Installment Promissory Note With Balloon Payment In Bronx

Description

Form popularity

FAQ

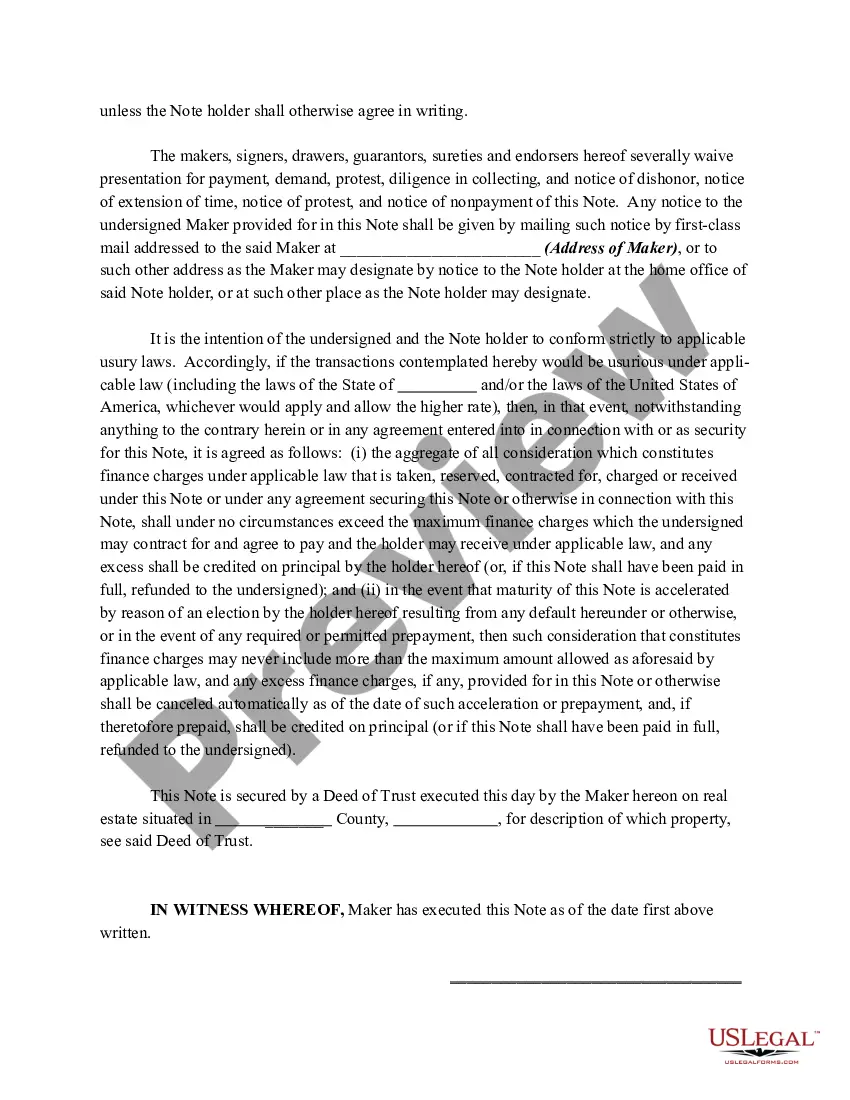

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers—include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

Disadvantages of a Balloon Payment Usage Restrictions. Car finance with a final balloon payment typically requires usage restrictions. Not Ideal for Those With Lower Credit Scores. Not Optional for Lease Agreements. Expensive Final Payment.

Promissory notes with balloon payments are a financing option you may be considering for your business. These types of loans may be secured by collateral or not, but they always end their repayment schedule with a big payment, known as the balloon payment.

The final payment is called a balloon payment because of its large size. Balloon payment mortgages are more common in commercial real estate than in residential real estate today due to the prevalence of mortgages with longer periods of amortization, in particular, the 30-year fixed-rate mortgages.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.

Promissory notes are contracts and contracts don't make dishonest people honest. A DIY contract is likely a mistake. You can buy a promissory note off of a site like or use a local attorney.

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers—include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

A simple promissory note might be for a lump sum repayment on a certain date. For example, let's say you lend your friend $1,000 and he agrees to repay you by December 1st. The full amount is due on that date, and there is no payment schedule involved.

The balloon amount is calculated based on the predicted future value of the vehicle at the end of the contract, known as the Guaranteed Minimum Future Value (GMFV). Balloon payments are often associated with PCP agreements but can also be applied to HP finance.