Deferred Compensation Plan To Ira In Wayne

Category:

State:

Multi-State

County:

Wayne

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

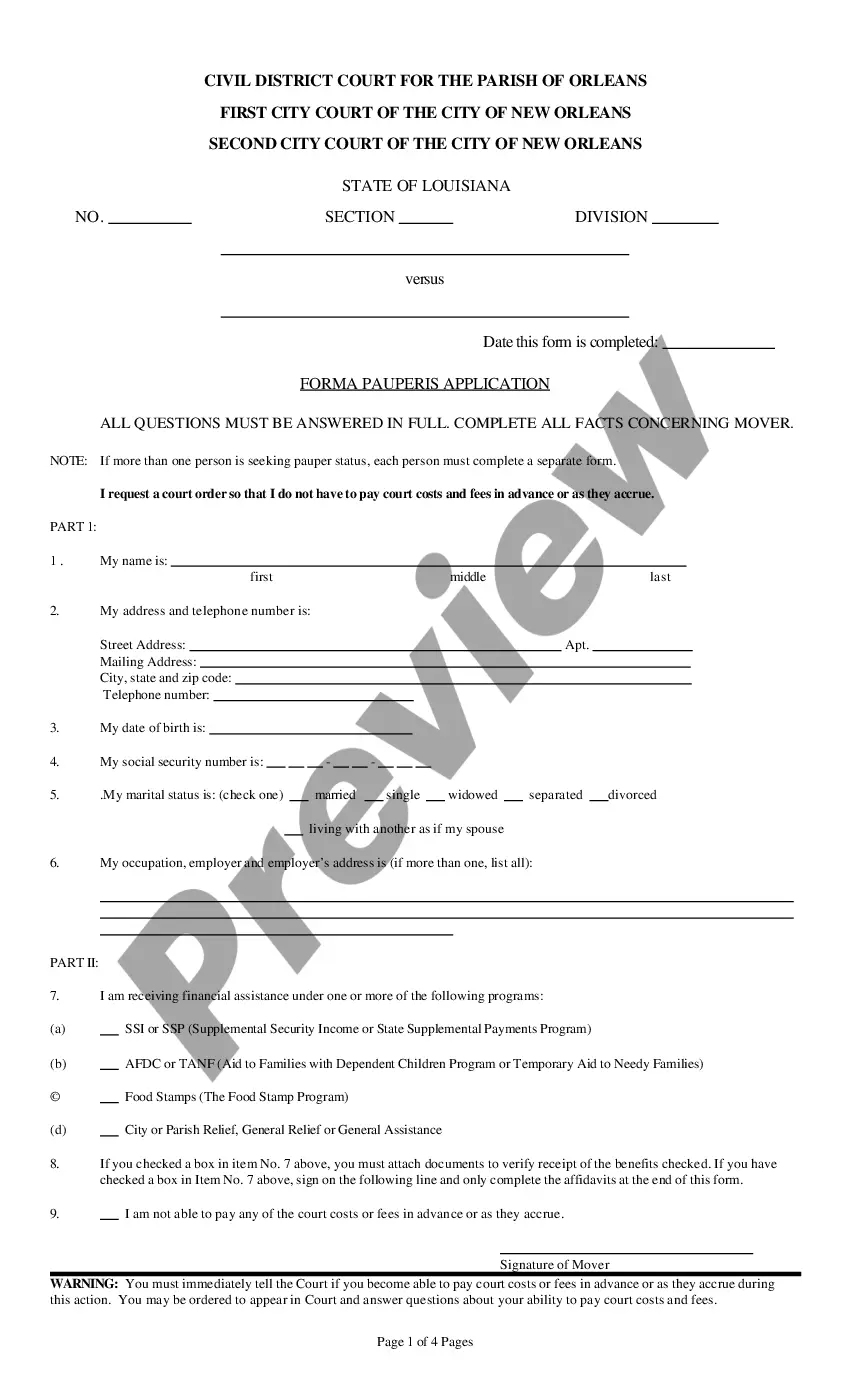

The Deferred Compensation Agreement between Employer and Employee outlines the terms under which an employee will receive additional compensation after retirement. This plan aims to provide the employee with a post-retirement income that exceeds the regular pension benefits. Key features include provisions for retirement payments, death benefits for the employee and their beneficiaries, and stipulations regarding compensation in the event of the employee's death prior to retirement. The agreement includes a multiplier mechanism tied to the National Consumer Price Index, ensuring that payments adjust for inflation. Specifics on termination conditions, noncompetition clauses, and arbitration procedures are also defined. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants navigating compensation planning and retirement benefits. They can use it to safeguard the financial interests of employees while complying with applicable laws. Filling out the form requires careful attention to names, addresses, compensation amounts, and timelines.

Free preview