Asset Purchase Form Irs In Alameda

Category:

State:

Multi-State

County:

Alameda

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

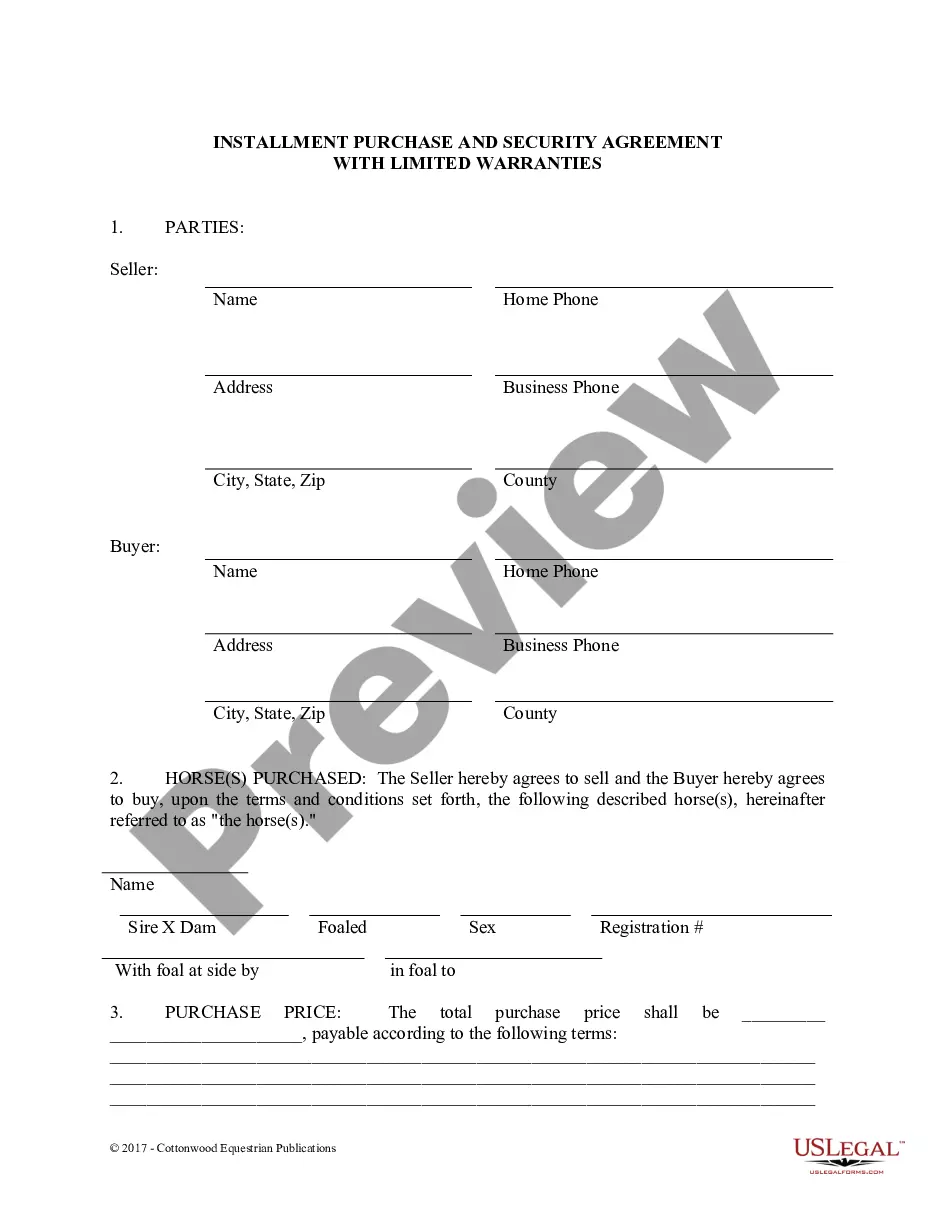

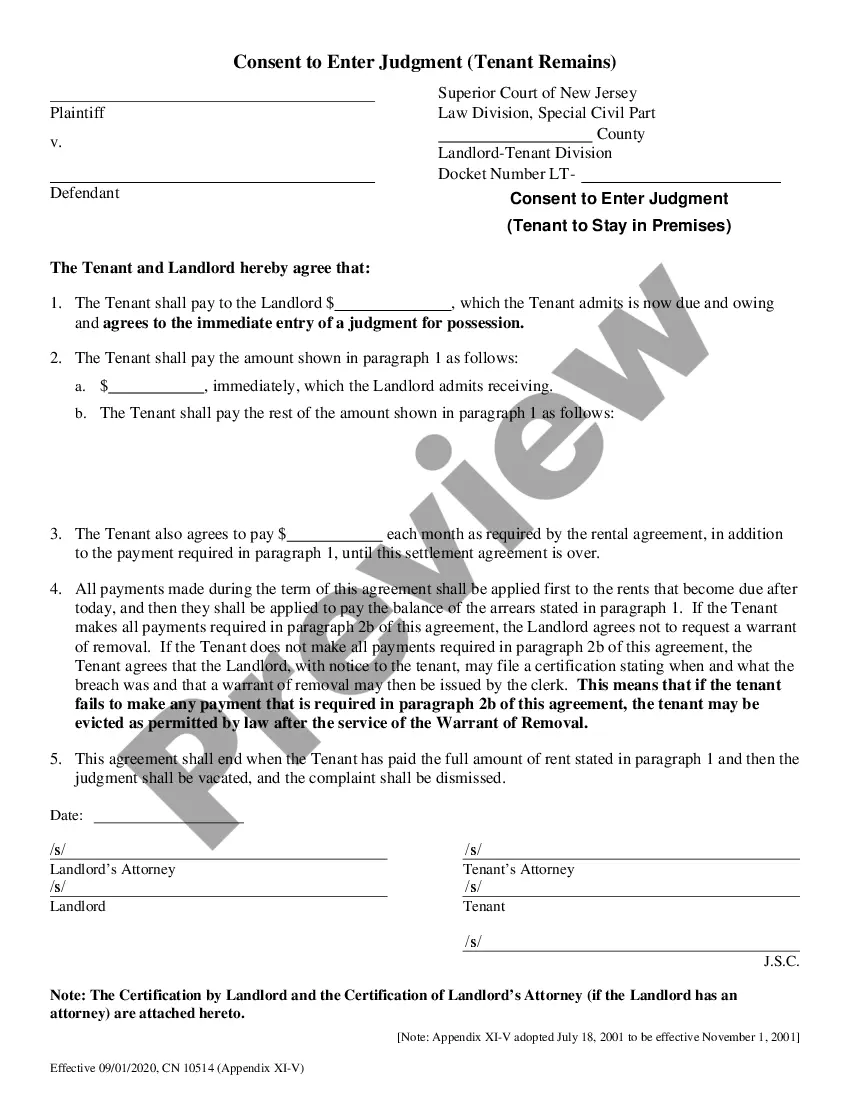

The Asset Purchase Agreement is a legal document outlining the terms and conditions under which a buyer acquires assets from a seller, specifically in Alameda. Key features of the form include sections detailing the assets being purchased, the purchase price, payment terms, and any liabilities not assumed by the buyer. Notably, it specifies the types of assets included, like equipment and inventory, while excluding items like cash and accounts receivable. Users are guided to fill in specific details, including the names of the parties involved and the closing date. Legal professionals should ensure proper execution and may need to include additional agreements, such as non-competition clauses. Target users – attorneys, partners, owners, associates, paralegals, and legal assistants – will find the form useful for facilitating asset transfers while protecting their clients' interests. This document assists in clarifying responsibilities, conditions of sale, and potential liabilities, making it essential for any business transaction involving asset acquisition.

Free preview