Promissory Note Procedure In Houston

Category:

State:

Multi-State

City:

Houston

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

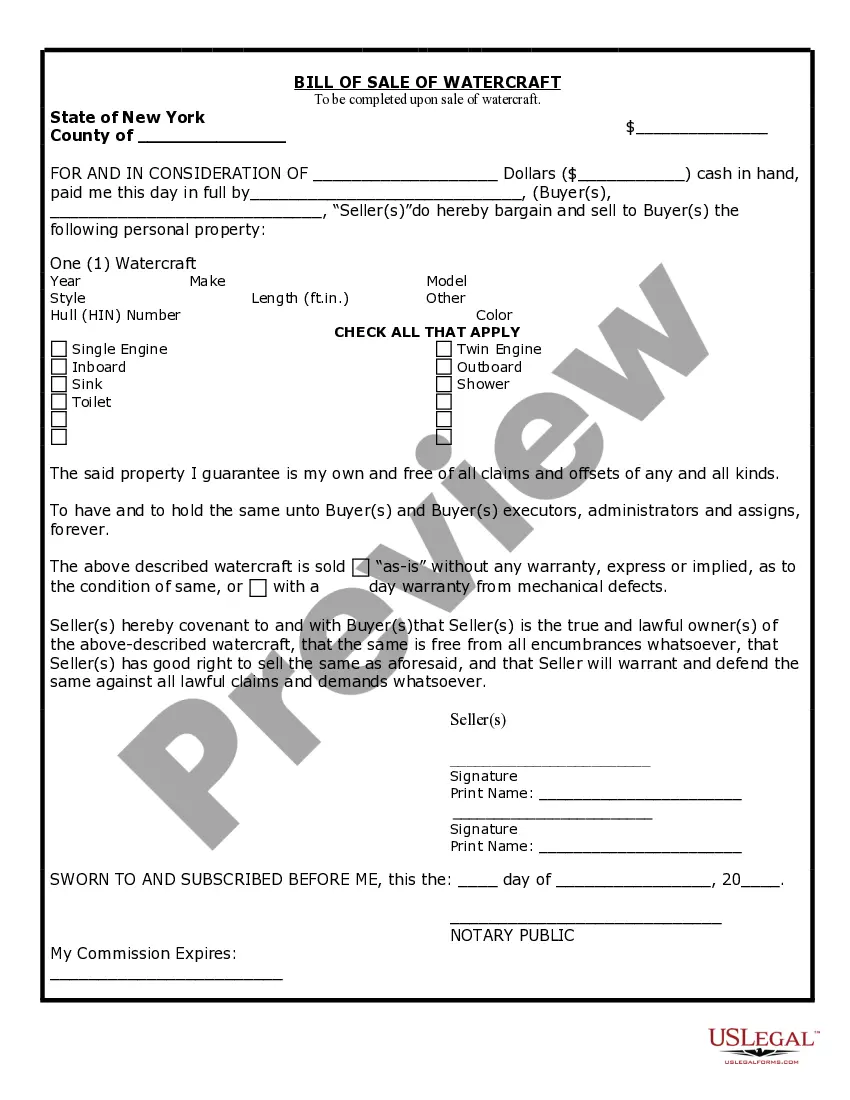

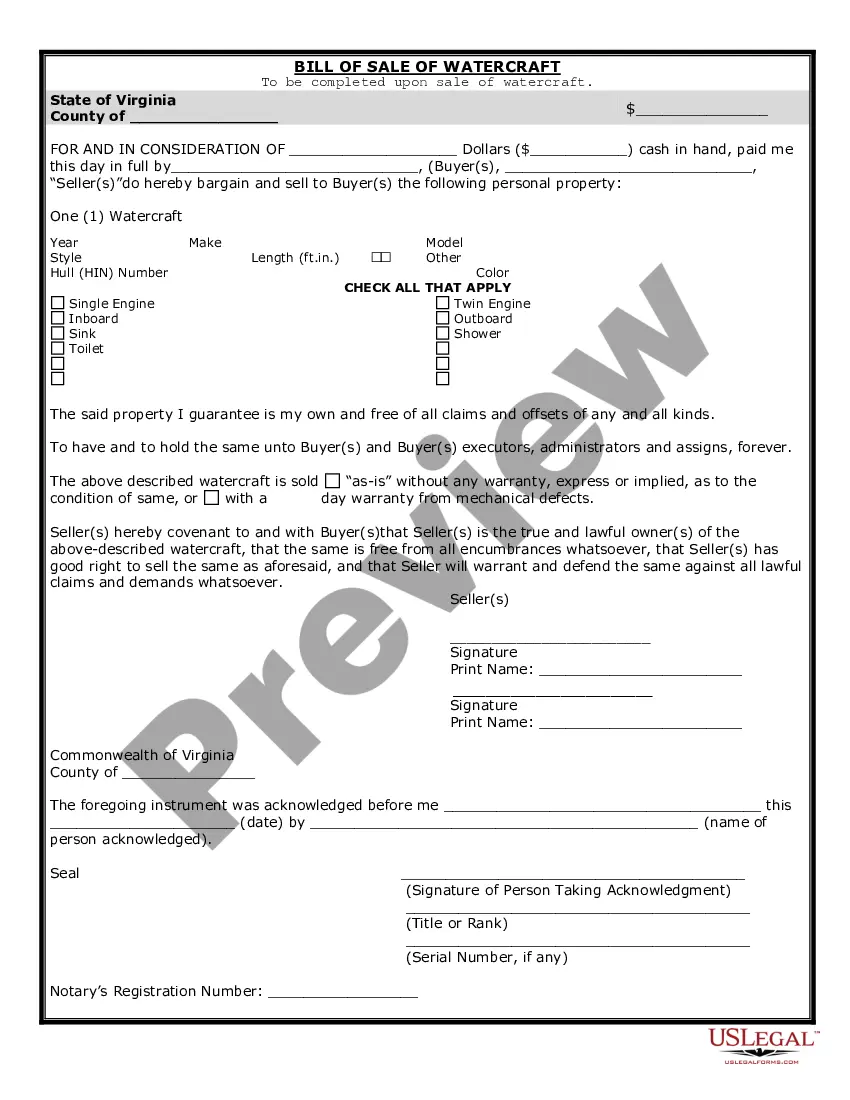

The Promissory Note procedure in Houston involves a legal document that outlines the borrower's promise to repay a specific loan amount to the lender, along with interest, under defined terms. This form includes key features such as the total amount borrowed, interest rates, payment schedules, and conditions for default. It specifies that payments are to be made in monthly installments, with a final balloon payment at the end of the loan term. Clear instructions for filling out the form are provided, including how to denote addresses and amounts. Users are guided on additional payments and prepayment penalties, which allows flexibility for the borrower. The document also addresses potential consequences in case of default, ensuring that both parties are aware of their rights. The utility of this form is significant for attorneys, partners, owners, associates, paralegals, and legal assistants as it serves as a foundational tool for structuring loans and securing financing. It helps legal professionals facilitate transactions, advise clients effectively, and maintain compliance with applicable laws in Houston.

Free preview