Balloon Payment Promissory Note Example In Hennepin

Category:

State:

Multi-State

County:

Hennepin

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

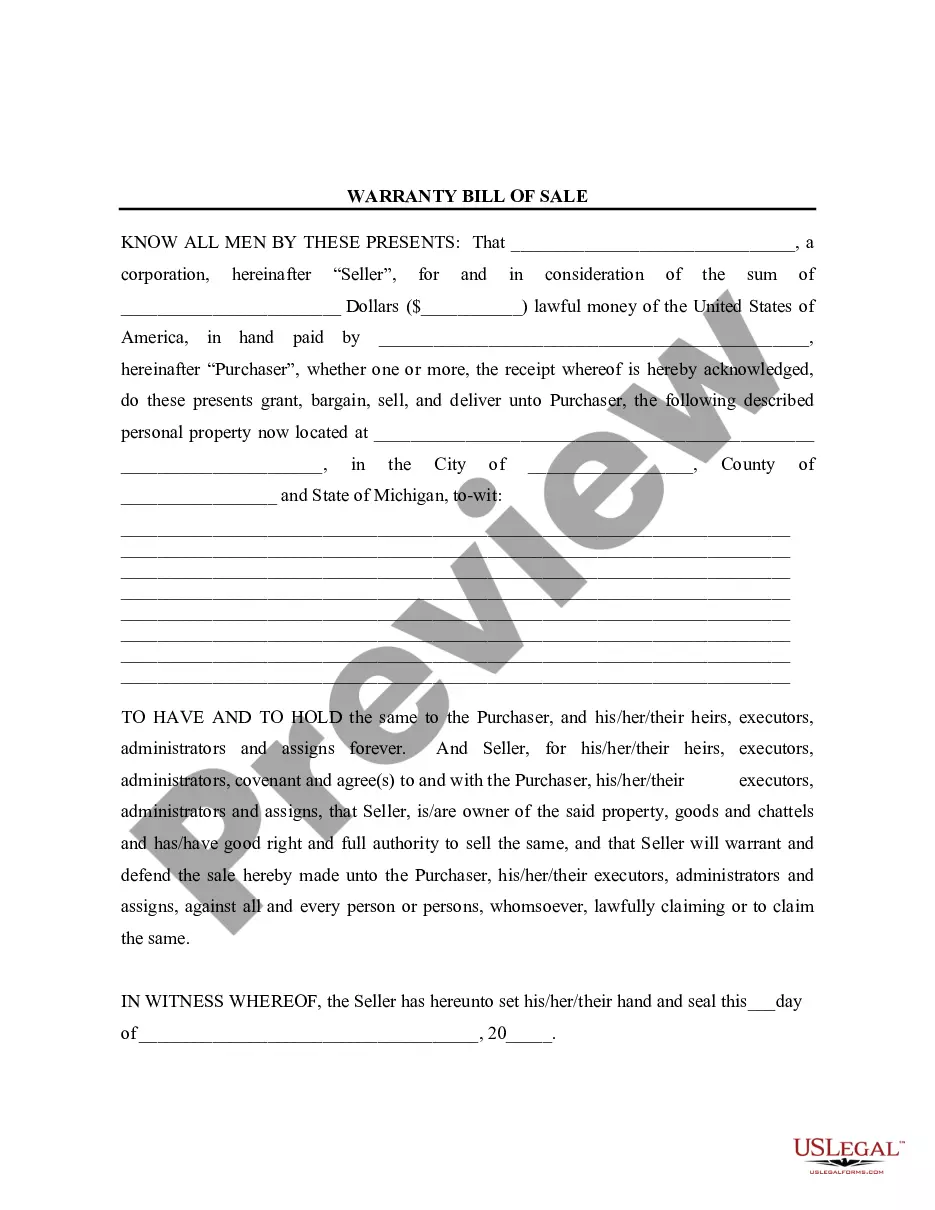

The Balloon Payment Promissory Note example in Hennepin is designed for borrowers to document a loan that will have periodic monthly installments followed by a larger balloon payment at the end of the term. The form specifies key details, including the total loan amount, interest rate, and payment schedule, ensuring clarity on monthly obligations and the final due amount. To fill out the form, users need to input details such as the lender's name and address, payment amounts, and dates. Editing may involve adjusting payment amounts or terms, based on negotiations between parties. This document is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who need a structured way to formalize loan agreements with balloon features. It helps these professionals understand the obligations and rights under the note while also ensuring compliance with relevant laws. The inclusion of default clauses and terms regarding prepayment penalties provides comprehensive coverage of loan management, making it an effective tool for risk mitigation. Overall, this form promotes clarity and protection for both lenders and borrowers in financial transactions.

Free preview