Installment Promissory Note With Balloon Payment In Bexar

Description

Form popularity

FAQ

Promissory notes with balloon payments are a financing option you may be considering for your business. These types of loans may be secured by collateral or not, but they always end their repayment schedule with a big payment, known as the balloon payment.

Promissory notes with balloon payments are a financing option you may be considering for your business. These types of loans may be secured by collateral or not, but they always end their repayment schedule with a big payment, known as the balloon payment.

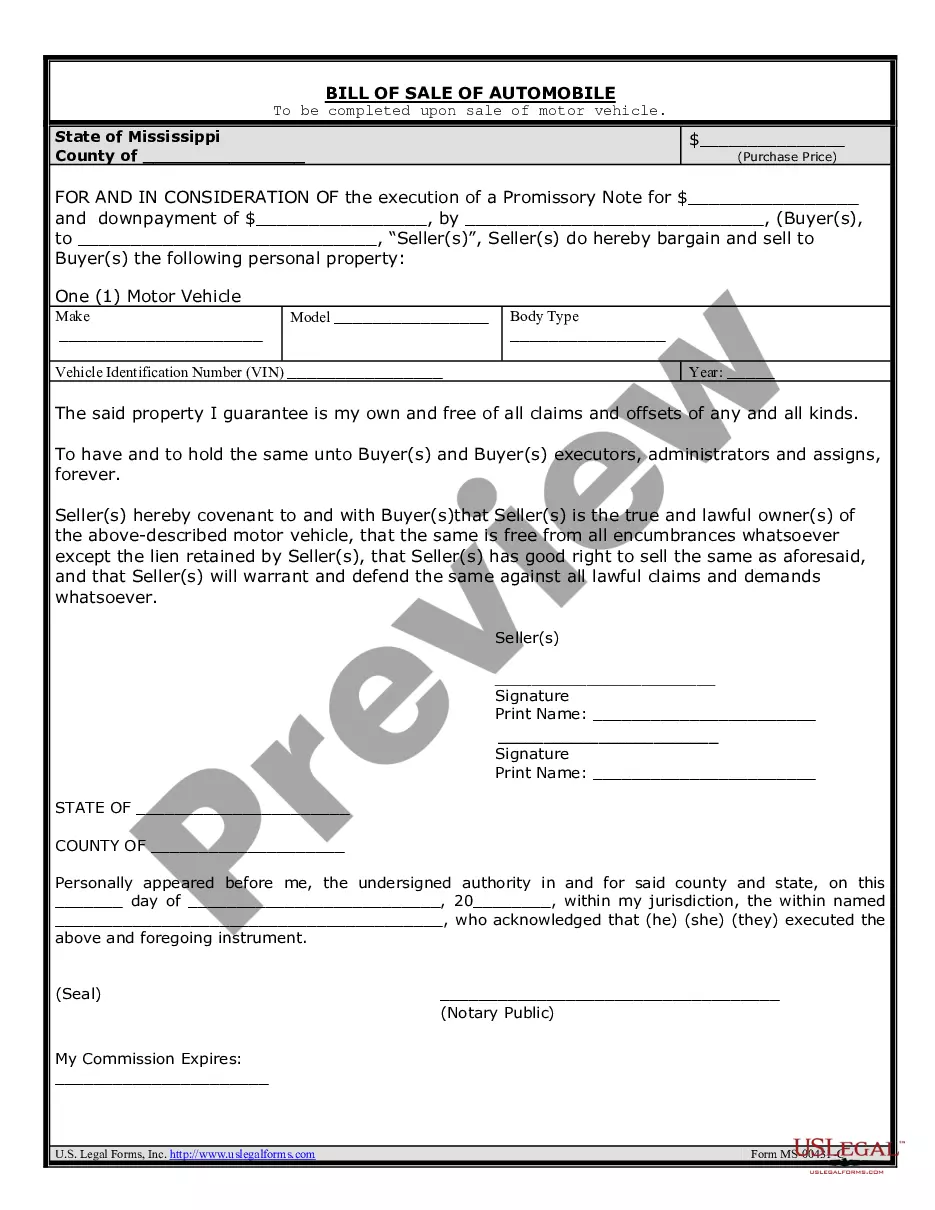

As for the promissory note, the parties should address issues related to payment terms, interest rate, late fees and prepayment penalties, among other issues. The Note is signed by the borrower, but does not have to be filed of record.

Answer: It's not illegal, but some states have already made balloon release laws. You can still release balloons in memory of a loved one or another occasion in Texas, but environmentalists want Texans to be aware that balloons released into the sky can be tangled with birds, power lines and can cause ocean debris.

A simple promissory note might be for a lump sum repayment on a certain date. For example, let's say you lend your friend $1,000 and he agrees to repay you by December 1st. The full amount is due on that date, and there is no payment schedule involved.

Disadvantages of a Balloon Payment Usage Restrictions. Car finance with a final balloon payment typically requires usage restrictions. Not Ideal for Those With Lower Credit Scores. Not Optional for Lease Agreements. Expensive Final Payment.