Agreement Dissolution Sample For Non Profit In Chicago

Category:

State:

Multi-State

City:

Chicago

Control #:

US-00426BG

Format:

Word;

Rich Text

Instant download

Description

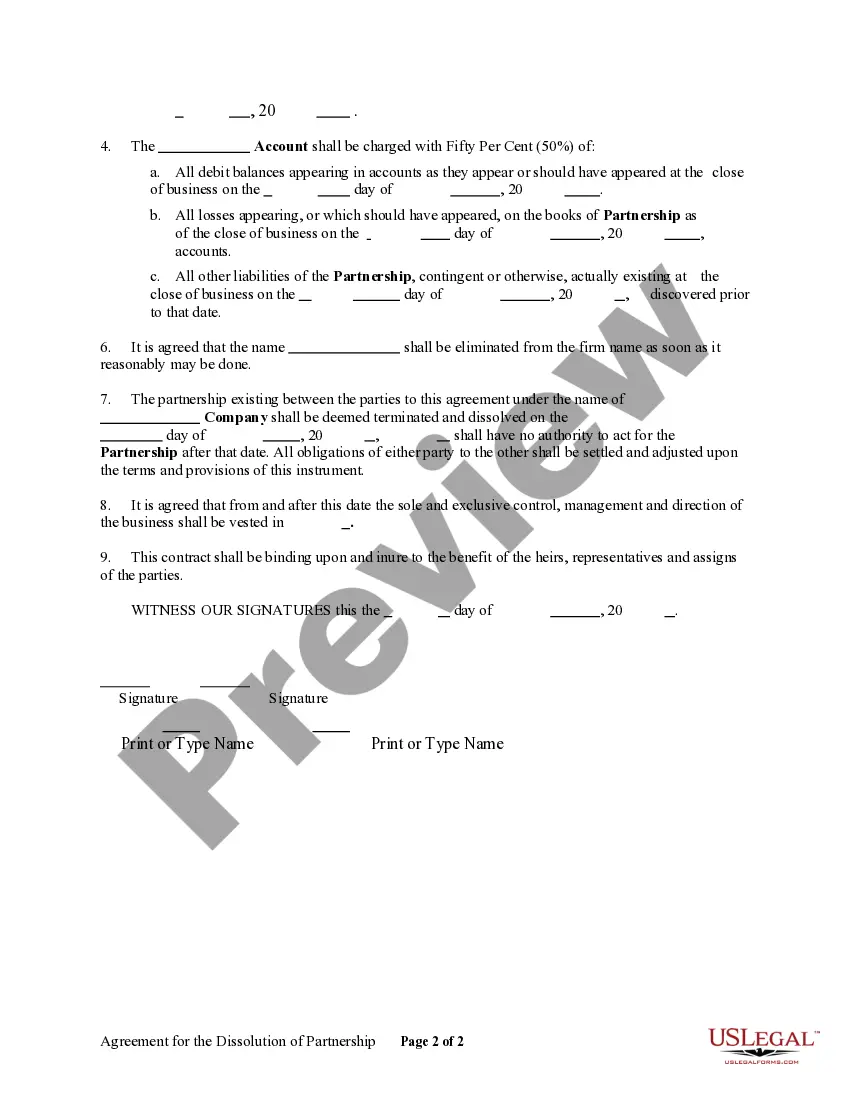

The Agreement Dissolution Sample for Non Profit in Chicago outlines the terms and conditions under which partners may dissolve their nonprofit organization. This form requires basic information about the partners and the business conducted, specifying the firm's name and addresses involved. Key features include provisions for an audit of the partnership's financials, the allocation of assets, liabilities, and the management of financial accounts after dissolution. Partners must equally share the audit cost, and detailed instructions are provided for transferring ownership of partnership property. The document ensures that management rights are reassigned post-dissolution and that all financial obligations are addressed, with clauses protecting the interests of heirs and assigns. This form is particularly useful for attorneys and paralegals who assist with nonprofit legal matters, as well as for partners, owners, and associates who need a structured approach to dissolve their partnership legally and efficiently. By following the straightforward instructions, legal assistants can help ensure compliance with local laws and protect the partners' interests during the dissolution process.

Free preview