Nys Deferred Comp Withdrawal Age In Travis

Category:

State:

Multi-State

County:

Travis

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

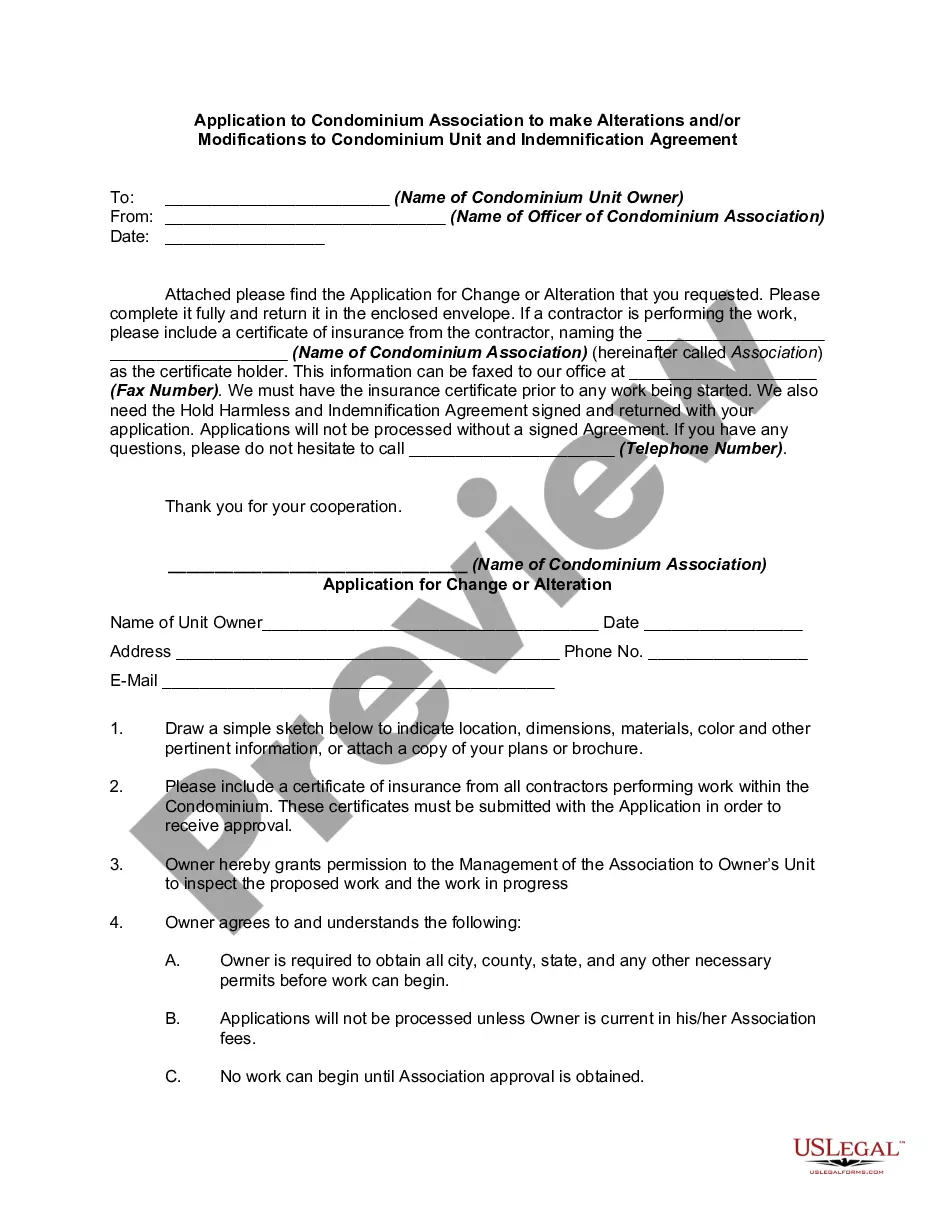

The Nys Deferred Comp Withdrawal Age in Travis outlines the provisions regarding retirement and compensation for employees under a deferred compensation agreement. This form is particularly useful for ensuring employees receive additional post-retirement income beyond regular pension benefits, tailored to their retirement age. Key features include stipulations for death benefits, early retirement options, and conditions for payment termination if the employee does not meet agreement obligations. The form guides users on the effective age of withdrawal and specifies the amount payable monthly, adjusted by the National Consumer Price Index. Attorneys, partners, owners, associates, paralegals, and legal assistants can utilize this document to navigate complex employment compensation matters, ensuring compliance with legal standards while addressing employee benefits. Clear filling and editing instructions accompany the form, making it accessible for individuals with varied legal expertise. This document supports strategic planning in employment contracts, safeguarding both corporate and employee interests.

Free preview