Simple Bill Of Sale For Car In Texas In Travis

Description

Form popularity

FAQ

Yes, Texas recognizes handwritten bills of sale as valid, as long as they contain all the necessary information and are signed by both the buyer and the seller. However, using a typed or printed document is generally more legible and professional.

Q: Do I always need a notary for my Texas bill of sale? A: Not always, but for transactions involving significant assets like real estate, a notarized bill of sale can offer additional legal protection.

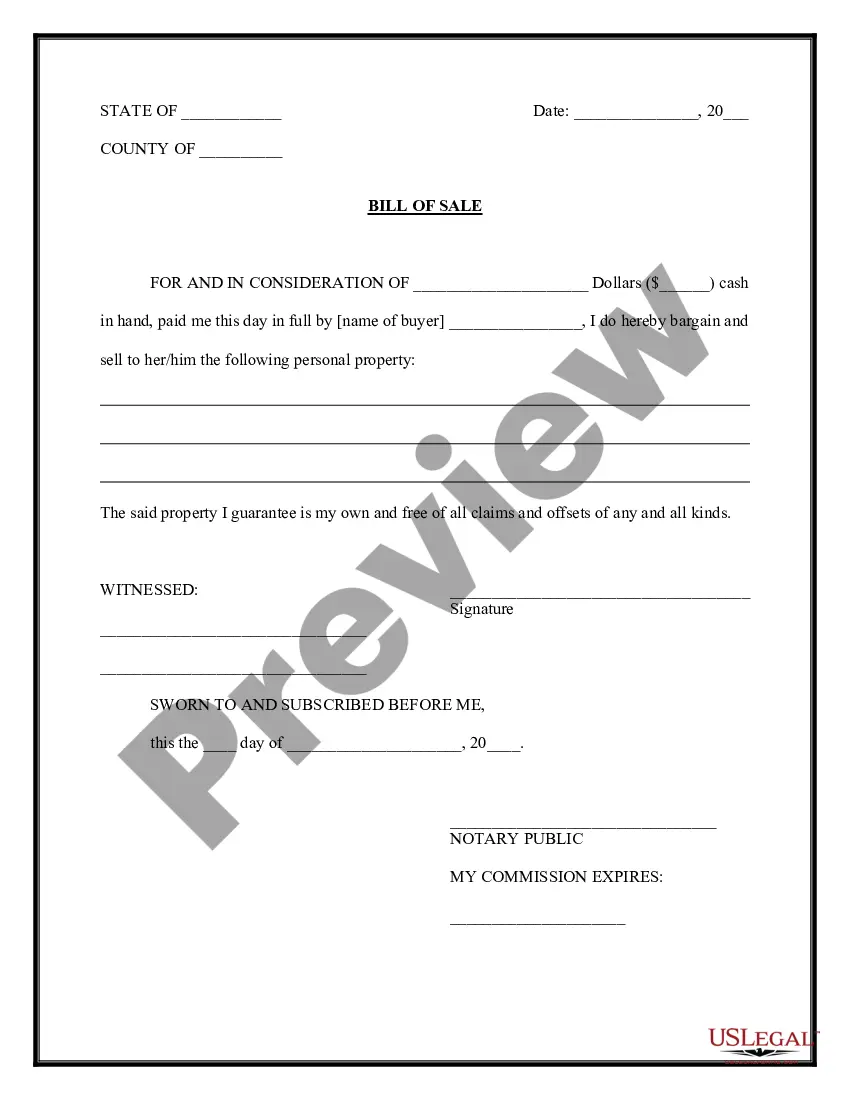

A valid Texas bill of sale needs clear identification of the buyer and seller. Names, addresses, and contact details for both parties must be included. It should provide a comprehensive description of the item sold, including make, model, year, and unique identifiers like VIN for vehicles.

Texas does not require a bill of sale except for bonded titles. The seller will need to provide you the original title for the car, signed as appropriate front and back. There will need to be no lienholders shown anywhere on the title, such as a bank, car note lender, etc.

Selling a Vehicle To protect yourself from liability, you should complete a Vehicle Transfer Notification within 30 days from the date of sale. You may still submit a vehicle transfer notification after 30 days from the date of sale, but it does not guarantee release from liability.

To transfer a Texas titled vehicle, bring in or mail the following to our offices: Texas title, signed and dated by the seller(s) and buyer(s). VTR-130U (Application for Texas title), signed and dated by the seller(s) and buyer(s). Proof of insurance in the buyer's name. Acceptable form of ID. Proof of inspection. Fees.

Bill of Sale: While not always required, having one helps document the sale and provides extra proof of the transaction. Proof of insurance: The buyer must have valid Texas insurance for the vehicle being transferred. Identification: A government-issued photo ID, like a driver's license, is needed for both parties.