Proposal Form For Professional Indemnity Insurance In Riverside

Description

Form popularity

FAQ

Only CMCs that represent clients in personal injury claims must have PII. This requirement also applies to any new business applying for authorisation to provide this service. Representing clients means acting on the client's behalf to settle a claim for compensation.

Professional indemnity cover will provide protection against an accidental lapse in judgement resulting in a defamation or libel claim. For example, an employee sharing information on social media about a client which could be perceived as negative or slanderous.

Whilst professional indemnity insurance is not a legal requirement, it is often compulsory before membership of a chartered body.

All health practitioners who undertake any form of practice in their respective profession(s) must have professional indemnity insurance (PII) arrangements that comply with the relevant registration standard, for all aspects of their practice.

The requirement for mandatory professional indemnity insurance applies to all licensees under the Act – including real estate agents, stock and station agents, business agents, strata and community managing agents, and on-site residential property managers.

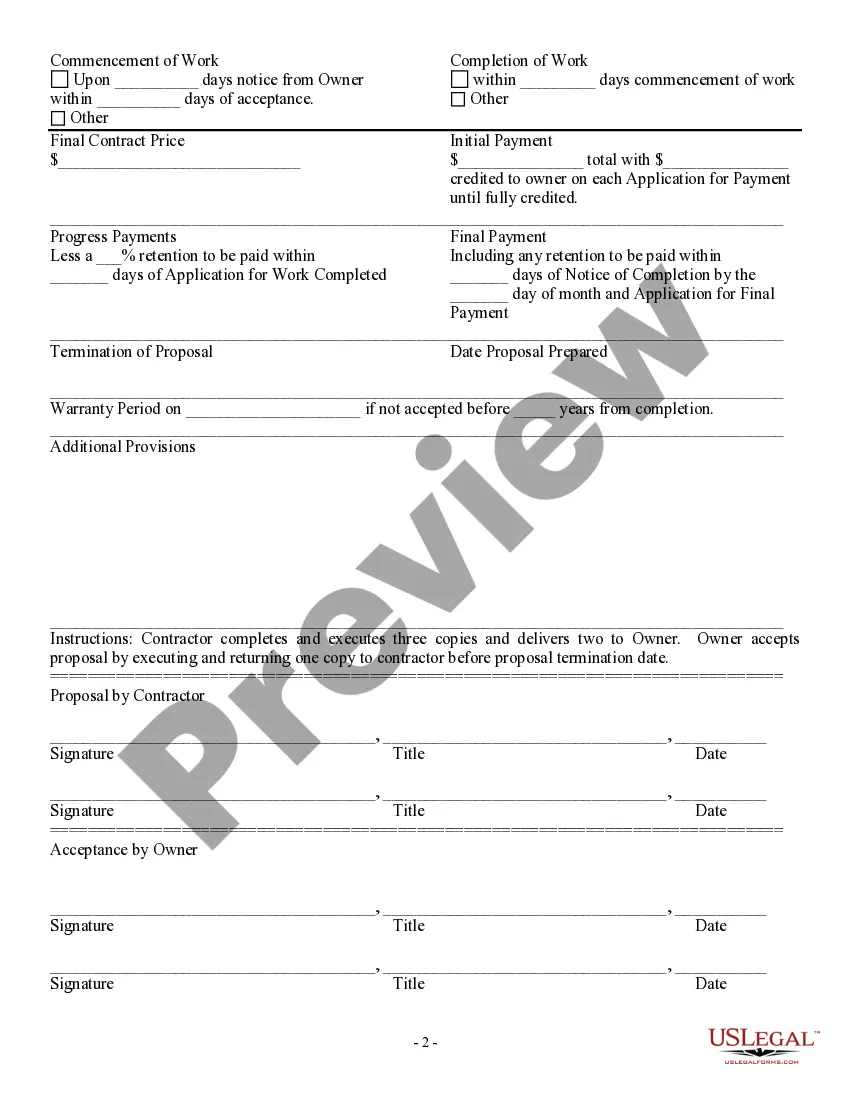

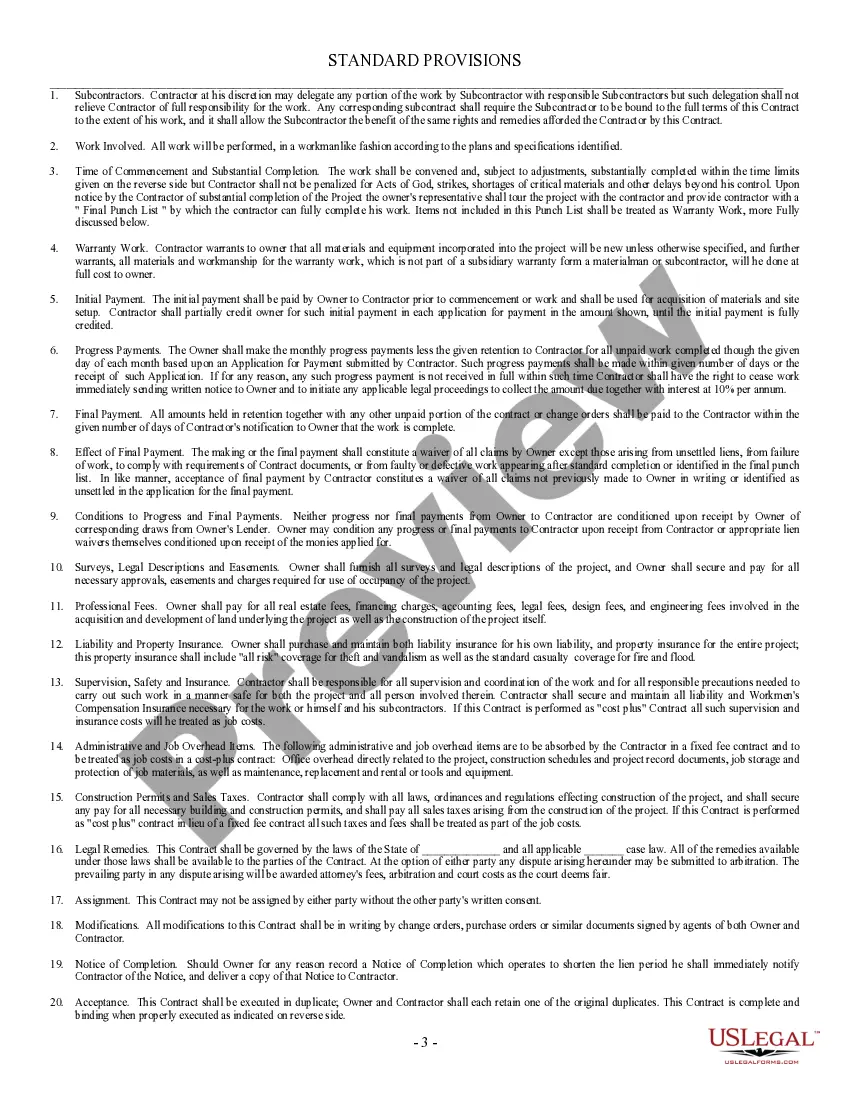

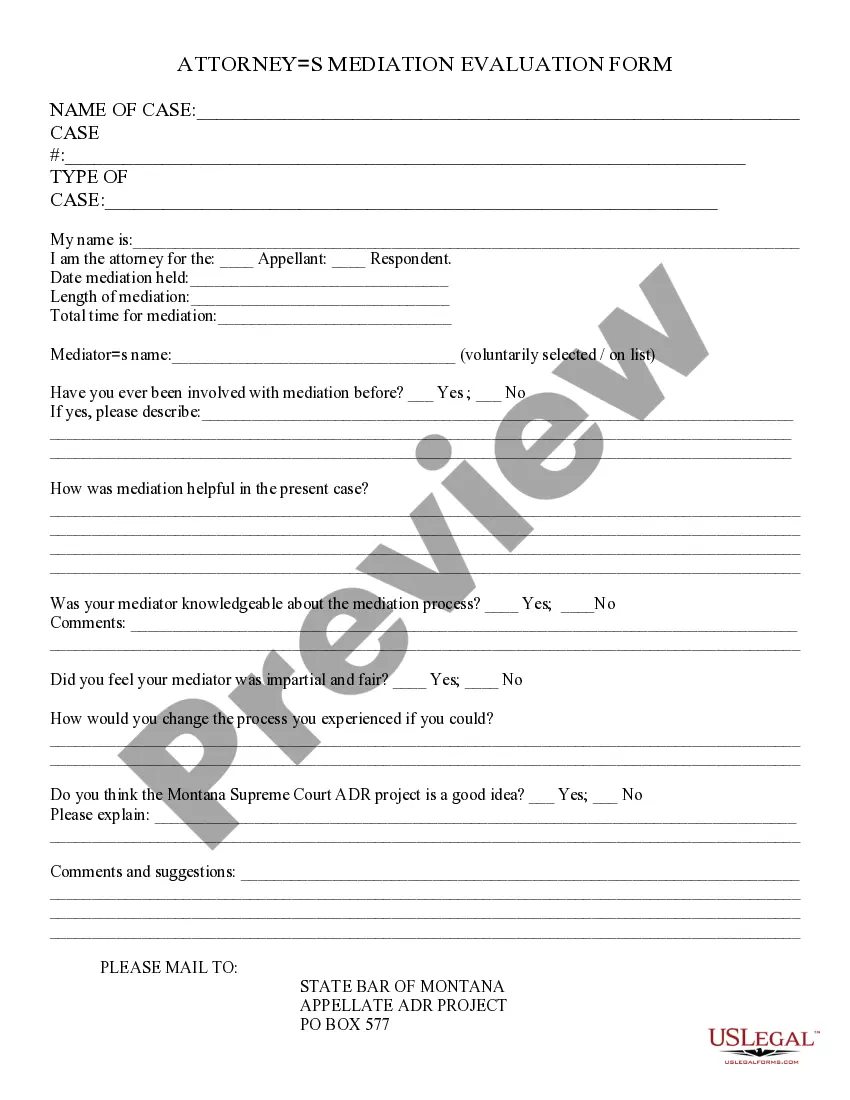

Components of a Proposal Form Personal Information: This includes the applicant's name, age, gender, occupation, and contact details. Policy Details The applicant specifies the type of insurance policy they are applying for, the term of the policy, and the sum assured or coverage amount.

Professional indemnity insurance can also cover: Unintentional breach of copyright – for example if you used someone's picture in your advertising without their permission. Defamation and libel – such as making a claim about a competitor that is untrue.

Professional Indemnity Insurance can provide cover in the event of a breach of contract, or a mistake from professional services provided, such as a mistake made in the course of providing professional services or advice, or recommendations to a client.

What is Professional Indemnity Insurance? Professional indemnity insurance (also known as PII) or professional liability insurance will protect you if you make a mistake while working for a principal that causes them financial loss.