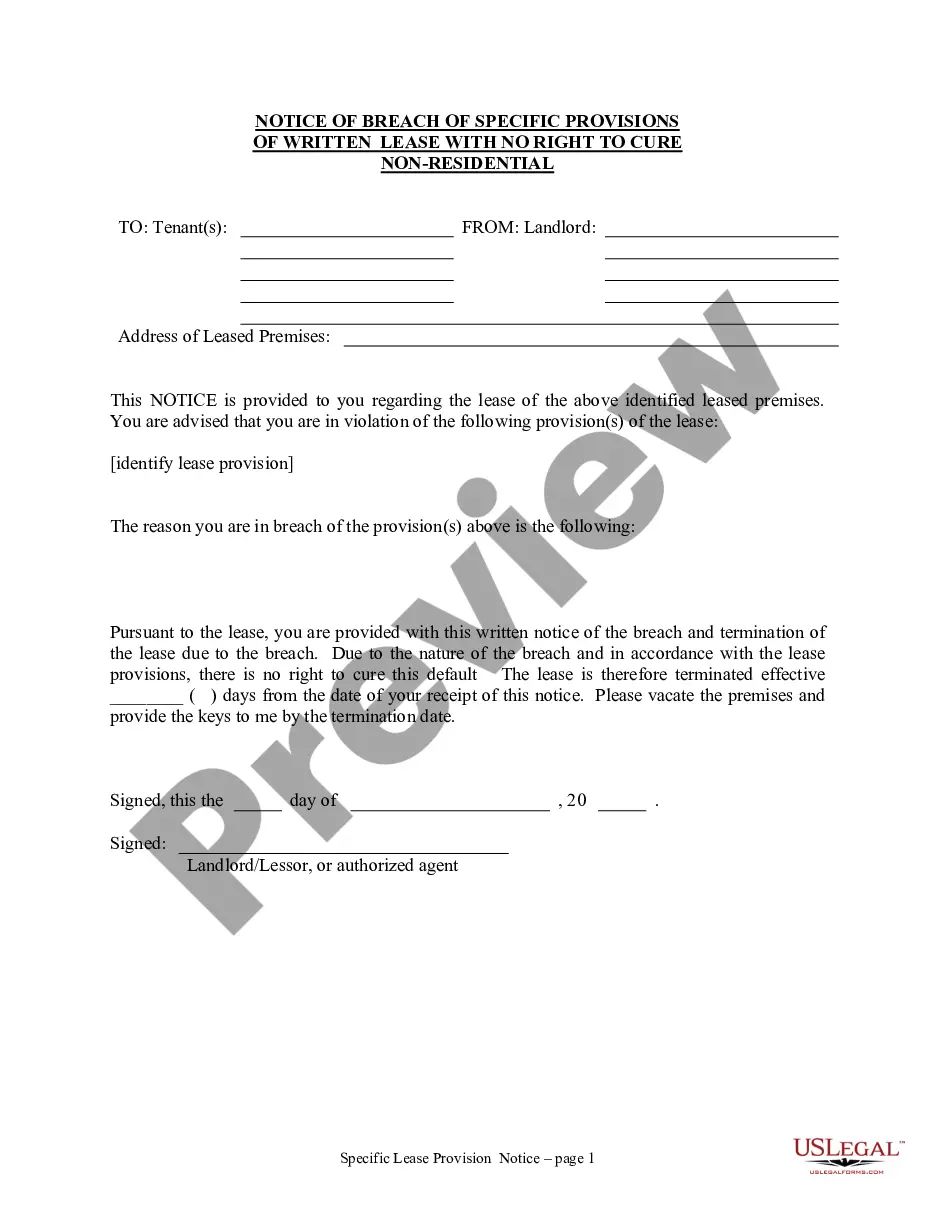

This form grants to a realtor or broker the sole and exclusive right to list and show the property on one ocassionsell the commercial property described in the agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Broker Commercial Property Estate Withholding Tax In Florida

