Agreement Dissolution Sample For Non Profit

Description

How to fill out Agreement For The Dissolution Of A Partnership?

No matter if you handle documents frequently or require to send a legal report from time to time, it is crucial to find a source where all the samples are pertinent and current.

The very first step you need to take with an Agreement Termination Sample for Non-Profit is to ensure that it is the latest version, as it determines whether it can be submitted.

If you wish to make your hunt for the most recent document samples easier, look for them on US Legal Forms.

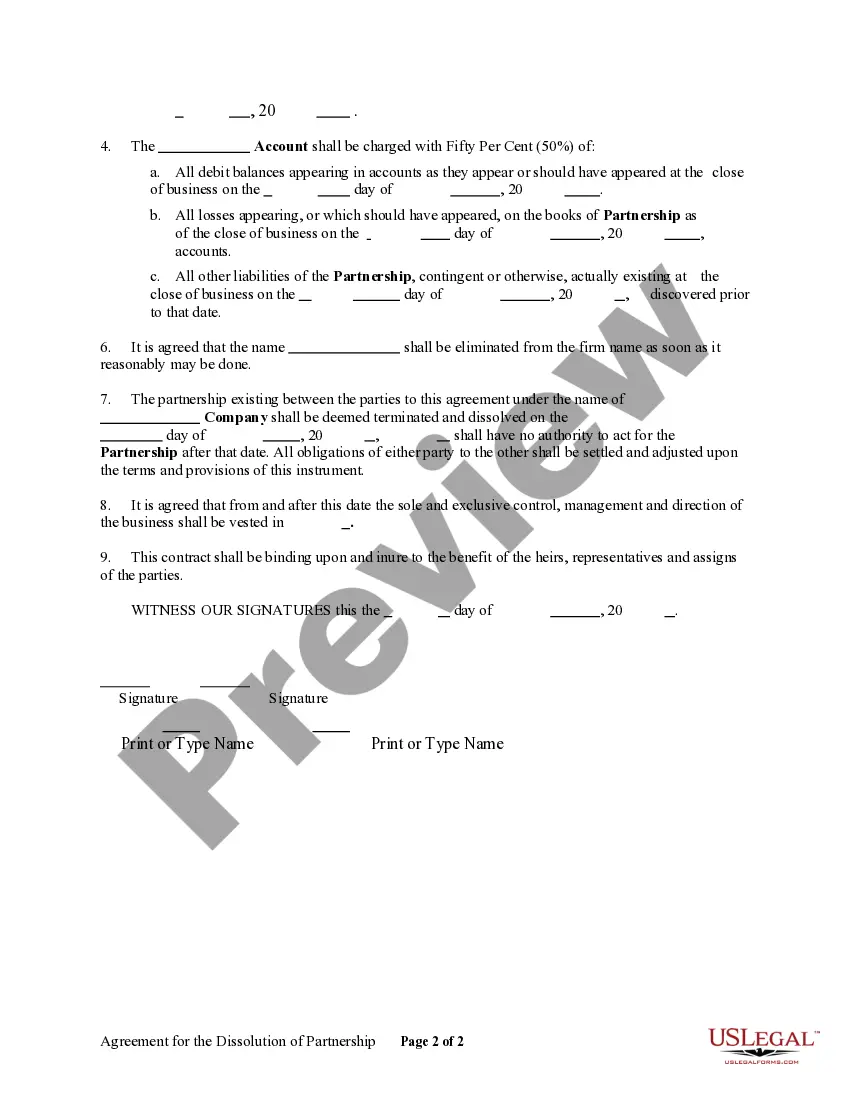

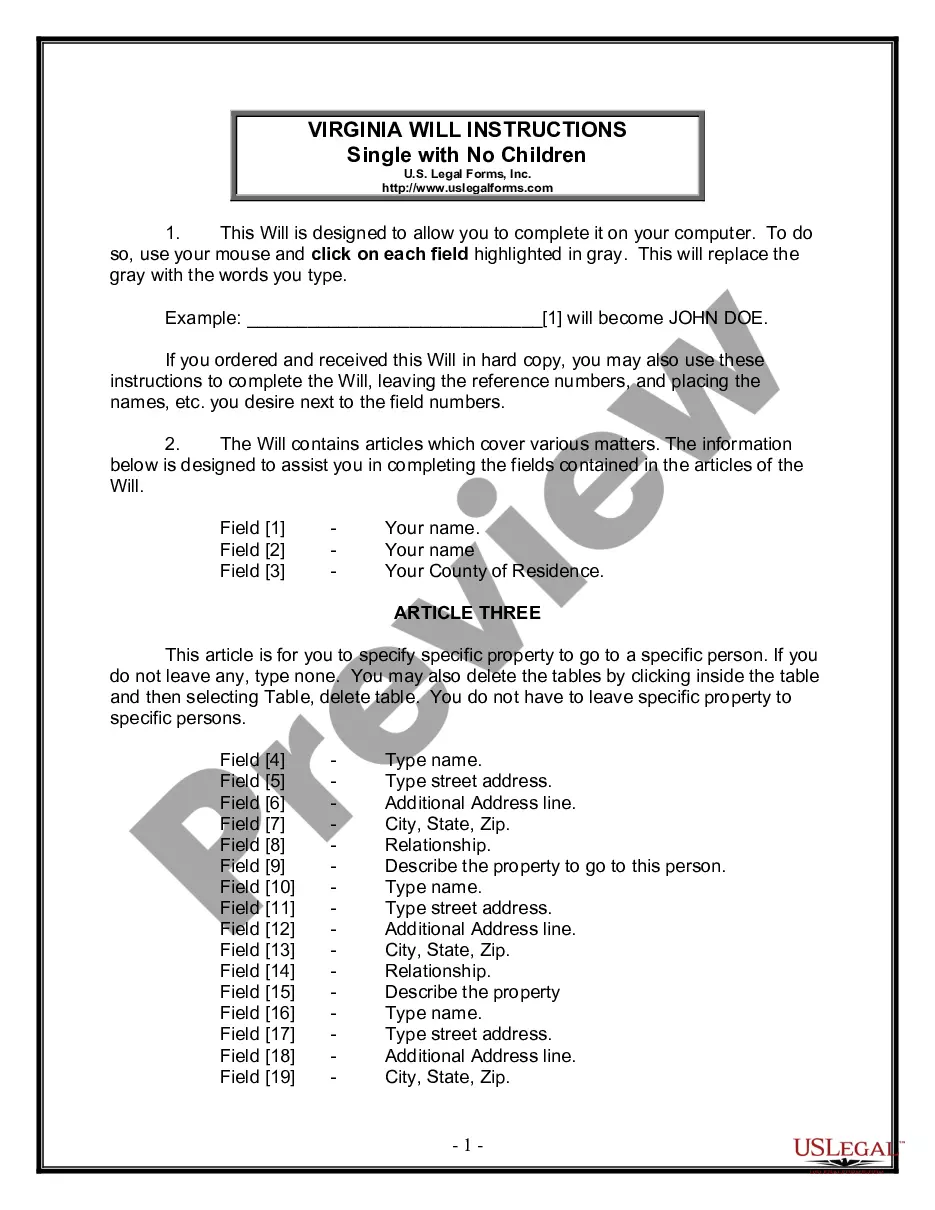

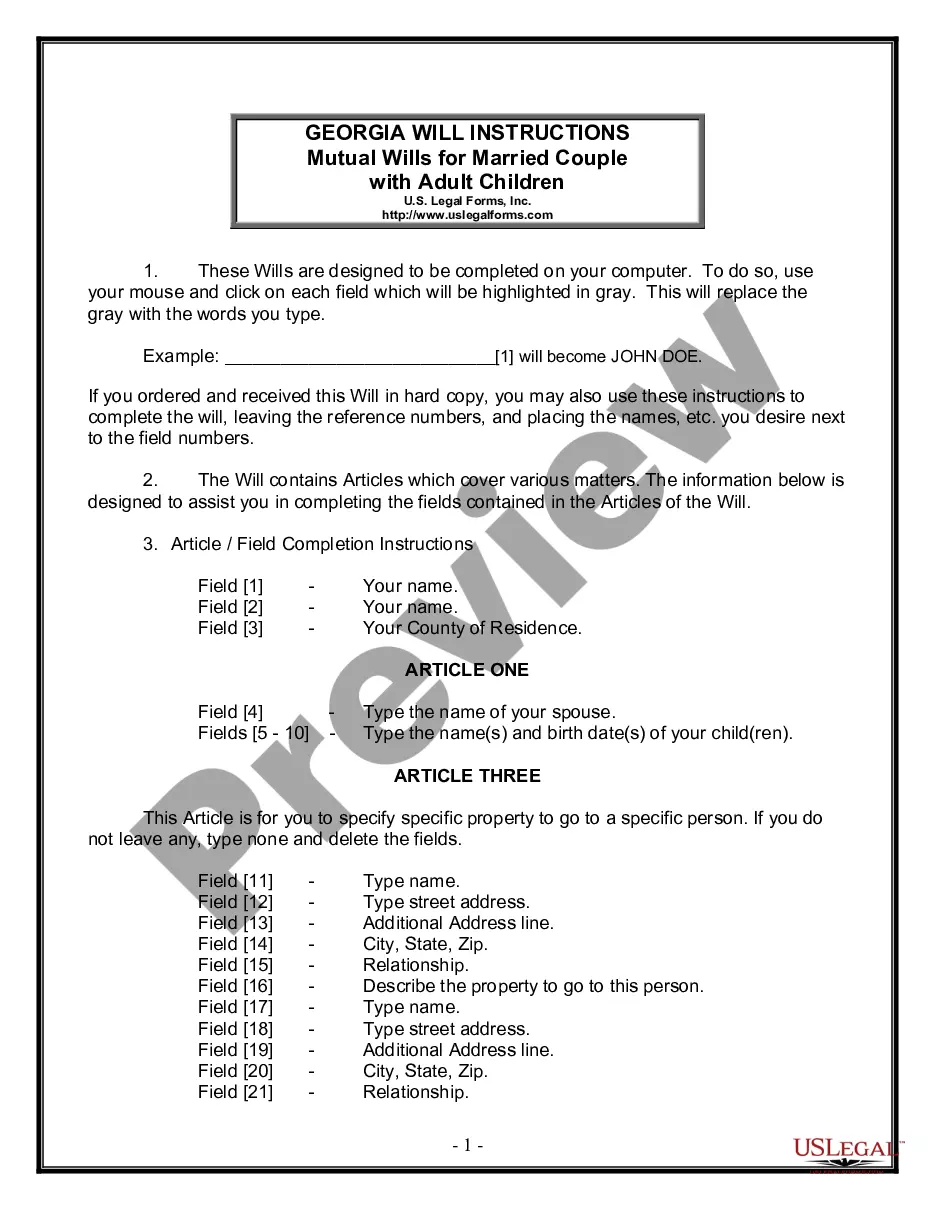

To obtain a form without an account, follow these steps: Use the search menu to find the form you desire. Review the Agreement Termination Sample for Non-Profit preview and outline to ensure it matches your interests. After confirming the form, click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card details or PayPal account to complete the purchase. Choose the file