Payment With Due Date In Bexar

Category:

State:

Multi-State

County:

Bexar

Control #:

US-00422

Format:

Word;

Rich Text

Instant download

Description

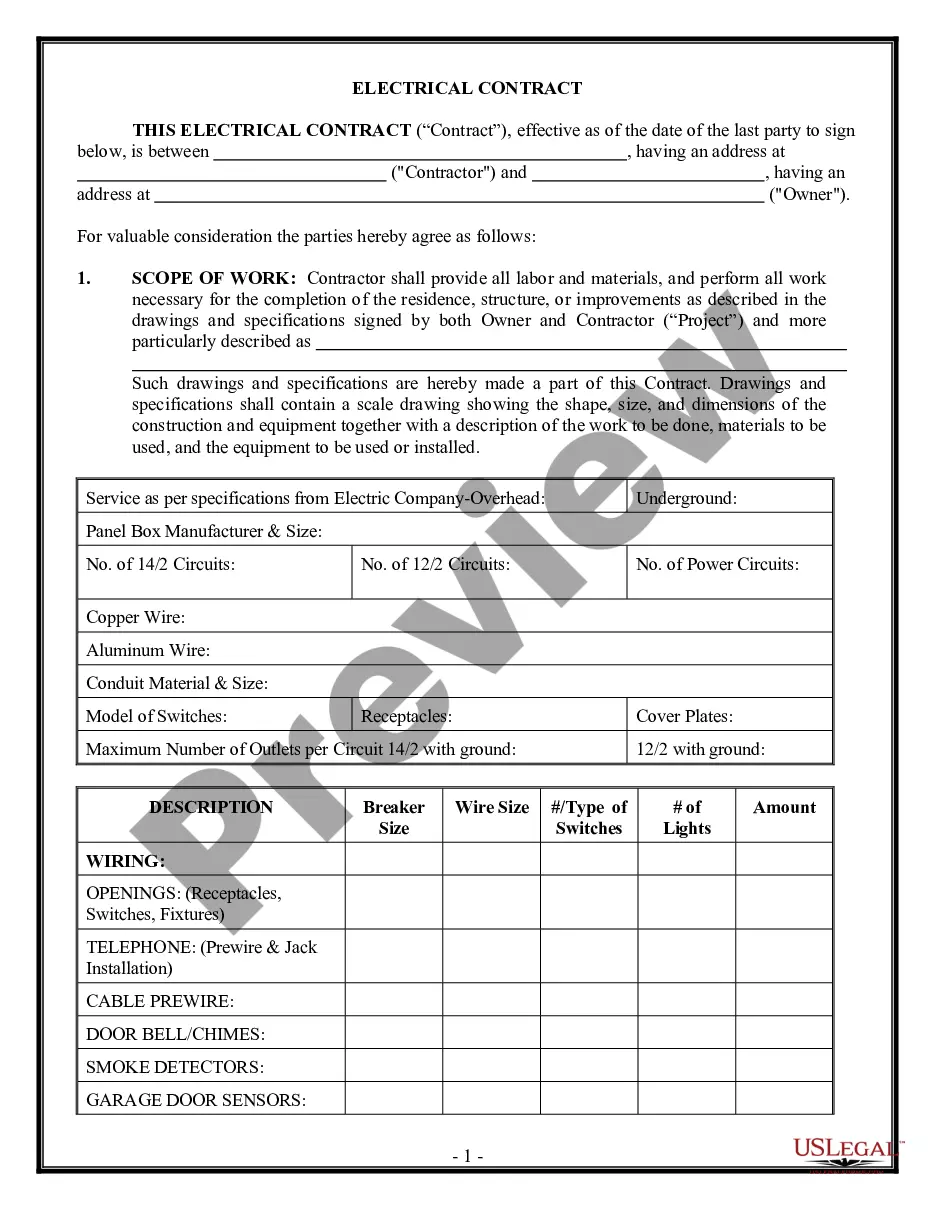

The Assignment of Money Due form is designed to facilitate the transfer of rights to receive payment for a specified debt between two parties, referred to as the Assignor and the Assignee. This form is particularly useful in Bexar, where specific due dates for payments need to be documented clearly. Key features include sections for detailing the debt amount, the due date, and a clause stating that the assignment is non-recourse, indicating that the Assignee bears the responsibility for collection. To fill out the form, users should clearly describe the debt, including the owed amount and the payment due date. Additionally, signatures from both the Assignor and Assignee are required to validate the transaction. Target audiences such as attorneys, partners, owners, associates, paralegals, and legal assistants will find this form relevant for managing debt assignments in their practices. It streamlines the process of formalizing financial transactions, ensuring that all legal obligations related to payment obligations are met while providing a clear record of the assignment.