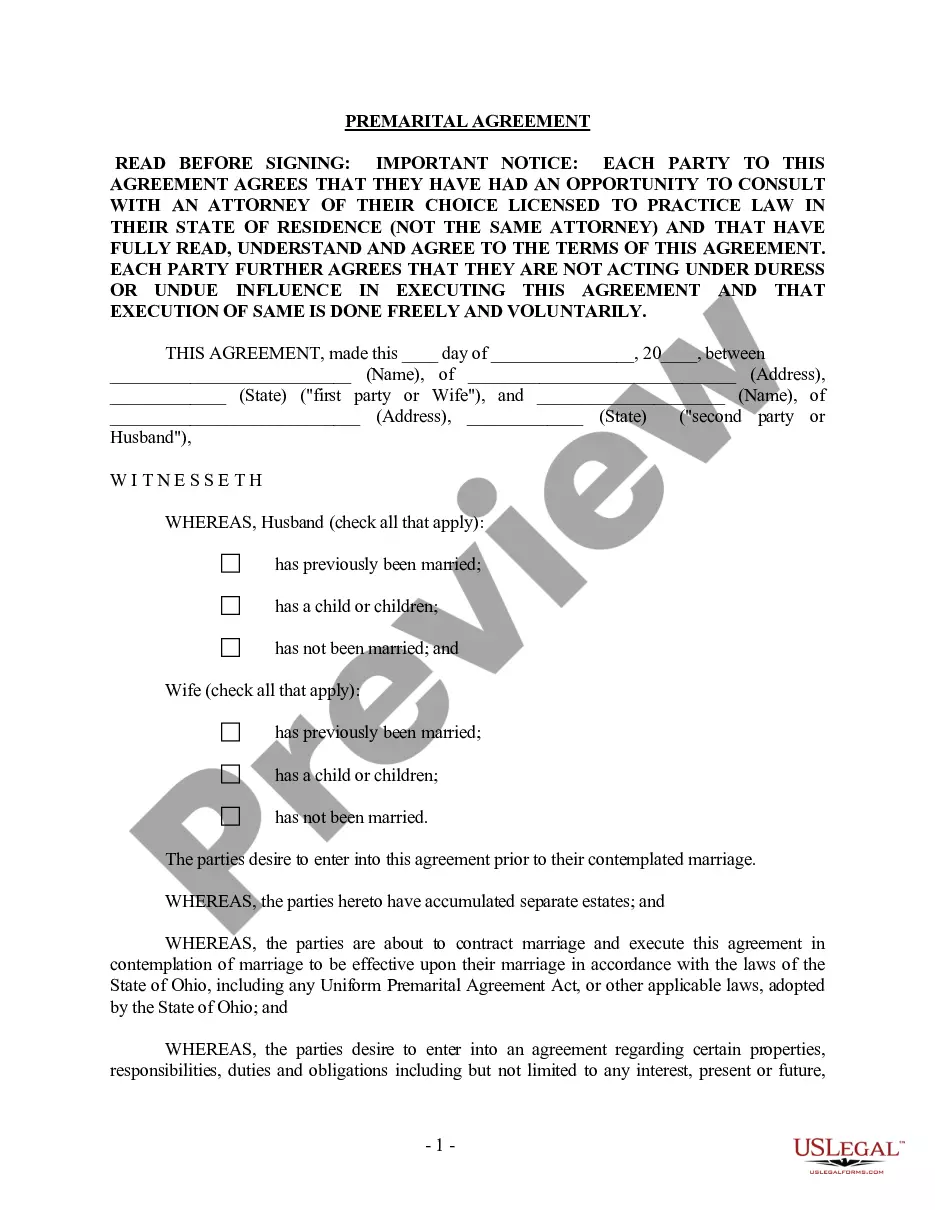

Description

Form popularity

FAQ

You must have owned the home for at least 2 out of the past 5 years; You must have lived in the house for at least 2 years (cumulatively) out of the last 5 years (this time does not have to be consecutive as long as it adds up to 2 years);

If you can prove that you are not a foreign seller, you can be exempt from FIRPTA withholding. This means that if you can show documentation confirming your U.S. citizenship or residency status, the FIRPTA withholding requirement won't apply to your property sale.

Florida does not require state income tax withholding on earnings.

Generally, the tax rate for commercial properties in Florida is based on the assessed value of the property and can range from 1% to 2% of the assessed value. Commercial property owners in Florida may be eligible for various exemptions and deductions that can lower their property tax liability.

Justin Bender of PWL Capital notes the impact on returns: “Holding a US-based US equity ETF in your RRSP or RRIF exempts all dividends from the 15% US withholding tax. Based on the current US equity dividend yield of 1.8%, this should save you around 0.3% per year.”

FIRPTA protects the buyer. Although the purpose of the law is to ensure that the IRS is able to collect the applicable income tax on a transaction, it has the secondary benefit of protecting the buyer by covering the projected amount for which they will be held liable.

How to avoid paying capital gains taxes on the sale of rental property Buy & Sell Real Estate through a Retirement Account. Gift Your Property Into a Charitable Remainder Trust. Convert Rental Property to a Primary Residence. Use a 1031 Exchange to Defer Capital Gains. Avoid Capital Gains Tax Through Tax-Loss Harvesting.

From the Landlord's Perspective They're required to collect this tax from their tenants and remit it to the DOR. Failure to do so can result in penalties and interest charges. Lease agreements should clearly state that the tenant is responsible for the tax amount.

What Is The Florida Capital Gains Tax? Unlike federal capital gains taxes, there is no capital gains tax in Florida. In other words, there is not a state-level tax imposed on capital gains earned by individuals, businesses, or other legal entities.

Generally, the tax rate for commercial properties in Florida is based on the assessed value of the property and can range from 1% to 2% of the assessed value. Commercial property owners in Florida may be eligible for various exemptions and deductions that can lower their property tax liability.