format for download and verify it. Eliminate the confusion associated with legal documents. All your templates will be sorted and validated with an account at US Legal Forms.

- US Legal Forms is a collection of legal documents that includes nearly every document sample you might seek.

- Look for the templates you need, assess their significance instantly and learn more about how to use them.

- With US Legal Forms, you can access over 85,000 document templates in various areas.

- Locate the Agreement Termination Sample for Non-Profit templates with just a few clicks and save them anytime in your account.

- Having a US Legal Forms account allows you to access all the templates you need with greater ease and less hassle.

- You only need to click Log In in the website header and enter the My documents section where all the forms you need will be available at your fingertips.

- You will not have to spend time looking for the fitting template or verifying its applicability.

Form popularity

FAQ

The certificate of dissolution must contain: the name of your nonprofit. a statement that the nonprofit has been completely wound up and is dissolved. a statement that all final returns required under the California Revenue and Taxation Code have been or will be filed with the California Franchise Tax Board; and.

Steps to Dissolving a NonprofitFile a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.

Dissolving a 501(c)(3) is the process of disbanding an organization and ending its non- profit status. Regardless of the reasons for dissolving its 501(c)(3) status, an organization must follow a series of steps with the state and the Internal Revenue Service (IRS) for the action to officially occur.

Basic Letter of Dissolution ElementsThe name of the recipient and the name of the person sending the letter.The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.More items...

Financial Actions Once the decision has been made to dissolve, the nonprofit must stop transacting business, except to wind down its activities. The assets of a charitable nonprofit can only be used for exempt purposes. 6feff This means that assets may not go to staff or board members.