Handwritten Bill Of Sale For Car Example With Notary Signature In Travis

Description

Form popularity

FAQ

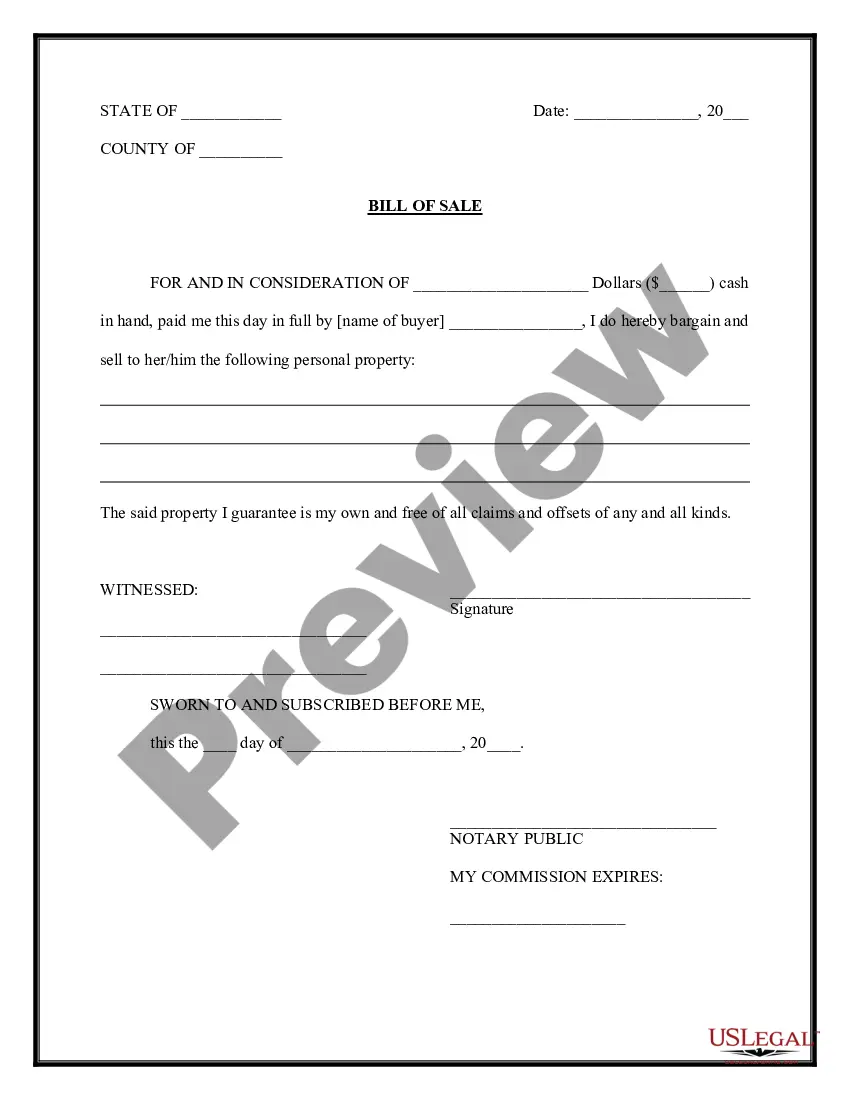

A Texas motor vehicle bill of sale is a legal document used to demonstrate that a motor vehicle has been legally sold. The state does not require the document to be notarized, but it does suggest1 that both parties jointly visit the county tax office when the seller is signing over the title of the vehicle.

In Texas, a bill of sale is not legally required; however, creating or obtaining one is a valuable way to verify a sale, especially when selling expensive personal property such commercial equipment or precious metals.

Yes, Texas recognizes handwritten bills of sale as valid, as long as they contain all the necessary information and are signed by both the buyer and the seller. However, using a typed or printed document is generally more legible and professional.

After you choose your buyer, you should provide them with a properly signed title. This should include the sale date and odometer reading. You will also need Form 130-U, the Application for Texas Title, and/or Registration. Form 130-U acts as a legal bill of sale.

Both parties must sign a Texas bill of sale. The buyer and seller's signatures make the document legally binding. While notarization isn't mandatory for most transactions, it offers additional legal protection. Notarizing the document helps prevent disputes by validating the identities of the parties involved.